Summary

- After President Trump’s remarks tolerating a weaker dollar, the dollar index fell 3%, and it reported that the dollar’s value is likely to decline for the time being.

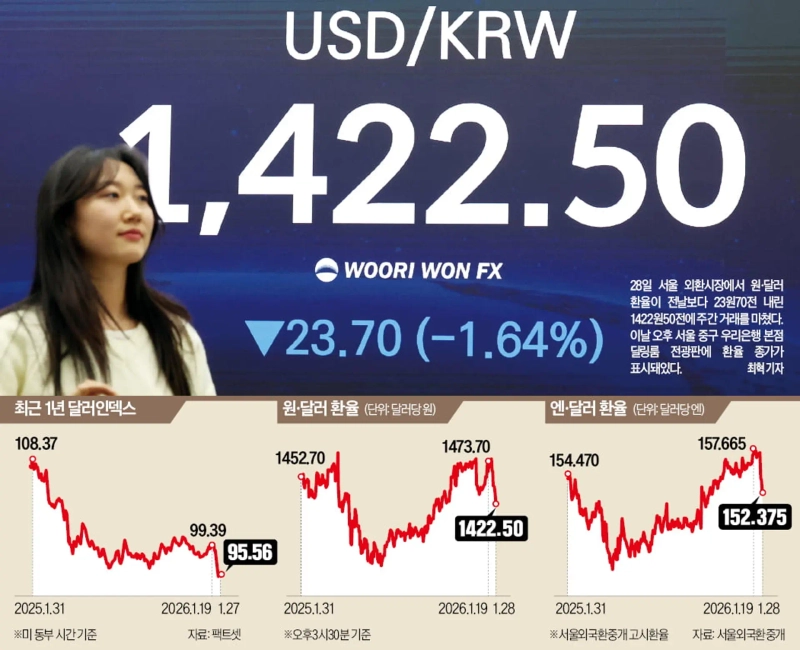

- In tandem with yen strength, the USD/KRW rate fell to 1,422.50 won, with expectations that it will face additional downward pressure.

- Amid the weaker dollar, spot gold broke above $5,200 and silver rose above $110, and it reported that the rise in precious-metal prices was driven by the “debasement trade.”

Trump appears to tolerate a weaker dollar

Global FX markets roiled

Trump: "Yuan and yen devaluation is unfair"

Japan’s finance minister signals FX coordination with the U.S.

Multiple weak-dollar drivers hit at once

"Dollar value likely to fall for the time being"

USD/KRW down more than 55 won in a week

Yen hits highest level in three months

Safe-haven gold tops $5,200 for the first time ever

After U.S. President Donald Trump made remarks that appeared to tolerate a weaker dollar, the greenback’s value plunged to levels last seen four years ago. With concerns growing about a “Sell America” trade—amid controversy over the U.S. attempt to take control of Greenland and alleged threats to the Federal Reserve’s independence—some expect uncertainty over the U.S. economy and foreign policy to accelerate the downtrend in the dollar. The USD/JPY and USD/KRW rates fell sharply in tandem with the weaker dollar (meaning the yen and won strengthened).

Dollar value down 3%

On the 27th (local time), the dollar index—which tracks the dollar against six major currencies—fell as much as 1.53% intraday to 95.55, the lowest level since February 2022. It has declined for four consecutive sessions and is down nearly 3% so far this year. Asked by reporters whether he was concerned about dollar weakness, Trump replied, “The dollar is doing great,” adding to the decline. He also said, “China and Japan have kept lowering the value of the yuan and the yen, and that’s unfair,” adding, “I have fought them fiercely.”

Markets interpreted Trump’s comments as a signal that he welcomes a weaker dollar. A softer dollar would help revive U.S. manufacturing and boost exports, in line with Trump’s preferences. The Wall Street Journal (WSJ), citing experts, reported: “Trump administration officials have denied wanting a weak dollar, but Trump’s latest remarks effectively amount to an official acknowledgment of the interpretation currently prevalent in markets.”

Markets are increasingly pricing in dollar weakness continuing this year, as the drivers behind the decline are likely to persist. In particular, if a rate-cut advocate is appointed to succeed Fed Chair Jerome Powell, whose term expires in May this year, the dollar could weaken further.

Stephen Jen, former Morgan Stanley currency strategist, said, “There is a very high chance this move marks the start of a phase in which the dollar drops another step.”

Gold and Asian currencies strengthen

As the dollar weakened, the yen also rose notably. In New York FX trading, USD/JPY fell to the 152.1 range per dollar, taking the yen to its strongest level in three months. A similar trend continued in Tokyo FX trading on the 28th. As recently as the 23rd, USD/JPY was 159 per dollar, but it fell sharply in just four sessions.

According to Nikkei, Japan’s Finance Minister Satsuki Katayama, after attending an online G7 finance ministers’ meeting, made comments that fueled yen strength, saying regarding FX rates, “We will respond appropriately in close coordination with U.S. authorities.”

Domestic experts expect the won to strengthen in tandem with dollar weakness and yen strength. They said USD/KRW, which fell to 1,422.50 won, could face additional downward pressure.

Min Kyung-won, an economist at Woori Bank, said, “Yen strength, concerns about a U.S. federal government shutdown, and Trump’s remarks tolerating a weaker dollar are all emerging simultaneously as FX-negative factors,” adding, “If exporters’ selling comes in, the bottom in the exchange rate could move even lower.”

Safe-haven demand flowed into gold. International spot gold prices topped $5,200 per troy ounce for the first time ever. Spot silver is also trading above $110 per troy ounce. Precious-metal prices rose amid a “debasement trade” shift—moves to reduce exposure to U.S. assets—as the dollar’s value declined.

Han Kyung-jae / Kang Jin-kyu, hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.