Understanding the Complex Principles of Crypto-Asset Taxation—and How to Respond [Taxation in the Public Square]

Summary

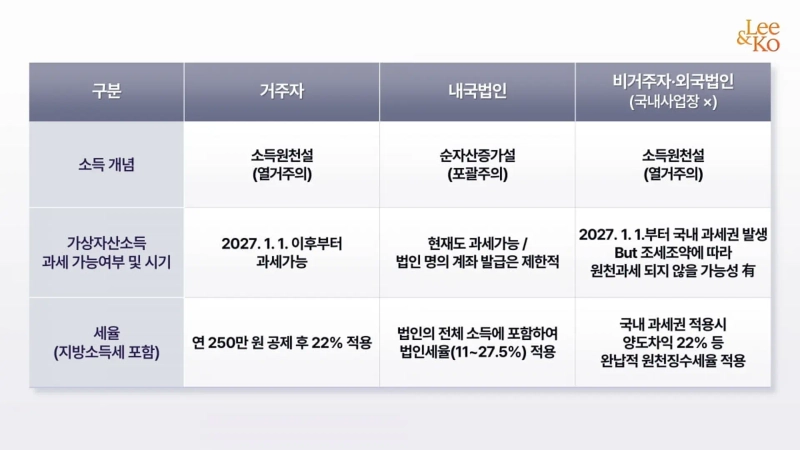

- Individuals’ capital gains from transfers of crypto assets are scheduled to be taxed at 22% on the portion exceeding KRW 2.5 million per year from Jan. 1, 2027.

- Domestic corporations are already subject to corporate income tax if their net worth increases through crypto-asset transfers.

- With tax infrastructure being strengthened—through CARF data collection from 2026 and tighter overseas financial account reporting obligations—systematic transaction recordkeeping and the establishment of tax strategies are needed.

Where crypto-asset taxation stands today

Where income arises, taxes usually follow. For now, however, capital gains realized by individuals from transferring crypto assets (e.g., Bitcoin) remain subject to a tax moratorium, with full-scale taxation scheduled to begin on Jan. 1, 2027. Accordingly, even if an individual investor earns an economic benefit through crypto-asset trading, it is not taxed at this time.

By contrast, capital gains from crypto-asset transfers by domestic corporations are already subject to corporate income tax. The reason individuals receive a moratorium while corporations are taxed immediately—despite the same economic benefit—stems from differences in the “income concept” underlying the (individual) Income Tax Act and the Corporate Income Tax Act.

Two pillars of the income concept: source theory vs. net-worth-increase theory

The source theory of income (a limited concept of income) recognizes income only when there is a continuing and recurring source of receipts. Under this view, temporary or windfall gains (e.g., a gold bar picked up by chance on the street) are excluded from income.

The net-worth-increase theory (a comprehensive concept of income), on the other hand, captures as income any increase in net worth over a given period regardless of the cause or nature of the gain. It encompasses not only temporary or windfall gains, but also nonrecurring capital gains and even illegal income (such as embezzled funds or bribes, gains from transactions that are void or rescinded under civil law, profits from unlicensed business activities, etc.).

Under the Income Tax Act (source theory), residents’ crypto-asset income to be taxed from Jan. 1, 2027

The Income Tax Act does not explicitly define the concept of income. Instead, it enumerates nine categories based on the source and nature of income for residents (individuals who have a domicile in Korea or a place of abode in Korea for 183 days or more), and taxes only the income specified by law. This framework can be said to be fundamentally grounded in the source theory of income. That said, it does not strictly adhere to the source theory in its original sense, as it taxes even temporary or windfall gains as “other income,” and includes broad provisions by income type such as “income similar thereto.”

Under the current Income Tax Act, income arising from the transfer or lending of crypto assets is classified as “other income,” and the portion exceeding KRW 2.5 million per year is taxed at 22% (including local income tax). However, the effective date of this provision has been deferred to Jan. 1, 2027; before then, there is no legal basis to tax residents’ crypto-asset income.

Under the Corporate Income Tax Act (net-worth-increase theory), domestic corporations’ crypto-asset income is taxable even now

The Corporate Income Tax Act likewise does not expressly define the concept of income, but it adopts the increase in a corporation’s net worth as the tax base and is therefore grounded in the net-worth-increase theory. A domestic corporation’s income for each business year is calculated as “total gross income - total deductible expenses,” where gross income is broadly defined as “revenue arising from transactions that increase a corporation’s net worth,” and deductible expenses as “expenses arising from transactions that decrease a corporation’s net worth.” Based on this comprehensive concept of income, the system excludes from income calculation only gains and losses from capital transactions and items specifically designated by law to be excluded.

Accordingly, even if the Corporate Income Tax Act does not explicitly list domestic corporations’ crypto-asset income as a taxable item, it becomes taxable if the corporation’s net worth increases due to a crypto-asset transfer. There are, however, practical constraints from financial regulation. In Feb. 2025, the Financial Services Commission finalized the “Roadmap for Corporate Participation in the Crypto-Asset Market,” restricting the opening of corporate-name accounts for crypto-asset transactions except for certain cases such as non-profit corporations and crypto-asset exchanges.

Korea-source crypto-asset income of non-residents and foreign corporations

Taxation scheduled from Jan. 1, 2027, but feasibility of enforcement must be assessed

Taxation of non-residents and foreign corporations without a domestic permanent establishment is imposed only on Korea-source income enumerated in the law, similar to the source theory of income. The Income Tax Act and the Corporate Income Tax Act designate Korea-source crypto-asset income of non-residents and foreign corporations as Korea-source “other income,” but—like residents—defer taxation until after Jan. 1, 2027.

Even after implementation, however, withholding tax (withholding) on non-residents and foreign corporations may not be straightforward. Given the nature of blockchain technology, the criteria for determining “Korea-source” may become a key issue, and tax treaty rules may allocate primary taxing rights to the country of residence (the treaty partner), not Korea. However, as both the amendments to the Commercial Act and the tax law bills have not yet passed the National Assembly, companies and shareholders need to closely monitor legislative developments and prepare, in advance, treasury share utilization plans and tax strategies suited to their respective circumstances.

Amid stronger tax enforcement capabilities, pre-checks and proactive responses are needed

Since its introduction in 2020, the crypto-asset taxation regime has been postponed three times (2023 → 2025 → 2027) due to investor pushback and insufficient tax infrastructure. Recently, however, tax infrastructure has been improving rapidly, making an additional delay appear unlikely.

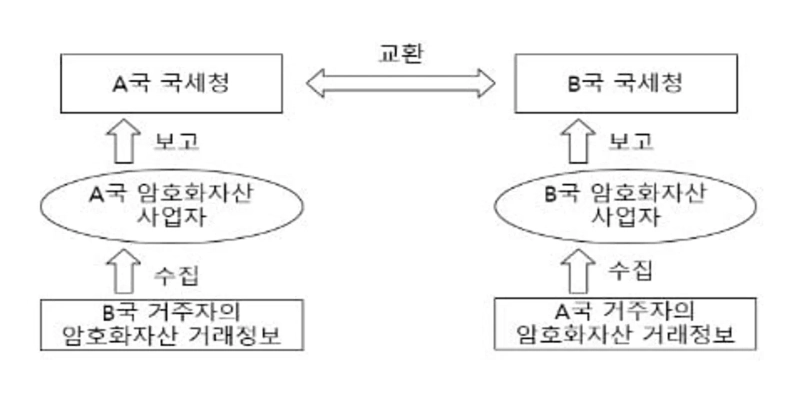

To implement the “OECD Crypto-Asset Reporting Framework (CARF),” led by the OECD and joined by 48 countries including the United States, the United Kingdom, Japan and Germany, Korea has also prepared implementing rules and began full-scale information collection from 2026. After data collection, automatic exchange of information among participating jurisdictions is set to commence from 2027. In addition, the National Tax Service is pushing to establish a new “Digital Assets Division” (tentative name) to respond to crypto-asset tax evasion.

It should also be noted that reporting obligations for overseas financial accounts already apply when financial assets in overseas financial accounts—including overseas crypto-asset accounts—exceed KRW 500 million.

Individual investors and corporations need to develop proactive response strategies, including systematic management of transaction histories, securing acquisition cost records and transaction documentation, and checking whether overseas account reporting obligations apply.

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Did it crash because of Trump?…The 'real reason' Bitcoin collapsed [Hankyung Koala]](https://media.bloomingbit.io/PROD/news/d8b4373a-6d9d-4fb9-8249-c3c80bbf2388.webp?w=250)

!["Will AI take our jobs?" Fear spreads…market rattled by a plunge in shares [New York Market Briefing]](https://media.bloomingbit.io/PROD/news/874408f1-9479-48bb-a255-59db87b321bd.webp?w=250)