Editor's PiCK

'Warsh shock'…$740bn wiped off gold and silver market caps in a single day

Summary

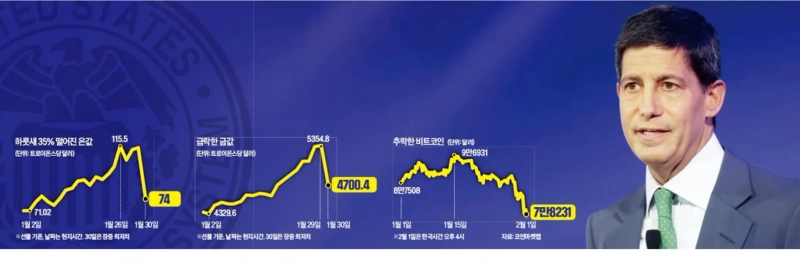

- After Kevin Warsh’s nomination, gold futures fell 11.6% and silver futures plunged 35.3%, with $740bn estimated to have been wiped off gold and silver market caps in a single day.

- With Warsh taking a conservative stance on quantitative easing (QE) and balance-sheet normalization, the dollar index and U.S. Treasury yields rebounded, intensifying concerns over shrinking market liquidity.

- Bitcoin broke below $80,000, falling about 5% to $78,309, while the drop in silver futures was amplified by higher margin requirements and margin calls.

Silver plunges 35.3%, gold 11.6%

Trump: "Warsh wants rate cuts"

The so-called “Warsh shock” has slammed financial markets. Prices of major assets including gold, silver and bitcoin tumbled after Kevin Warsh, a former Federal Reserve governor, was nominated as the next Fed chair.

On the 30th of last month, the day President Donald Trump nominated Warsh as chair, gold futures on the New York Mercantile Exchange (CME) slid 11.6% to as low as $4,700 per troy ounce. Silver futures were down as much as 35.3% per troy ounce at one point. MarketWatch estimated that gold and silver market capitalization evaporated by $740bn (about 1 quadrillion won) in a single day. Bitcoin fell below the $80,000 level for the first time in about four months.

By contrast, the U.S. dollar index, which measures the greenback against a basket of six major currencies, rose 0.74% to 96.99. The yield on the 10-year U.S. Treasury also climbed, topping 4.3% intraday. The move reflected the spotlight on Warsh as the most cautious about cutting rates among the names floated for the Fed, and his long-held negative view of quantitative easing (QE), the Fed’s liquidity-provision policy.

Asked by reporters whether Warsh had promised rate cuts, Trump answered “no,” but added, “He clearly wants rate cuts.” The Wall Street Journal reported that at a social gathering on the 25th of last month, attendees joked to Warsh that they would “sue him” if he did not cut rates.

Kevin Warsh ‘shock’ as next Fed chair nominee…global markets whipsaw

Trump mindful of undermining central bank independence…Kevin Warsh tough on inflation

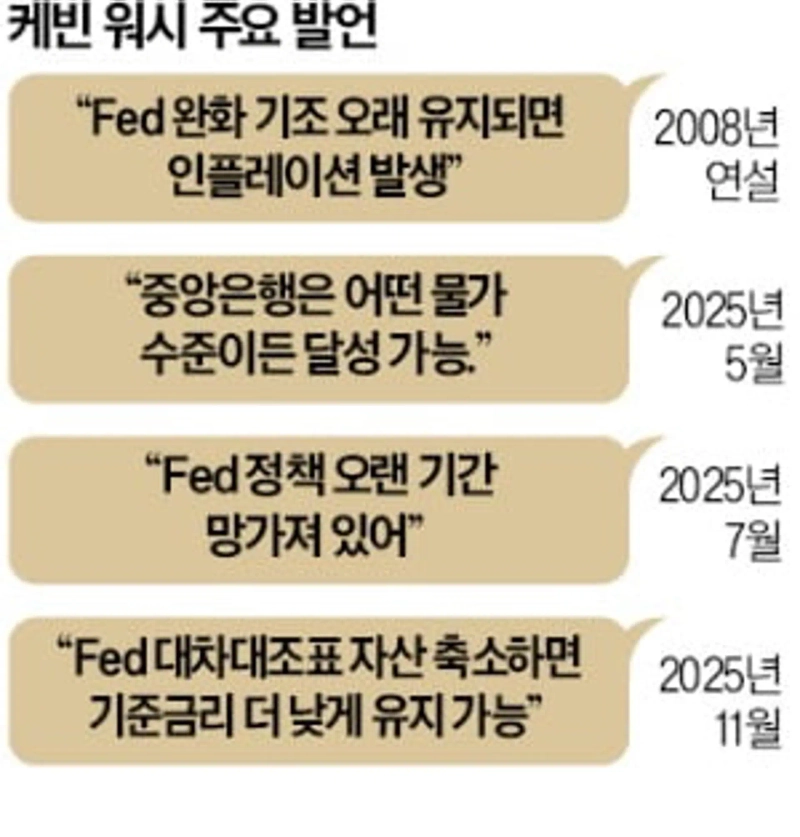

Kevin Warsh, President Trump’s nominee to lead the Federal Reserve, is negative on the liquidity-fueled policy known as “quantitative easing (QE).” His view is that even if the policy rate is lowered, QE should be scaled back. That would inevitably drain liquidity from the system. This is the backdrop to the shock in asset markets following Warsh’s nomination.

Expectations of “balance-sheet reduction”

On the 30th (local time), in the U.S. Treasury market, the policy-sensitive 2-year yield fell 0.027 percentage point from the previous session to 3.52%. Meanwhile, the 10-year yield rose 0.014 percentage point to 4.24%, and briefly topped 4.3% intraday. This is a sign the market does not view Warsh as merely a rate-cut advocate. Investors see a strong chance he could lower the policy rate in the near term under pressure from President Trump, but expect him to take a tough stance on inflation control over the medium to long term.

The key reason the Treasury market was rattled by Warsh’s nomination is “balance-sheet normalization.” When Warsh resigned as a Fed governor in 2011, he publicly opposed then-Chair Ben Bernanke’s second round of quantitative easing, criticizing it by saying, “The Fed’s massive purchases of long-term Treasuries to artificially lower rates distort the market’s price-discovery function.” Markets are watching whether, if Warsh takes office as Fed chair, he will move to reduce the Fed’s large holdings of Treasuries and mortgage-backed securities (MBS). That could lead to a decline in market liquidity. This helps explain the rebound in the dollar and U.S. Treasury yields after Warsh’s nomination.

Meanwhile, prices of major assets such as gold, silver and bitcoin plunged. Liquidation of short-term funds that had recently poured into the precious-metals market also contributed to the sharp declines in gold and silver. Silver in particular is seen as being hit by a wave of margin calls due to its high share of leveraged trading. Some also say the selloff was exacerbated as margin requirements for silver futures were raised from the current 9% level to 11% starting on the 28th of last month.

Bitcoin, the largest cryptocurrency by market capitalization, fell back below $80,000 for the first time in about nine months. According to Coinbase, a U.S. cryptocurrency exchange, as of 1:30 p.m. Eastern time on the 31st of last month, one bitcoin was priced at $78,309, down about 5% from 24 hours earlier. It was the first time bitcoin fell below $80,000 since April 11 last year.

Concerns ease over erosion of Fed independence

The easing of market concerns about an erosion of Fed independence also played a role. Speaking to reporters at the White House that day, Trump said “no” when asked whether Warsh had promised to pursue rate cuts if he is confirmed by the Senate. He added, “I don’t want to ask him that. It would probably be inappropriate,” and said, “It may be allowed, but I want to keep this process clean and pure.” The remarks were interpreted as reflecting awareness that extracting a prior policy commitment from a Fed chair nominee could run counter to central bank independence.

“Beware of an excessive ‘Warsh trade’”

On Wall Street, some also warn against extrapolating the so-called “Warsh trade” too aggressively across the broader asset market. Krishna Guha, an economist at Evercore ISI, said, “We should be cautious about overextending the ‘Warsh trade’ across the asset market,” adding, “There is a risk it could reverse sharply.” He assessed that “Warsh is closer to a pragmatist than an ideological hawk (favoring monetary tightening).” The view is that if inflation re-emerges, he could pivot hawkish after next year, but this year he is likely to take a more dovish course. Some also interpret that he will not want conflict with President Trump.

New York=Park Shin-young, correspondent / Lim Da-yeon, reporter nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)