[Analysis] "Ethereum decline driven by derivatives deleveraging rather than spot selling"

Summary

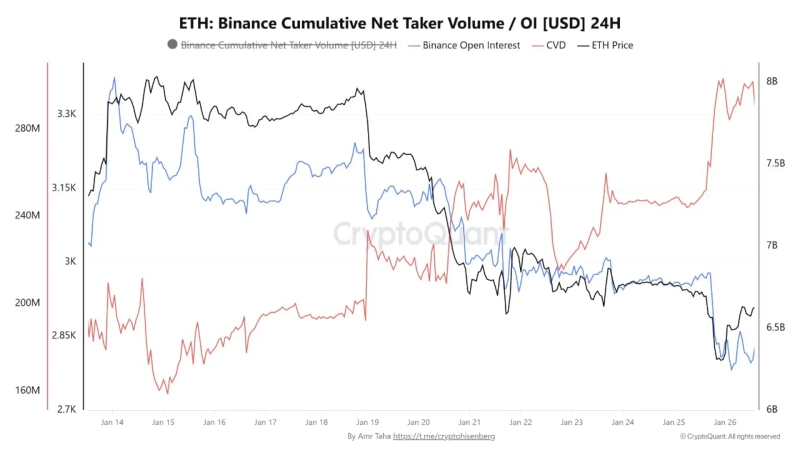

- Over the past two weeks, Ethereum derivatives open interest (OI) plunged from $8 billion to $6.4 billion, indicating the market has entered a deleveraging phase.

- During the price decline, CVD rose alongside large-scale short liquidations, suggesting derivatives-driven position unwinding rather than aggressive selling.

- This Ethereum pullback is closer to leveraged position unwinding than fundamental deterioration, and additional spot supply-demand signals are needed to judge the medium-term trend.

An analysis finds that Ethereum (ETH)’s recent price pullback was triggered less by the spot market than by a deleveraging process in the derivatives market.

On the 26th (local time), CryptoQuant contributor Amr Taha, citing Binance derivatives data, said that “over the past two weeks, Ethereum derivatives open interest (OI) plunged from about $8 billion to around $6.4 billion,” adding that “this is a signal that the market has entered a deleveraging phase rather than an expansion of directional selling.”

Notably, while OI fell rapidly, cumulative volume delta (CVD) based on market-order flow continued to trend higher. This suggests that, rather than a surge of new short positions, existing accumulated shorts were liquidated, leaving positioning lighter, the contributor explained. He pointed out that “a pattern in which CVD rises during a price decline indicates the market is undergoing position unwinding rather than aggressive selling.”

The same pattern is also seen in liquidation data. On Binance, large-scale short liquidations occurred when Ethereum was attempting to break above the $3,300 level, after which the trend weakened as short-term upside pressure was exhausted. This is interpreted as a typical derivatives-led setup in which prices pull back again after a rebound because fresh demand fails to come in sufficiently.

In the subsequent decline, leveraged long positions initiated near the highs were liquidated in a chain. As longs forcibly closed on the way down hit the tape as market sells, downside volatility increased, creating conditions in which prices could slide quickly even without spot selling.

Amr Taha added, “The current Ethereum price pullback is closer to a process of unwinding excessively built-up leveraged positions than a signal of deteriorating fundamentals,” and said, “Given the decline in OI and the liquidation structure, volatility may persist in the short term, but additional spot supply-demand signals are needed to assess the medium-term trend.”

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)