Gold, silver and copper prices plunge…$120 million in forced liquidations in tokenized markets

Summary

- It reported that a plunge in international metal prices led to about $120 million in forced liquidations in tokenized markets tied to gold, silver and copper.

- It said copper futures on the London Metal Exchange (LME), the world’s largest metals market, fell about 4% in a day to around $13,000.

- It said gold and silver fell 4% and 5.9%, respectively, while gold-based tokenized products such as XAU and XAUT and the tokenized silver market saw declines of more than 7% and $32 million in losses, respectively.

A sharp selloff in international metal prices in the physical market triggered large-scale liquidations in tokenized markets tied to gold, silver and copper.

On the 30th (Korea time), cryptocurrency news outlet CoinDesk reported that about $120 million in forced liquidations occurred in metal-backed tokenized markets over the past 24 hours.

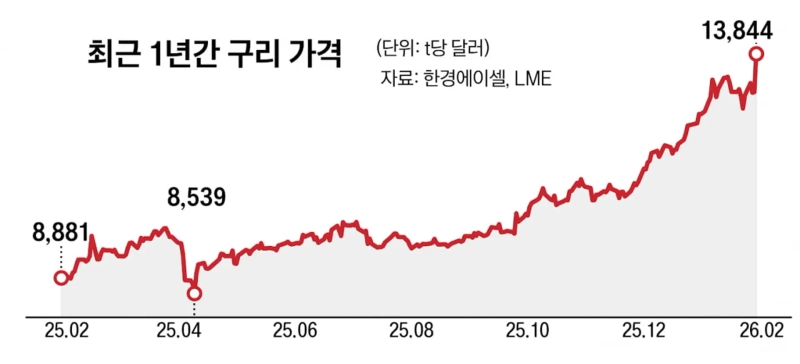

The move is seen as spillover from falling metal prices on the London Metal Exchange (LME), the world’s largest metals market. Three-month copper futures on the LME briefly topped $14,500 per metric ton the previous day, but slid roughly 4% in a single day to around $13,000 as technical issues coincided with position adjustments by Chinese traders.

Copper prices had recently been surging on expectations of a recovery in Chinese demand, rising electrification demand from the energy transition, and a weaker dollar.

Precious metals also fell in tandem. According to TradingView, gold and silver were down 4% and 5.9%, respectively, from the previous day.

Losses therefore widened in tokenized products that track metal prices and related derivatives. In particular, the tokenized silver market posted losses of $32 million, the largest hit. Prices of gold-backed tokenized products such as XAU and XAUT also fell more than 7% in a day.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.