Tokenized gold is gaining traction… Tether Gold takes over half of the gold-linked stablecoin market

Summary

- Tether said the market capitalization of its Tether Gold (XAUt) has surpassed $2.2 billion, giving it more than half of the gold-backed stablecoin market.

- XAUt is backed 1:1 by one troy ounce of physical gold, and the gold holdings supporting it have grown to a level comparable to the gold reserves of some countries, Tether said.

- It added that even as central banks’ net gold purchases continue and the U.S. Dollar Index (DXY) declines, bitcoin has not managed to draw inflows as stable as gold.

Amid heightened geopolitical tensions and trade uncertainty, demand for safe-haven assets is strengthening, rapidly expanding the tokenized gold market.

According to Cointelegraph on the 26th (local time), Tether said the market capitalization of its gold-linked stablecoin Tether Gold (XAUt) has surpassed $2.2 billion, accounting for more than half of the entire gold-backed stablecoin market. As of the end of the fourth quarter of last year, there were 520,089 XAUt in circulation, with each token backed 1:1 by one troy ounce of physical gold.

Paolo Ardoino, Tether’s CEO, said the amount of physical gold backing XAUt has grown to a level comparable to the gold reserves of some countries. The announcement coincided with COMEX gold prices surpassing $5,000 per ounce for the first time ever.

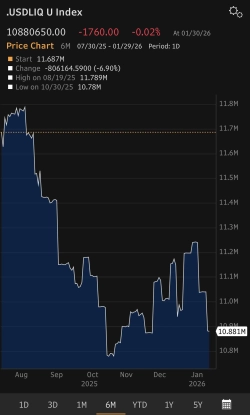

Behind the gold rally is a push by central banks to reduce reliance on the U.S. dollar. According to the World Gold Council (WGC), central banks purchased a net 220 tons of gold in the third quarter of last year alone. Over the same period, the U.S. Dollar Index (DXY) continued to trend lower, underscoring a clear weakening in the dollar.

Meanwhile, bitcoin (BTC) is often cited as a hedge against currency debasement, but is seen as failing to attract inflows as steady as gold. Some analysts say gold continues to serve as the preeminent safe-haven asset, particularly among conservative investors.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)