US spot Ethereum ETFs see $177.87 million net outflows…led by BlackRock and Fidelity

Summary

- US spot Ethereum ETFs as a whole posted $177.87 million in net outflows in a single day.

- Major large products including BlackRock’s ETHA and Fidelity’s FETH continued to see fund outflows in tandem.

- The market views Ethereum’s price as repeatedly swinging between limited rebounds and pullbacks, with institutional flows via spot ETFs also developing cautiously.

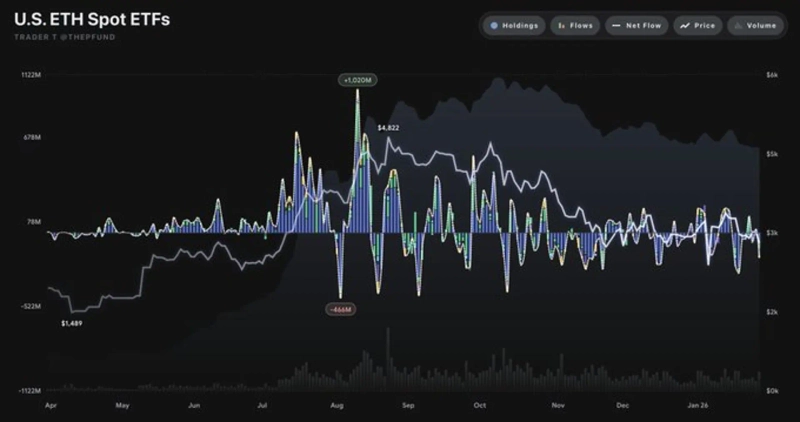

US spot Ethereum exchange-traded funds (ETFs) recorded net outflows of nearly $180 million in a single day. Outflows were seen across major issuers, keeping near-term supply-demand conditions under pressure.

According to Trader T data released on the 30th, total net outflows from all US spot Ethereum ETFs the previous day came to $177.87 million.

BlackRock’s ETHA saw $55.22 million in net outflows, while Fidelity’s FETH lost $59.19 million. Outflows were also confirmed in Bitwise’s ETHW (-$2 million) and VanEck’s ETHV (-$13.05 million).

Grayscale’s ETHE posted $26.49 million in net outflows, and the Grayscale Mini Trust also saw $21.92 million exit, adding to the bearish tone.

By contrast, there were no fund flow changes on the day in 21Shares’ CETH, Invesco’s QETH, or Franklin’s EZET. While some ETFs avoided outflows, it was not enough to offset the broader exodus concentrated in larger products.

Market participants interpret the move as a sign that, with Ethereum’s price repeatedly oscillating between limited rebounds and pullbacks, institutional flows via spot ETFs are also unfolding cautiously.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.