[Analysis] “Global liquidity’s leading signal re-emerges…Ethereum could replicate the 2021-style breakout pattern”

Summary

- Sykodelic said Ethereum could enter a medium- to long-term uptrend similar to 2021, citing a cyclical pattern among global liquidity, the Russell 2000 index, and Ethereum’s price.

- If the pattern is applied mechanically, Ethereum’s medium- to long-term breakout timing could be around March 2026, and Ethereum previously rose about 226% from March to November 2021.

- Max, CEO of BecauseBitcoin, said the Russell 2000’s record high (2,738) and CryptoQuant’s Ethereum accumulation-address realized price (around $2,720) point to greater upside expansion potential for Ethereum and underscore the significance of a medium- to long-term support level.

As global liquidity conditions improve, analysis suggests Ethereum (ETH) could enter a medium- to long-term uptrend similar to 2021.

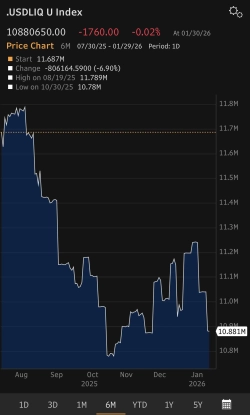

According to Cointelegraph on the 26th (local time), cryptocurrency analyst Sykodelic presented a recurring cyclical pattern among global liquidity, the Russell 2000 index, and Ethereum’s price, saying: “Looking at past moves, global liquidity breaks out first, then the Russell 2000 turns higher, and after a certain lag Ethereum begins a full-fledged advance.”

Sykodelic said that on a monthly chart, global liquidity has already completed an upside breakout, and the Russell 2000 has followed by setting a fresh record high. Ethereum has typically lagged this phase by several weeks to several months. In the 2021 cycle, Ethereum entered a full rally about 119 days after the Russell 2000 confirmed its trend. If that pattern is applied mechanically, Ethereum’s medium- to long-term breakout could occur around March 2026.

Under similar conditions from March to November 2021, Ethereum rose about 226%. Sykodelic stressed that liquidity conditions—rather than short-term technical indicators—are a key variable determining the long-term trend of high-beta assets.

The Russell 2000’s role as a leading indicator is also back in focus. Max, CEO of BecauseBitcoin, said the Russell 2000 has historically led Ethereum’s price-discovery phase, adding that the Russell 2000’s recent move to a record high (2,738) is “a signal that increases the likelihood of further upside expansion in Ethereum.”

On-chain indicators also point to downside resilience. According to CryptoQuant data, the realized price of Ethereum’s long-term-holder “accumulation addresses” has climbed to around $2,720. This metric has acted as a medium- to long-term support level that has never been breached even during past downturns. With the gap versus the spot price not large, the data are being interpreted as showing continued accumulation even amid heightened volatility.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)