Meta rallies while Microsoft sinks despite strong results… Big Tech no longer moving in lockstep

Summary

- Meta said profitability metrics improved—including ad revenue, earnings per share (EPS), operating margin, and average revenue per user (ARPU)—driving the stock up 11% in after-hours trading on the back of AI investment.

- Microsoft said that despite a 66% increase in capex, a slowdown in Azure cloud revenue growth sent the stock down 6.14% in after-hours trading.

- While software-as-a-service (SaaS) companies saw pullbacks as customers moved to general-purpose AI despite heavy data center spending, the ad tech space that includes Meta was cited as more efficient at converting AI investment into profits.

Wall Street shifts focus to AI profitability

Meta posts $59.8bn in Q4 revenue

EPS jumps… up 11% in after-hours trading

Profitability metrics such as revenue per user improve

Microsoft falls 6% despite 17% revenue growth

Azure cloud revenue slowdown cited as the cause

Big Tech stocks that led the U.S. market through last year are moving in different directions so far this year. In 2025, money poured indiscriminately into companies delivering “earnings surprises,” but lately investors have been scrutinizing whether companies have a credible path to profitability and growth that can absorb astronomical artificial intelligence (AI) investment costs. On the Street, analysts say Meta Platforms (Meta) and Microsoft (MS), which both posted strong results on the 28th (local time), exemplified this shift in sentiment.

Both deliver an “earnings surprise”

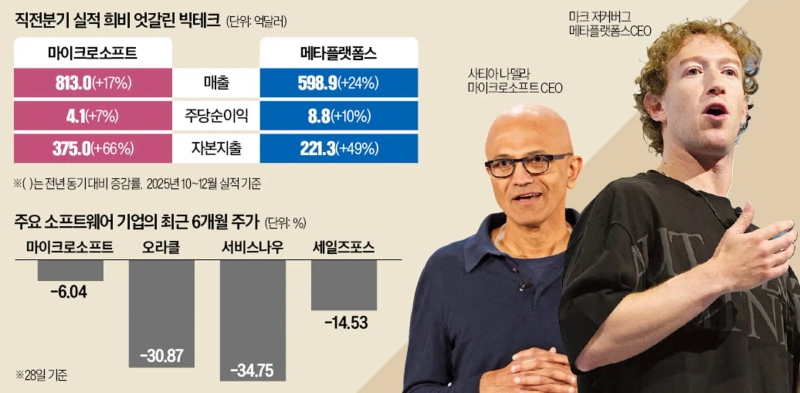

After the close, Meta said its fourth-quarter revenue totaled $59.89bn (about 85 trillion won). That marked a 24% surge from a year earlier and beat the consensus estimate of $58.59bn. Earnings per share (EPS) also came in at $8.88, topping the expected $8.23.

Microsoft likewise turned in better-than-expected numbers. Fourth-quarter revenue rose 17% from a year earlier to $81.3bn, above Wall Street’s $80.2bn forecast. Operating profit ($38.3bn) and EPS ($4.14) also improved.

Yet the market’s reaction diverged. Meta’s shares jumped more than 11% at one point in after-hours trading, while Microsoft ended down 6.14%.

Microsoft spends more, grows less

Brokerages say investors are now judging not only the “quantity” of Big Tech’s growth but also its “quality.” In other words, the market is weighing whether AI spending is translating into tangible improvements in profitability.

Meta is being viewed as a case where spending and growth are in balance. In Q4, Meta’s advertising revenue rose 24% year on year to $57.1bn. Over the same period, it recorded $22.1bn in capital expenditures—close to half that amount. Meta is pouring astronomical sums into recruiting AI talent to advance its ad model, including acquiring the small startup Scale AI for $14.3bn.

The impact of that spending showed up quickly. Key profitability metrics such as Meta’s operating margin and average revenue per user (ARPU) improved sharply last quarter. The result reflects a jump in ad penetration from 6% to 18%, helped by AI-enhanced ad models. CEO Mark Zuckerberg’s confidence that losses in the money-losing AI hardware business will “peak this year and then begin to decline” was also viewed positively.

Microsoft, by contrast, hit a snag as growth in a core unit slowed. Microsoft spent $37.5bn in capex in the fourth quarter, up 66% from a year earlier and above the market estimate of $36.2bn. Even so, the revenue growth rate of Azure—its cloud service that has driven Microsoft’s expansion—slipped to 39% from 40% in the previous quarter.

Microsoft CFO Amy Hood explained that the disappointing ratio of Azure’s growth to capex was because a significant portion of cloud computing capacity at new data centers was allocated to internal businesses such as Copilot.

SaaS becomes the “bad value bet”

Even Microsoft, the world’s No. 2 cloud provider, is being marked down relative to its results, underscoring how the market is souring on software-as-a-service (SaaS) companies. As these firms pour huge sums into improving software performance and building data centers, existing customers are shifting to general-purpose AI, analysts say. ServiceNow, also a software company, posted strong results and upbeat guidance, yet its shares still saw an after-hours pullback of around 3%.

By contrast, the ad tech sector that includes Meta is cited as an industry where AI investment converts to profits more efficiently. AppLovin, the No. 1 player in mobile game advertising, has surged 49.98% over the past six months.

By Beomjin Jeon forward@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.