Stablecoin market cap down $2.2 billion in 10 days… Santiment: "Funds moving into gold and silver"

Summary

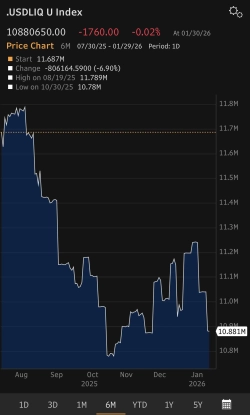

- An analysis said the crypto market’s recovery could be delayed as stablecoin market capitalization fell by about $2.24 billion over the past 10 days.

- Investment funds are shifting from crypto assets such as Bitcoin into safe havens such as gold and silver, and Tether (USDT) reportedly purchased $4.4 billion worth of gold.

- Santiment said a recovery in stablecoin supply is a key leading indicator for a rebound, warning that as supply contracts, altcoins may face heavier pressure and broader market upside could be limited.

An analysis suggests that the recovery in the crypto-asset (cryptocurrency) market could be delayed as the total market capitalization of stablecoins has fallen by about $2.24 billion over the past 10 days.

On the 26th (local time), Santiment said on X that "a decline in stablecoin market cap means investors are converting to fiat rather than keeping funds on the sidelines to buy during a correction." The analysis is that as uncertainty grows, investors increasingly opt for safe-haven assets instead of highly volatile crypto assets.

Recent price action underscores this shift: while gold and silver have notched fresh record highs, the broader crypto market—including Bitcoin (BTC)—has undergone a correction. Bitcoin has remained in a downtrend since a large-scale leveraged liquidation on Oct. 10 last year and is currently trading in the $88,000 range. Over the same period, gold prices have risen more than 20%, breaking above $5,000 per ounce, while silver has surged by more than twofold in terms of market capitalization.

This preference for safe-haven assets is also evident in the moves of stablecoin issuers. Tether (USDT) emerged as a major buyer, purchasing about 27 tonnes of gold in the fourth quarter of 2025 alone—worth $4.4 billion.

Santiment pointed to a rebound in stablecoin supply as a key leading indicator for the next leg up in crypto markets. "Historically, strong market rebounds began when stablecoin market cap stopped falling and turned back to growth," it said, adding that "this signals fresh inflows and a recovery in investor sentiment."

Until then, however, the altcoin market could face greater headwinds. Santiment added that "in this environment, Bitcoin shows relatively stronger defensiveness, but with stablecoin supply shrinking, upside potential across the broader market is inevitably constrained."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)