Powell holds rates despite Trump pressure… Asked if he’ll stay at the Fed, says “no comment”

Summary

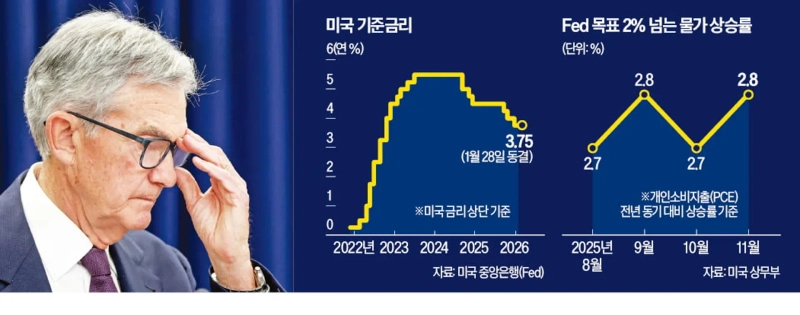

- The U.S. central bank held the policy rate at 3.5%–3.75% and said inflation is still somewhat elevated.

- It said PCE inflation rose 2.9% and core PCE increased 3.0% last year, while suggesting the likelihood of further rate hikes is low.

- Powell stressed Fed independence and said the rate-hold stance would remain in place despite the Trump administration’s pressure for rate cuts.

“Inflation still somewhat elevated”… Policy rate kept at 3.75% a year

Inflation has eased from its peak, but…

Last year, PCE rose 2.9%

Still above the 2% long-run goal

Powell on investigative subpoena: “No comment”

Even after his term as Fed chair ends in May

Speculation he may stay on without resigning as governor

The U.S. central bank (Fed) on the 28th (local time), at its first monetary policy meeting of the year, held the policy rate steady at 3.5%–3.75% a year. It marked a pause in a run of three consecutive rate cuts in September, October and December last year. The hold came as President Donald Trump has called for rate cuts and the U.S. Justice Department has launched an investigation into Fed Chair Jerome Powell.

“The U.S. economy is solid”

The Fed assessed the U.S. economy by saying that “economic activity has been expanding at a solid pace.” It said job gains have remained low and the unemployment rate is showing signs of stabilizing. It added, however, that inflation is “still somewhat elevated.”

At a press conference after the decision, Powell said, “(Last year) the unemployment rate in December was 4.4%, with little change in recent months,” adding, “Inflation has eased from its mid-2022 peak, but remains somewhat elevated relative to the longer-run goal of 2%.” He said there is no need to cut rates to support employment stability or to raise rates to rein in prices.

He also said, “Based on estimates using the consumer price index, over the 12 months through December (last year), total personal consumption expenditures (PCE) inflation rose 2.9%, and core PCE inflation, excluding volatile food and energy, increased 3.0%.” He added, “A substantial part of the rise in goods prices is due to tariffs,” saying it is “easier to resolve than demand-driven inflation,” and that tariffs “are likely to act as a one-off price increase.”

On the timing and pace of additional rate cuts, Powell reaffirmed the stance he set out after the December cut, saying the Fed is “well positioned to respond to the risks we face” between its dual mandate of price stability and maximum employment. He added, however, that “no one’s baseline outlook is that the next adjustment is a rate hike.”

Internal divisions resurface

Powell’s decision to hold rates was already expected by the market. That is because the Fed had cut the policy rate by 0.25 percentage point in each of the past three meetings, and Powell said at last year’s final meeting that rates were now around the neutral level. The neutral rate is the level that can support job growth without stoking inflation.

Even at this meeting, differences within the Fed surfaced. While Powell and 10 other members backed holding rates, Stephen Miran, chair of the White House Council of Economic Advisers (CEA) and a Trump confidant, and Governor Christopher Waller, cited as one of the candidates for the next Fed chair, dissented, arguing for a 0.25 percentage point cut.

Measured response to Trump pressure

At the briefing, reporters pressed Powell for his view on the Trump administration’s investigation, which was sparked by issues raised over the Fed headquarters renovation costs and related congressional testimony. Powell said, “Please refer to the statement released on the 11th. I won’t elaborate on it or repeat it.” Asked whether he had complied with a subpoena, he replied, “I have nothing to say.” In the public statement on the 11th, he criticized the probe as an unprecedented threat by the executive branch to the Fed’s independence.

Asked whether he would serve out the remainder of his term as a Fed governor after his term as chair ends in May, Powell said, “I have nothing to say today,” declining to comment. It is customary for Fed chairs to step down as governors when their chair terms end. But as the Trump administration’s pressure for rate cuts has intensified, speculation has grown that Powell may keep his seat as a governor to protect the Fed’s independence. His term as governor runs through Jan. 31, 2028.

Powell again underscored his conviction on why he attended U.S. Supreme Court arguments related to the Trump administration’s attempt to remove Fed Governor Lisa Cook. “This case will be the most important legal case in the Fed’s 113-year history,” Powell said, adding, “It would have been harder to explain why I didn’t attend.”

New York=Park Shin-young, correspondent nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.