Copper heats up, decoupled from the physical market… “Brace for a potential pullback”

Summary

- Copper prices, after surging more than 40% last year, have climbed more than 10% again in January, with fresh record highs and continued inflows of speculative buying, the report said.

- It noted that a favorable macro backdrop—including the U.S. government’s decision to defer tariffs, a weaker dollar, and a stronger yuan—is supporting upward pressure on copper prices.

- It warned that weak demand in China and rising inventories, along with signals of soft physical supply and demand, mean investors should brace for the possibility of a near-term price pullback in copper.

Up more than 10% even this year

Overheating warnings are growing

Bearish factors persist on the physical supply-demand front

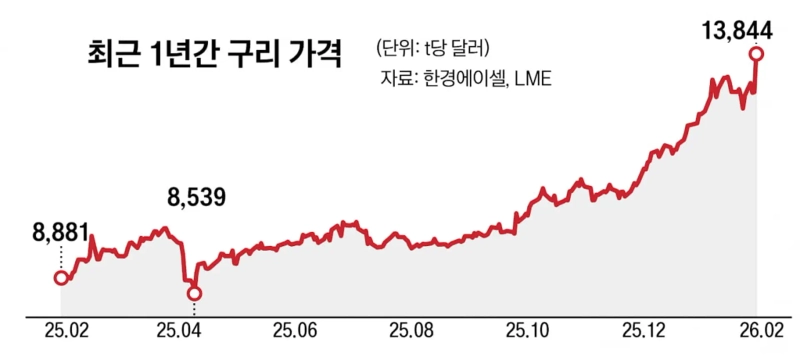

Copper—dubbed “Dr. Copper” and the latest superstar of global commodity markets—has extended its rally into the new year. After posting a record gain of more than 40% last year, it recently surged past $13,000 per tonne (t), rewriting its all-time high.

According to Hankyung ASL and the London Metal Exchange, copper on Jan. 19 settled at $13,844, up 6.54% from the previous day.

While prices continue to trend higher, overheating warnings are also emerging. In other words, unlike the supportive macro backdrop, the physical supply-demand picture is flashing elements that warrant concern.

◆Weaker dollar and easing tariff worries

According to LS Securities’ research center on the 29th, copper prices jumped 44% in 2025 and have risen more than 10% again in January this year. The key driver of this rally has been a favorable macro environment. A weaker dollar driven by expected rate cuts from the U.S. Federal Reserve (Fed), along with yuan strength stemming from a narrower U.S.-China rate differential, is supporting upside pressure on copper.

A decisive factor was the easing of tariff risks that had weighed on the market. Hong Sung-ki, an analyst at LS Securities, said, “After the U.S. government decided to defer tariff imposition and prioritize negotiations on supply contracts following the release of Section 232 probe findings on critical minerals, the probability of tariffs—which exceeded 70% in December last year—has plunged to under 30% now,” adding, “Speculative buying into the metals sector as a hedge against ‘currency depreciation’ is also flowing in.”

◆Weak China demand and rising inventories as a “wild card”

In contrast to the lofty price rally, physical supply-demand indicators look shaky. That is because real demand capable of underpinning higher prices is not keeping pace.

Conditions in China, the world’s largest consumer, are not reassuring. Despite an output-cut agreement among Chinese smelters, refined copper production in December hit a record high, stoking concerns about oversupply. On the demand side, China’s operating rate for copper product output in December fell to its lowest level in four years, suggesting that the demand slump that began in the third quarter of last year is continuing.

A sharp drop in the “Yangshan premium,” a gauge of heat in the spot market, also stands out. Shin Seung-yoon, an analyst at LS Securities, said, “Even though this is seasonally a stockpiling period in China, the spot premium has been falling steeply since January, which is interpreted as evidence that actual purchasing demand is weak,” adding, “With inventories at the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) turning back to an uptrend, signals of a shift in market supply-demand dynamics are being detected.”

◆“Brace for the possibility of a near-term price pullback”

On the supply side, the impact of the accident at Indonesia’s Grasberg mine in September last year is expected to persist into the first half of this year, worsening supply-demand conditions. Many analysts say that fears of supply disruptions that intensified after the incident, combined with recent speculative buying, have fueled the surge in prices.

Researcher Hong said, “A weaker dollar and speculative buying into the metals sector are keeping the upward momentum intact,” but added, “With easing concerns over tariff imposition overlapping with signals of weak physical supply and demand, a price pullback could emerge going forward.”

By Park Jong-seo

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.