Editor's PiCK

Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]

Summary

- It said that liquidity and investor sentiment are weakening further as the Fed held its benchmark rate steady and expectations for rate cuts faded.

- It reported that crypto market trading volume and near-term buying interest are weakening as stablecoin supply declines and funds shift into traditional safe-haven assets.

- It reported that experts said the altcoin market has entered a structural inflection point due to Bitcoin dominance, limited room for an altcoin rebound, and liquidity issues.

After the Federal Reserve (Fed), the US central bank, held its benchmark rate steady at the first Federal Open Market Committee (FOMC) meeting of the year and dialed back expectations for rate cuts, renewed caution is resurfacing across the cryptoasset (cryptocurrency) market over liquidity and investor sentiment. Analysts say the market is approaching an inflection point that could determine direction amid falling volumes and slowing fund flows.

“Volume contraction meets capital outflows…Liquidity strain rises as stablecoins shrink”

The broader altcoin (cryptoassets other than Bitcoin) market is seeing limited rebound momentum as declining trading volumes coincide with signs of capital outflows. A drop in stablecoin supply is also cited as a factor weighing on market liquidity.

According to CoinMarketCap, a global crypto market data site, total crypto market capitalization has recently slipped below $3 trillion and is hovering around $2.82 trillion (about KRW 4,049 trillion). This month, aggregate trading volume across major crypto exchanges totaled $1.118 trillion (about KRW 1,600 trillion), the lowest level since July last year. Crypto-focused outlet BeInCrypto reported that “the fact that buying interest is not coming in even though many altcoins remain 70–90% below their highs clearly shows a deterioration in investor sentiment.”

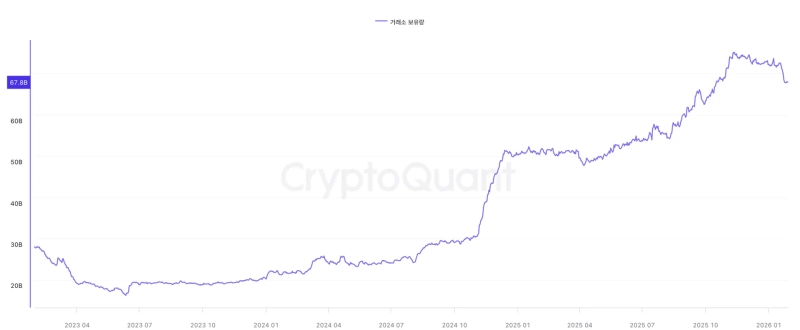

With investor participation weakening, stablecoin supply dynamics are also losing steam. According to on-chain analytics platform CryptoQuant, both the total supply of Ethereum-based (ERC-20) stablecoins and the stablecoin balances held by major crypto exchanges have recently been trending lower. Stablecoins are viewed as dry powder—cash on the sidelines that can be deployed for future buying in the crypto market. Typically, when both indicators fall at the same time, it signals that funds are leaving the market.

Some in the market also say uncertainty surrounding stablecoin legislation is constraining investor sentiment. On the 28th, crypto services firm Matrixport said, “Under the regulatory framework based on the US GENIUS Act and the (under review) CLARITY Act, interest payments by stablecoin issuers are expected to be restricted,” adding that “as a result, funds are shifting from stablecoins into traditional safe-haven assets such as gold and silver.” It also assessed that “this is weakening near-term buying power in the crypto market alongside shrinking liquidity.”

While smaller altcoins have continued to rebound, some say the setup makes it difficult for the move to persist. Axie Infinity (AXS), for example, spiked as much as 260% intraday this month before undergoing a short-term pullback. Meanwhile, The Sandbox (SAND) and Decentraland (MANA) rose as much as 62% and 54%, respectively, before giving back most of their gains.

AltcoinVector said, “As large-cap assets remain in a consolidation phase, fast money is rotating into smaller altcoins in pursuit of short-term returns,” but added that “‘pocket rallies’ built on thin liquidity—including Axie Infinity—are likely to end as speculative moves until core assets such as Bitcoin (BTC) and Ethereum (ETH) establish a base.”

Can altcoins rebound?…“Crypto market enters a structural inflection point”

Experts say that as the crypto market remains in a corrective phase, it is nearing a pivotal point that could shape the next move.

Swissblock, a crypto analytics firm, said, “The market is currently in the early stage of an inflection point where Bitcoin dominance (market share) has begun to rise,” while noting that “in this zone, overall market dynamics can diverge sharply depending on price direction.” It added, “If Bitcoin continues to trend higher, an altcoin rotation could unfold; conversely, if Bitcoin falls while dominance remains elevated, market instability could expand quickly.”

Unlike traditional financial markets, which have shown relatively stable price action, inflows into the crypto market appear limited. Alex Kuptsikevich, chief analyst at FxPro, said, “As crypto market cap approaches $3 trillion, selling pressure intensifies, constraining altcoins’ attempts to rise.” He added, “While recent dollar weakness has supported equities, flows into crypto remain limited,” and noted that “flagship tokens such as Ethereum, XRP and Binance Coin (BNB) are holding up, but the broader market is showing divergent moves by asset.”

Caution around geopolitical tensions and policy uncertainty has also been slow to fade. With Trump-driven tariff wars still ongoing, President Trump’s remarks about Greenland are also cited as a factor adding to uncertainty. On top of that, renewed fears of a US federal government shutdown are keeping broader market nerves elevated. Global crypto exchange Bitfinex said, “Geopolitical risks are intensifying risk-off sentiment toward risk assets,” adding that “with inflation high, the Fed’s monetary policy is likely to maintain a tightening bias for the time being.”

Some analysts see limited scope for an altcoin rebound. Crypto analyst Benjamin Cowen said, “Ethereum, the bellwether altcoin, is being heavily affected by a market environment that is effectively a Bitcoin bear market,” adding that “this cycle formed its high amid indifference rather than euphoria, similar to the 2019 downturn, and as back then, the market is likely to see a weaker trend that alternates between rebounds and pullbacks.” He added that “when Bitcoin faces resistance, altcoins also struggle to secure upside momentum; while some altcoins may rise, overall downside pressure is likely to dominate.”

Crypto analyst Michaël van de Poppe also said, “After a strong rally around Trump’s inauguration last year, expectations for a bull market weakened quickly and investor sentiment cooled.” He added, “The current decline is less about fundamentals and more about market structure and liquidity,” and said, “Until most altcoins recover prices from before last October’s ‘mass liquidation’ event, there is little reason for investors to engage in aggressive trading.” He added, “For now, we are maintaining portfolios and reviewing response strategies centered on assets with faster recovery momentum.”

Kang Min-seung, Bloomingbit reporter minriver@bloomingbit.io

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)