Reviewing the State of South Korea’s Cryptocurrency Market Regulation in 2026 [Tiger Research Report]

Summary

- Korea said it has succeeded in preventing incidents and strengthening investor protection through the Special Financial Transactions Act and the Virtual Asset User Protection Act, but has failed to foster the Web3 industry.

- The government said it is continuing discussions around key regulations, including a spot ETF, a KRW stablecoin, cryptocurrency taxation, and limits on exchange ownership stakes.

- The report said Korea is pursuing the STO amendment and limited institutional inclusion, and that it needs to shift into a regulatory-leading country through close dialogue with the industry.

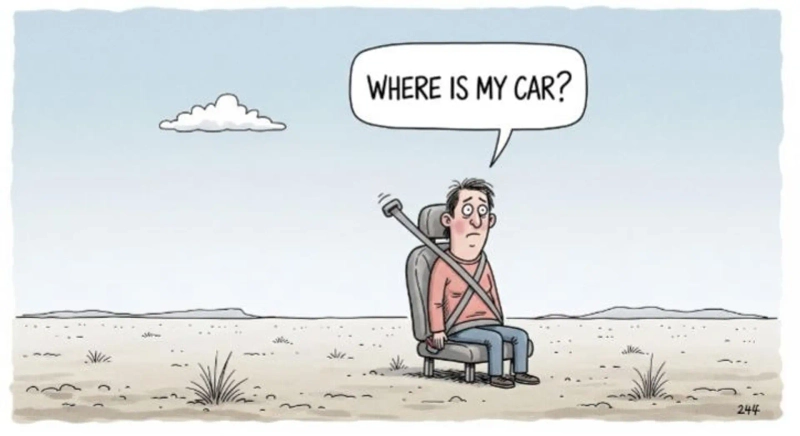

A Seat Belt, but No Car

South Korea’s virtual-asset regulation is built on an “ex ante regulation” framework. Shaped by the 1997 IMF crisis and the global financial crisis, this approach has persisted to this day and has been applied to the Web3 industry as well. Over the past decade, regulation has largely focused on investor protection through the Act on Reporting and Using Specified Financial Transaction Information (2021) and the Virtual Asset User Protection Act (2024).

With the newly passed STO amendment, Korea is attempting a limited entry into the institutional framework, and four core discussions below are also underway.

1. Spot ETF: The current administration continues to consider introducing spot virtual-asset ETFs, as reflected in its campaign pledges and “Economic Growth Strategy.”

2. KRW stablecoin: The Financial Services Commission (FSC) maintains an industrial-policy stance that would allow fintech participation, while the Bank of Korea (BOK) holds to a monetary-stability stance advocating a bank-led 51% consortium—an ongoing standoff (the most contentious issue).

3. Virtual-asset taxation: Taxation of individual virtual-asset trading has been delayed for years, but is scheduled to be introduced as planned in 2027.

4. Exchange equity ownership cap: The debate began with a proposal from the FSC, and the Digital Asset eXchange Alliance (DAXA) has officially expressed opposition.

The biggest disappointment in writing this report is that exchanges have been confined to “trade intermediation,” with expansion into custody, brokerage, ICO platforms, and the like fundamentally blocked. Unlike Coinbase, which evolved into a comprehensive crypto financial platform, Upbit has remained merely an “exchange,” failing to generate spillover effects that would foster the domestic ecosystem.

In short, Korea’s regulations have succeeded in “preventing incidents,” but failed at “fostering the industry.” It is as if the seat belt is ready, but there is no car to ride. Although Korea is one of the most active participants in the global Web3 ecosystem, it has failed to grow its own ecosystem—there is a market, but no industry.

Even now, Korea needs to shift toward becoming a regulatory leader where investor protection and industrial innovation coexist, through close dialogue with the industry.

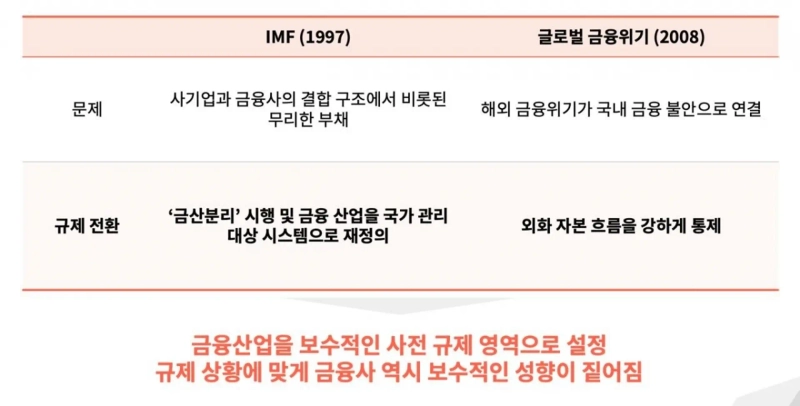

The Core Orientation of Korea’s Financial Regulation = “Ex Ante Regulation”

- Korea’s ex ante regulatory tendency took shape through the 1997 IMF crisis and the 2008 global financial crisis

- Through two financial crises, the government came to view financial markets not as an area to “leave to autonomy,” but as a “system to manage and control”

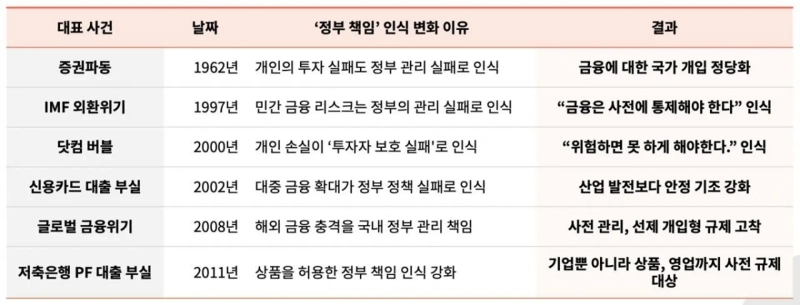

A Culture of Attributing Responsibility for Failure to the Government

- Under a state-led growth model, a structure formed in which failure is viewed not as an individual’s judgment but as a “failure of government management”

- When financial incidents occur, responsibility for damages is attributed to the government, directly translating into regime risk and political burden

- To avoid ex post responsibility, the government has strengthened a regulatory approach that restricts people’s choices in advance

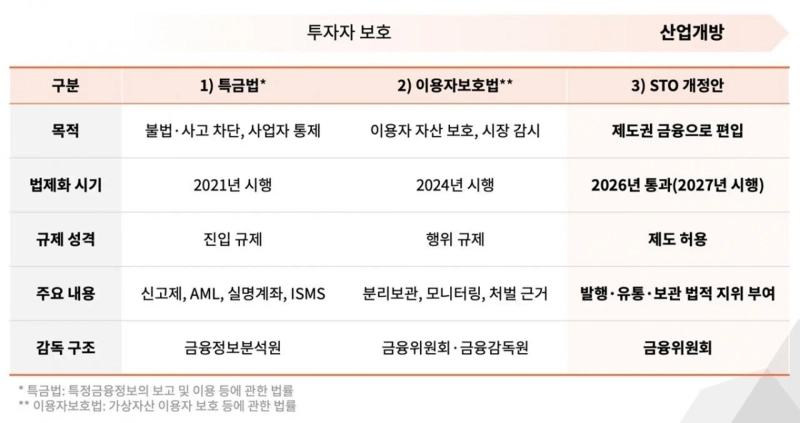

From Investor Protection to Limited Industrial Opening

- Over the past decade, Korea’s virtual-asset regulatory stance has been a management framework centered on incident prevention and user protection, not on fostering the industry

- While the STO bill seeks limited inclusion, it remains confined to limited openings such as a KRW stablecoin

1) Act on Reporting and Using Specified Financial Transaction Information (Special Financial Transactions Act): Limited exchange spillover effects

- In 2021, amid hacking and money-laundering issues at smaller exchanges, the exchange-regulation-focused bill amended the Special Financial Transactions Act

- To offer KRW trading, a partnership with a bank for real-name accounts was essential; however, amid negative sentiment toward the industry at the time, smaller exchanges failed to secure partnerships and shut down in succession

- This led to a monopolistic structure dominated by the top five exchanges, including Upbit and Bithumb. Even afterward, business licenses limited to “trading” constrained spillover effects across the ecosystem, and Korea failed to build a native Web3 ecosystem

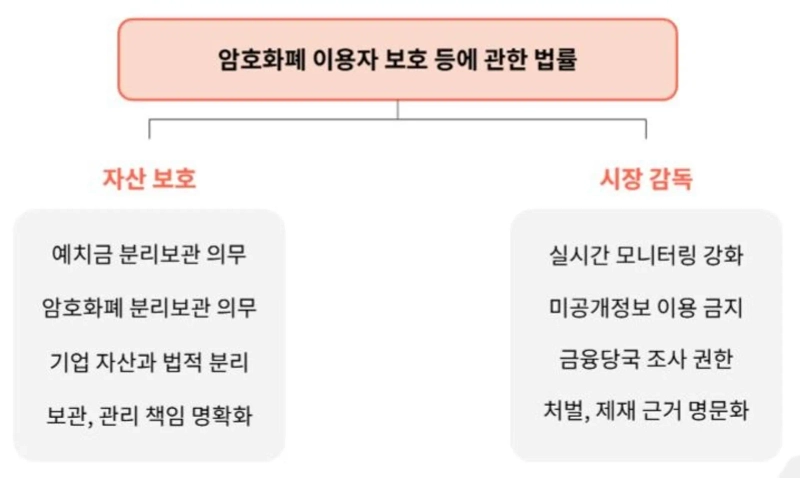

2) Virtual Asset User Protection Act: Businesses must align with regulatory guidelines

- Mandatory segregation of user assets and corporate assets prevents user asset losses even if an exchange goes bankrupt, establishing an institutional foundation for users to trade with confidence

- Codified investigative authority for financial regulators clarifies the basis for investigating and punishing illegal activity, strengthening regulation of unfair trading practices such as the previously prevalent illegal market-making (MM)

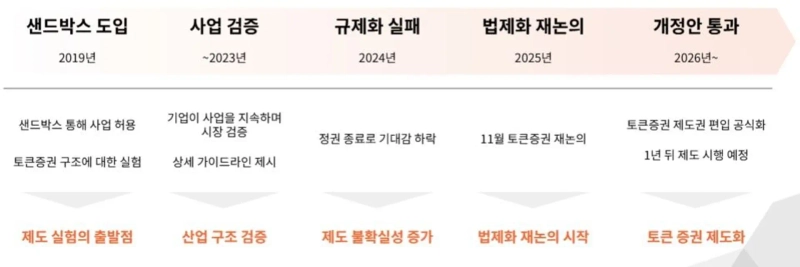

3) STO amendment: Passed, but actual operators remain undecided

- Since 2019, STO pilot projects have been allowed through the regulatory sandbox. Korea began institutional experimentation on tokenized securities relatively early, but a bill introduced in 2023 was automatically scrapped with the end of the 21st National Assembly’s term

- After the new administration took office, discussions resumed from November 2025. In about three months, the amendment to the Virtual Asset User Protection Act was passed at a plenary session

- Currently, Nextrade and the Korea Exchange (KRX) received the highest scores in the preliminary licensing review for an OTC tokenized securities exchange. However, existing operator LucentBlock has filed an objection, creating controversy as the licensing process proceeds

Korea’s Ongoing Regulatory Agenda

- In addition to regulations already in force, multiple items are under discussion, including 1) introduction of spot ETFs, 2) a KRW stablecoin, and 3) cryptocurrency taxation

- Most discussions have faced difficulties, and controversy continues due to disagreements with the industry over matters such as 4) limits on major shareholder stakes in exchanges

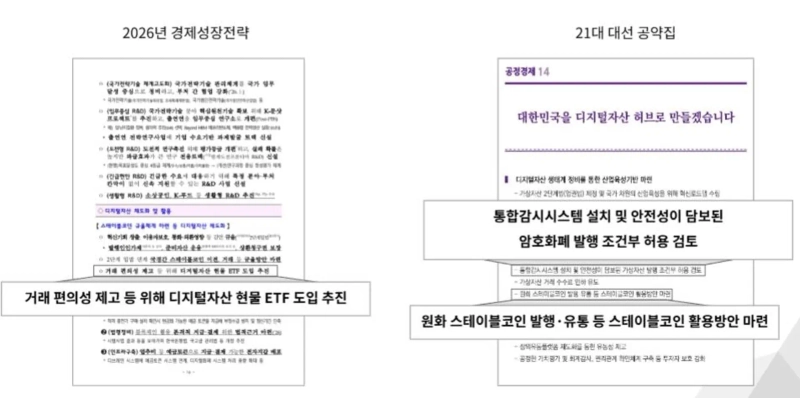

- Spot ETF: Included in the government’s core Economic Growth Strategy

- Through the “2026 Economic Growth Strategy,” the government announced a push to introduce spot ETFs to provide users with greater trading convenience

- The current administration’s campaign pledges include not only approval of a Bitcoin spot ETF but also the introduction of a KRW stablecoin and conditional permission for ICOs, suggesting a high likelihood that these will also be pursued

2) KRW stablecoin: Stability vs. industrial development

- As global discussion of stablecoins spreads, Korea is also reviewing the introduction of a KRW stablecoin, but differences among government agencies are sharp

- The FSC supports allowing fintech firms to participate based on capital requirements and technical capability criteria, emphasizing that risks can be managed through issuance regulation

- The BOK argues for a bank-led consortium with 51% equity. It is concerned that if non-bank institutions issue at scale, it would be difficult to control money supply via reserve requirements

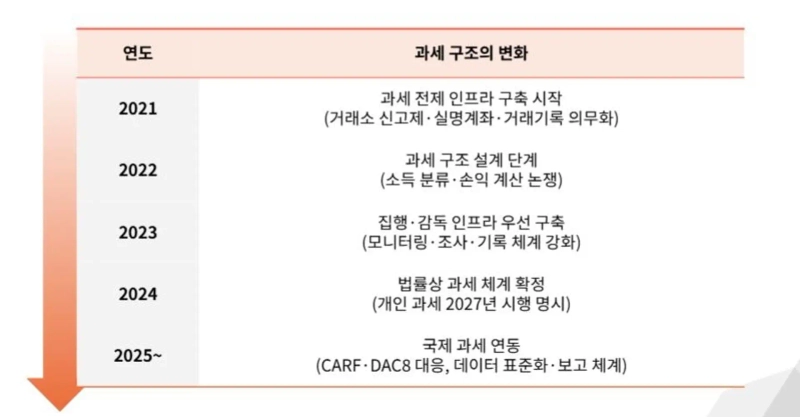

3) Cryptocurrency taxation: The near future

- Korea is one of the few countries deferring cryptocurrency taxation, and the non-taxation of individual trading profits is one reason for the high level of investment fervor

- While implementation has been repeatedly deferred, the law confirms enforcement from January 2027. Corporations are already accounting for cryptocurrency gains and losses within the existing corporate tax framework

4) Limits on major shareholder stakes in cryptocurrency exchanges: A topic likely to be revisited

- The issue of exchange ownership stakes became a debate following an FSC proposal, and the Digital Asset eXchange Alliance (DAXA) submitted opposing views

- At a Digital Asset TF meeting, it was said the item would be excluded from the Phase 2 cryptocurrency bill, but it may be revisited later

Korea has succeeded in preventing incidents, but failed to foster the industry

- Although Korea is one of the most active participating countries in the global Web3 ecosystem, it has failed to build a domestic ecosystem, forming a distorted structure in which there is a market but no industry. The seat belt exists, but there is no car

- Like the U.S. crypto advisory council model, Korea needs to become a regulatory leader where investor protection and industrial innovation coexist through close dialogue with the industry

Tiger Research is a blockchain-focused research firm that provides standards enabling sound decision-making in the complex Web3 industry. Since its founding in 2022, it has provided Web3 market research and strategic advisory services to more than 100 global blockchain foundations and more than 150 institutions. Its reports are published in five languages—Korean, English, Chinese, Japanese, and Indonesian—and distributed through major media and platforms in each country. It is currently growing into a global knowledge hub by leveraging local networks and analytical capabilities across major Asian countries to deliver actionable insights.

Disclaimer

This report has been prepared based on reliable sources. However, it does not expressly or implicitly guarantee the accuracy, completeness, or suitability of the information. We shall not be liable for any losses arising from the use of this report or its contents.

The report’s conclusions and recommendations, expectations, estimates, projections, targets, opinions, and perspectives are based on information available at the time of writing and may change without notice. They may also not align with, or may contradict, the views of other individuals or organizations. This report is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. Any reference to securities or digital assets is for explanatory purposes only and does not constitute an investment recommendation or an offer to provide investment advisory services. This material was not intended for investors or potential investors.

This report is independent of the editorial direction of any media outlet, and all responsibility rests with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io