Editor's PiCK

White House to convene banks and crypto industry next week… talks resume on the CLARITY Act

Summary

- The White House said it has convened banks and the crypto industry to discuss the CLARITY Act and rules on stablecoin interest.

- Banks warned that stablecoin interest payments could trigger deposit outflows, while crypto exchanges such as Coinbase said it is an attempt to block competition, it said.

- It said the meeting will be a key inflection point for whether the Trump administration’s crypto-friendly stance leads to legislation and for the outlook of the CLARITY Act.

The White House plans to bring together representatives from the banking sector and the crypto industry to restart discussions on the CLARITY Act, a stalled crypto market structure bill. Whether to allow interest on stablecoins is emerging as the biggest sticking point.

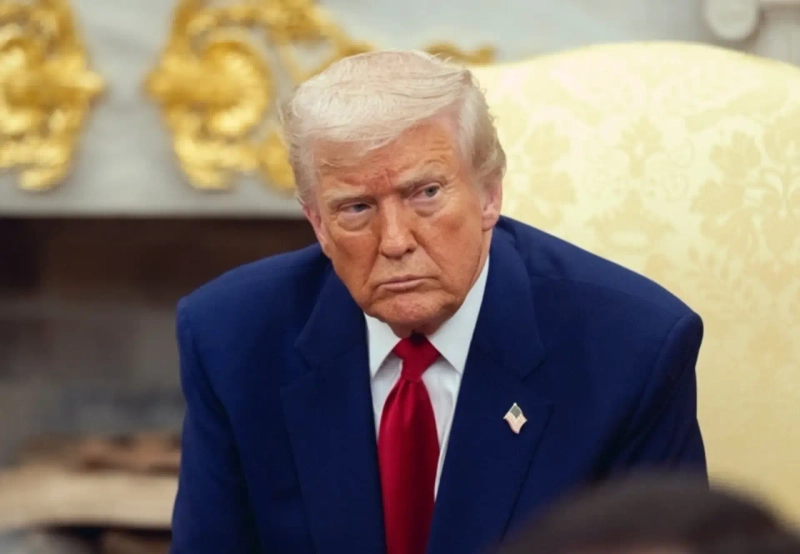

According to Reuters on the 28th (local time), officials in President Donald Trump’s administration will meet on Monday next week with banks, crypto firms and industry associations under the auspices of a White House crypto advisory body. The meeting is expected to focus on how the CLARITY Act will address rules on interest and rewards applied to dollar-pegged stablecoins.

The CLARITY Act is a market structure bill aimed at clarifying the crypto regulatory framework, with the division of supervisory authority between the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) at its core. Deliberations in the Senate have been delayed for months, and a vote in the Senate Banking Committee that had been scheduled for earlier this month has also been postponed.

Behind the delay are differences between banks and the crypto industry over the payment of stablecoin interest. The GENIUS Act, passed in July 2025, prohibited stablecoin issuers from paying interest, but did not clearly specify whether that restriction also applies to rewards offered by exchanges or intermediaries.

Banks argue that offering stablecoin interest through third parties could spur deposit outflows. Bank of America CEO Brian Moynihan warned on the 15th that “interest-bearing stablecoins could siphon off as much as $6 trillion in bank deposits.”

By contrast, crypto exchanges such as Coinbase contend that banks are trying to block competition through legislation. Coinbase CEO Brian Armstrong withdrew his support for the CLARITY Act on the 14th, saying, “If it’s a bad bill, it’s better to have no bill at all.”

Still, views within the crypto industry are split. Some major companies and groups—including Coin Center, Andreessen Horowitz (a16z), the Digital Chamber, Kraken and Ripple—continue to support the Senate version.

The White House-led meeting is expected to be a key test of whether the Trump administration’s crypto-friendly stance can translate into actual legislation. The direction of the CLARITY Act is also likely to hinge on whether a compromise can be reached on stablecoin interest rules.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE