Editor's PiCK

U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]

Summary

- Bitcoin was reported to have broken below the key $82,000 support level amid U.S.-driven risks including a sharp selloff in U.S. tech stocks, renewed federal government shutdown concerns, geopolitical risks, and uncertainty over the next Fed chair.

- Ethereum was said to face downside concerns amid a steep drop in derivatives open interest and risks of a break in the $2,900 and $2,750 support levels, while expectations also coexist for expansion into AI economy infrastructure with the introduction of ERC-8004.

- XRP and Worldcoin were reported to be under downside pressure at key support levels, requiring a cautious approach, as the former saw its first weekly net outflow from spot ETFs and the latter was hit by a token unlock and a rumor-driven surge followed by a sharp pullback.

<Lee Soo-hyun’s Coin Radar> is a weekly column that tracks trends in the digital-asset (cryptocurrency) market and explains the forces behind them. Going beyond a simple price rundown, it provides a multidimensional analysis of global economic issues and investor positioning to offer insights into where the market may be headed.

Major Coins

1. Bitcoin (BTC)

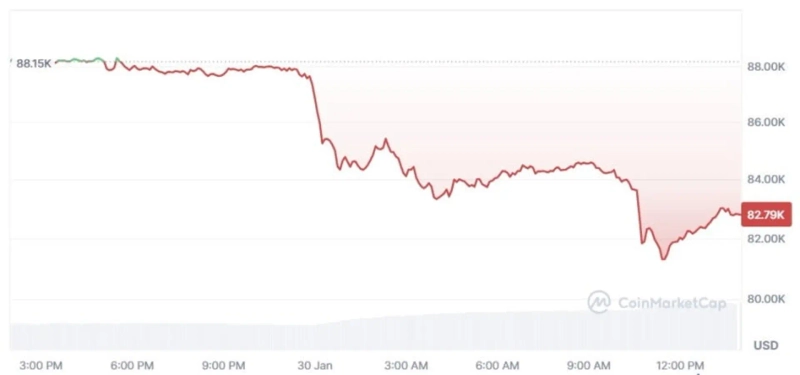

Bitcoin appeared to be holding within a range this week, but began to swing sharply after midnight on the 30th. It fell nearly $3,000 from its highs, sliding below the $82,000 level. As of the 30th, it is still trading around $83,000 on CoinMarketCap.

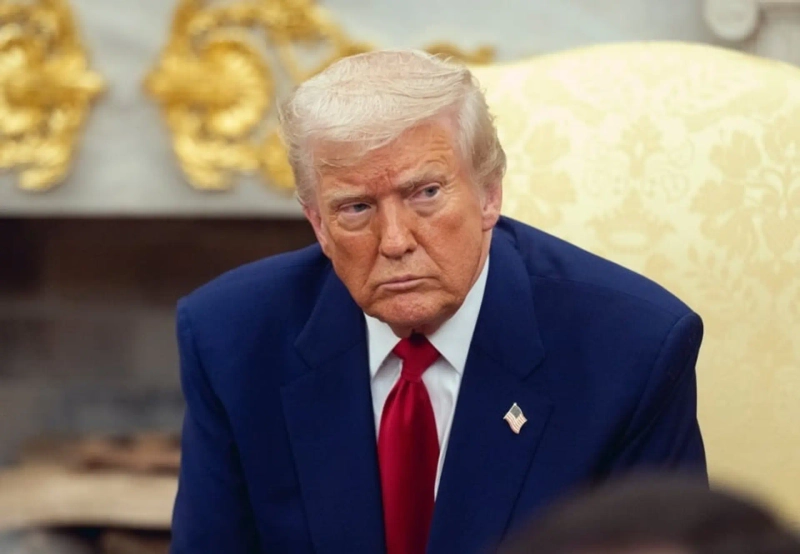

Many see the drop as the result of multiple U.S.-driven risks overlapping at once rather than a single issue. The most direct trigger was the sharp selloff in U.S. tech stocks. On the 29th (local time), Microsoft shares in particular plunged more than 11% in a single day, rattling markets. While results themselves were not dramatically bad, concerns over slowing cloud growth and rising investment costs came to the fore, marking its worst day since March 2020. In the wake of that move, the Nasdaq fell 1.5%, and risk-off sentiment spread quickly across risk assets. Bitcoin struggled to avoid that flow.

U.S. political risk also compounded the move. The U.S. Senate rejected a House budget bill in a procedural vote, putting the possibility of a federal government shutdown back in focus. While President Donald Trump and Democrats later reached a temporary agreement to avert a shutdown, a significant portion of market anxiety had already been priced in.

Geopolitical tensions added to the pressure. After the U.S. disclosed details of an aircraft carrier’s operations in the Indian Ocean and President Trump issued hardline remarks toward Iran, tensions between the U.S. and Iran came back into focus. Such geopolitical risk tends to boost demand for safe havens, creating downside pressure on Bitcoin as well.

Uncertainty ahead of the appointment of the next Federal Reserve chair also weighed on markets. With President Trump signaling on the 30th that he would announce the next Fed chair, reports said the shortlist had narrowed to Kevin Warsh, a former Fed governor, and Rick Rieder, BlackRock’s chief investment officer (CIO). According to sources familiar with the matter, President Trump was said to be leaning toward Warsh. As the likelihood increased that Warsh—seen as relatively hawkish—could be nominated, expectations for rate cuts retreated, adding further pressure to Bitcoin.

Against that backdrop, Bitcoin showed signs of panic selling on the morning of the 30th, plunging more than $2,000 in just minutes and quickly surrendering the key $82,000 support level. Once that zone broke, automatic stop-loss selling and forced liquidations hit simultaneously, accelerating the decline. CoinGlass data showed that roughly $770 million in positions were liquidated in just one hour, most of them long positions.

Looking ahead, the risk of heightened volatility remains elevated in the near term. Glassnode assessed that Bitcoin failed to regain the short-term holder cost basis and has slipped back into a bearish structure, leaving room for further downside. CoinDesk cited $81,000 as an initial support level, warning that if it breaks, a move into the mid-$75,000s could come into play. For now, this appears to be a zone where prices can swing sharply depending on macro variables.

2. Ethereum (ETH)

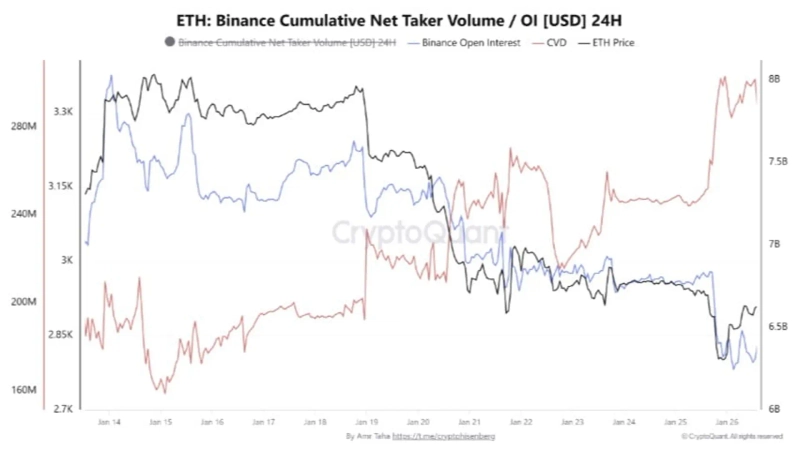

Ethereum also swung sharply alongside Bitcoin, at one point sliding below $2,800 and entering a technically uncomfortable zone.

Many analysts say this pullback was driven more by leverage unwinding in derivatives markets than by spot selling. According to CryptoQuant, Ethereum derivatives open interest fell sharply over the past two weeks, from about $8 billion to roughly $6.4 billion. The interpretation is that prices were pushed lower as built-up leverage was rapidly flushed out rather than by fresh aggressive selling. Indeed, while open interest declined, the cumulative market-order execution flow remained in an uptrend, suggesting it was not a phase in which short positions were being piled on aggressively.

Technically, the break below $2,900 support amplified the selloff. CoinMarketCap said that the move took out both the 30-day moving average and the Fibonacci 50% retracement level. The MACD also signaled accelerating downside momentum, and the sideways structure that had persisted for two weeks has now broken.

That said, there were some supportive catalysts. On the 28th, BitMine added roughly 60,000 ETH to staking, temporarily helping the price recover $3,000. BitMine’s total staked amount now stands at about 2.32 million ETH, and its annual staking proceeds are also estimated to be sizable.

On the fundamentals side, attention is also on the deployment of the new “ERC-8004” standard on mainnet. ERC-8004 is an Ethereum Improvement Proposal designed to register and verify AI agents on-chain. With the standard, AI agents belonging to different organizations and platforms could discover each other, check reputation, and interact without pre-established trust relationships. Some view this as laying groundwork for Ethereum to expand as infrastructure for an AI economy.

Technically, $2,750 is the next key support level. If that support is decisively lost, the possibility of a retest of the $2,400 area also opens up. Crypto outlet Cointelegraph offered a more bearish outlook, saying: “After breaking below the lower boundary of a triangle pattern, Ethereum retested the level that had acted as resistance but failed, increasing the likelihood of further declines. The Ethereum price could fall to $2,250 by mid-February.” The analysis added that if the price reclaims the lower boundary of the triangle pattern and breaks above $3,065, the bearish scenario could be invalidated.

3. XRP (XRP)

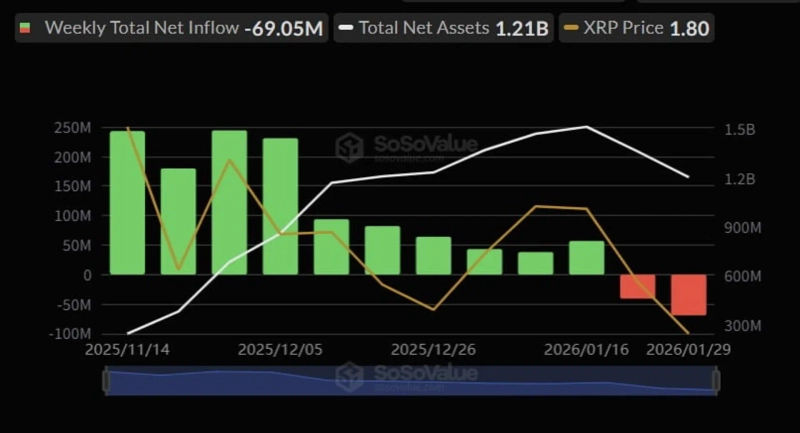

XRP showed a particularly frustrating price action during this correction. It stayed below the $1.8 level and failed to mount a meaningful rebound. As of the 30th, it is trading at $1.76 on CoinMarketCap.

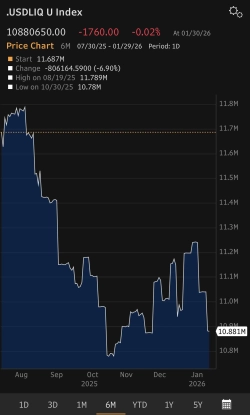

The biggest change was that flows into spot XRP exchange-traded funds (ETFs)—which had acted as a pillar—wobbled for the first time. Last week, spot XRP ETFs saw net outflows of about $41 million (about KRW 58.8 billion), marking the first weekly net outflow since listing. Total net assets also fell from $1.6 billion to $1.36 billion.

Some analyses say selling accelerated after the key support at $1.87 broke. Crypto media outlet CoinDesk noted that “with $1.87, a major technical support, decisively breaking down, heavy volume and selling pressure accelerated and a short-term downtrend was confirmed.” The inflow of selling at that point quickly pushed the price down to $1.8.

On-chain indicators, however, sent mixed signals. The number of wallets holding at least 1 million XRP turned back to growth for the first time in four months. On the 29th, on-chain analytics firm Santiment said on X that “the number of wallets holding 1 million or more XRP has turned to growth for the first time since last September, rising by 42 on a net basis.” This is interpreted as a sign that whale-class investors are accumulating even during a short-term correction, which is positive from a medium- to long-term supply-and-demand perspective.

In terms of outlook, many remain cautious. CoinDesk pointed to $1.8 as a key support level, warning that if it breaks, there is a risk of a drop to $1.73. Since it is currently moving below that, additional downside cannot be completely ruled out. Cointelegraph is even leaving open the possibility that XRP could remain in a range around $2 for an extended period as in the past—suggesting that the sluggish pattern may persist until a clear breakout.

Issue Coins

1. Worldcoin (WLD)

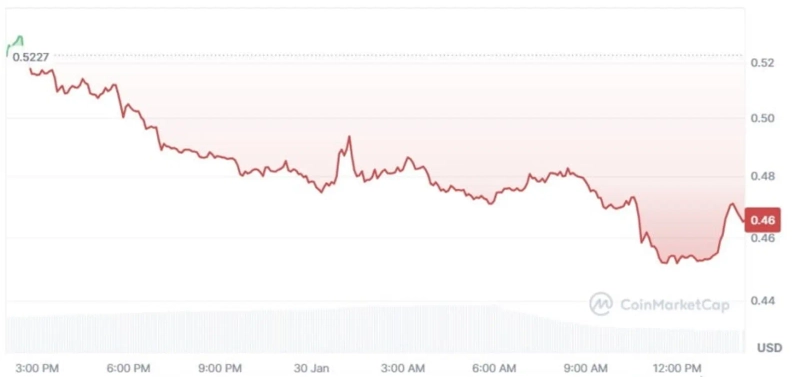

One of the coins that showed the biggest volatility this week was Worldcoin. It surged in a short period on speculation of possible integration with OpenAI, but then plunged in just a day, giving back a substantial portion of the gains.

On the 29th, Worldcoin fell more than 17% in a single day on CoinMarketCap. Considering that the average decline across the broader crypto market that day was under 5%, the drawdown was notably larger. With the overall market already in a fear-driven phase, volatile altcoins effectively absorbed the shock head-on.

The core driver of the drop was a short-term rally fueled by unconfirmed catalysts, followed by profit-taking. Worldcoin surged more than 20% over two days as speculation spread that OpenAI was reviewing biometric authentication technology, but there were no official announcements or concrete follow-up news. Because the price had run ahead on expectations alone, buying interest evaporated very quickly.

Token unlock overhang also compounded the decline. Recently, about $20 million worth of Worldcoin tokens were released into the market, increasing circulating supply and adding selling pressure at a time when demand was weakening. The fact that mid-cap altcoins are relatively vulnerable during periods of high Bitcoin dominance also appears to have contributed to the magnitude of the drop.

The market is now effectively demanding that Worldcoin “bring confirmed catalysts, not rumors.” Technically, the $0.47 level is being cited as key support, and if that zone fails to hold, volatility could increase further. For the time being, it appears more likely that the market will focus on verifying actual business progress rather than trading on expectations.

Lee Soo-hyun, BloombergBit reporter shlee@bloomingbit.io

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

![U.S.-Driven Risks Hit All at Once… Bitcoin Plunges Below $82,000, Broad Selloff Shakes Altcoins [Lee Soo-hyun’s Coin Radar]](https://media.bloomingbit.io/PROD/news/86ed8e14-c966-4bb5-bcdb-000bf9907ac4.webp?w=250)

![Liquidity strains deepen as trading volume contracts and funds exit…Can altcoins rebound? [Kang Min-seung’s Altcoin Now]](https://media.bloomingbit.io/PROD/news/5fa259b1-0308-4c7b-9259-04f38ad8fc2a.webp?w=250)