Will they hit ‘Samsung Electronics at 170,000’ and ‘Hynix at 900,000’?…Investor sentiment heats up in the bull market [Today’s Market Preview]

Summary

- It said the KOSPI and KOSDAQ indices have been setting fresh records day after day, with expectations for a semiconductor bull market coexisting with concerns about a near-term peak.

- It said retail investors heavily bought KODEX KOSDAQ150 and leveraged ETFs, and investor sentiment has rebounded sharply as investors’ cash balances topped 100 trillion won.

- It said brokerages advised that, based on upward revisions to semiconductor earnings estimates, it is an appropriate time to maintain allocations to market leaders such as semiconductors.

With the KOSPI and KOSDAQ indices extending their string of record highs, attention is focused on the direction of South Korea’s stock market on the 29th. Expectations for a semiconductor bull run, underpinned by Samsung Electronics’ solid results, coexist with concerns about the market’s valuation ceiling after a sharp short-term rally.

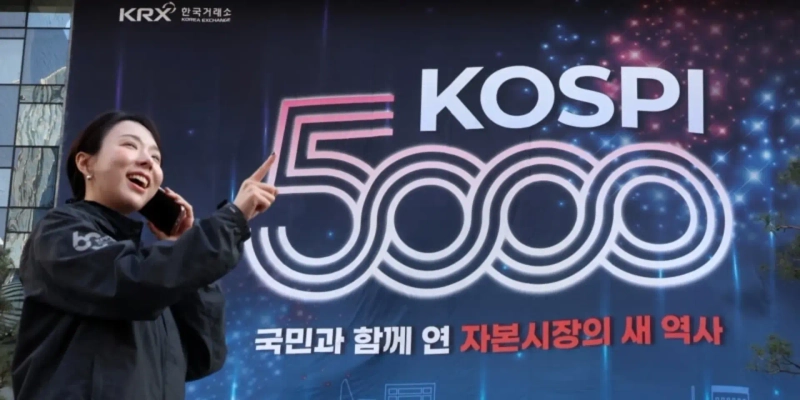

According to the Korea Exchange on the 29th, the KOSPI closed the previous day up 1.69% at 5,170.81. Just one day after surpassing 5,000 on a closing basis, it broke through 5,100 and is pushing toward the 5,200 level. Buying interest flowed in after U.S. President Donald Trump said he would “work out a solution (to tariff hikes) with South Korea.” Samsung Electronics, the bellwether semiconductor stock, rose 1.82% to reclaim the 160,000 won level. SK hynix surged 5.13% on news it had secured about two-thirds of the volume of high-bandwidth memory (HBM)4 to be used in Nvidia’s AI platform, Vera Rubin, and others.

The KOSDAQ also jumped 4.70% to close at 1,133.52, topping 1,100 for the first time in 25 years. The market rally is stoking investor sentiment. Retail investors bought 1.009 trillion won worth of ‘KODEX KOSDAQ150’ and ‘KODEX KOSDAQ150 Leverage’ the previous day. Investors’ cash balances, a key measure of sidelined funds, surpassed 100 trillion won on the 27th—up a whopping 12.4535 trillion won this year.

On the 28th (local time), U.S. stocks ended mixed. The Dow Jones Industrial Average rose 0.02%, while the S&P 500 fell 0.01% to close at 6,978.03. The Nasdaq gained 0.17%. The S&P 500 broke above the 7,000 mark at the open, but momentum faded and it failed to hold the level. Strength in Nvidia (1.59%) and Intel (11.04%), among others, lifted the Philadelphia Semiconductor Index by 2.34%. The U.S. central bank (Fed) held its policy rate steady at 3.5–3.75% at the January Federal Open Market Committee (FOMC) meeting. In a press conference, Fed Chair Jerome Powell explained the decision, saying, “The unemployment rate has stabilized somewhat, but inflation is still somewhat high.” As the hold was widely expected, it had little impact on equities.

Brokerages see the rally continuing on the back of robust semiconductor earnings and a tailwind in the KOSDAQ market. Han Ji-young, a researcher at Kiwoom Securities, said, “With strength in U.S. memory makers and solid results from the Magnificent Seven, the domestic market could trade firm today,” adding, “A tug of war is intensifying between the KOSPI, which has solid fundamentals, and the KOSDAQ, where FOMO (fear of missing out) is elevated.” Against this backdrop, strategists say it is positive to maintain exposure to market leaders for the time being. Lee Sung-hoon, a researcher at Kiwoom Securities, said, “With ample liquidity in the domestic market, sidelined buying interest in semiconductor names that are leading earnings is increasing,” adding, “Given that semiconductor earnings estimates are being revised higher, it appears appropriate to keep a meaningful allocation to leaders such as semiconductors.”

By Cho Ara rrang123@hankyung.com

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE