Editor's PiCK

"Virtual-asset alert system refined into three tiers…order restrictions also under review starting in March"

Summary

- Financial authorities and the Digital Asset Exchange Alliance (DAXA) said they are operating a three-tier alert system—Caution·Warning·Risk—for virtual assets designated as investor-caution items.

- They said measures are being prepared to allow only limit orders and restrict market orders when Risk alerts are triggered simultaneously in both sharp price swings and global price-gap categories.

- They said this market order restriction function will apply to the top 20 virtual assets by market capitalization and stablecoins, and is expected to take effect starting in March.

Financial authorities and major domestic virtual-asset (cryptocurrency) exchanges have refined the virtual-asset alert framework to strengthen investor protection, and are also reportedly reviewing the introduction of order restrictions.

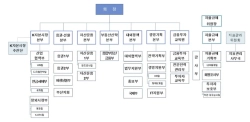

According to the industry on the 30th, the Financial Supervisory Service and the Digital Asset Exchange Alliance (DAXA) are operating the alert levels applied to virtual assets designated as investor-caution items by dividing them into three tiers—“Caution,” “Warning,” and “Risk”—from the previous single-tier system. The move is seen as aimed at reflecting price volatility and discrepancies with global prices more precisely.

If the price gap versus global virtual-asset prices is at least 10% but less than 20%, it is classified as “Caution”; at least 20% but less than 30% as “Warning”; and 30% or more as “Risk.” In cases of sharp price swings, a “Risk” alert is issued if the current price rises by at least 200% or falls by at least 90% from a day earlier.

The alert framework is an enhancement of the virtual-asset alert system introduced in 2023. Authorities and exchanges are said to be operating the system to address information asymmetry and curb excessive speculative trading.

By exchange, Upbit and Bithumb have applied the new criteria since the 29th, Korbit since the 28th, and Gopax since the 27th.

According to the industry, measures are also being prepared to restrict orders when “Risk” alerts are triggered simultaneously in both categories—sharp price swings and global price gaps. Under the measure, only limit orders would be allowed within a specified price range, while market orders would be restricted.

In addition, a “market order restriction” function is set to be added. The main provision is to restrict market orders for a certain period if price volatility persists for a certain time for the top 20 virtual assets by market capitalization and for stablecoins.

These order-restriction features are expected to take effect starting in March.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)