2026 Is It a Crypto Winter Now? How the Market Has Changed After Regulation [Tiger Research Report]

Summary

- Unlike in the past, external factors such as ETF approvals, tariff policy, and interest rates are driving both rallies and selloffs—meaning it is neither winter nor spring.

- As the market structure splits into three layers—regulated sphere, unregulated sphere, and shared infrastructure—ETF inflows remain concentrated in Bitcoin and do not flow into alts.

- For the next rally, a new killer use case must emerge from the unregulated sphere, supported by a favorable macro environment.

Key Takeaways

Crypto winters arrive in the order of a major shock, a collapse in trust, and a talent exodus

Past winters were driven by issues inside the industry

Today, both rallies and selloffs are driven by external factors—so it is neither winter nor spring

After regulation, the market has split into three layers: the regulated sphere, the unregulated sphere, and shared infrastructure

The old trickle-down effect—Bitcoin up, alts up—has disappeared

ETF inflows stay in Bitcoin and do not flow outside the regulated sphere

The next rally will require killer use cases and a supportive macro environment

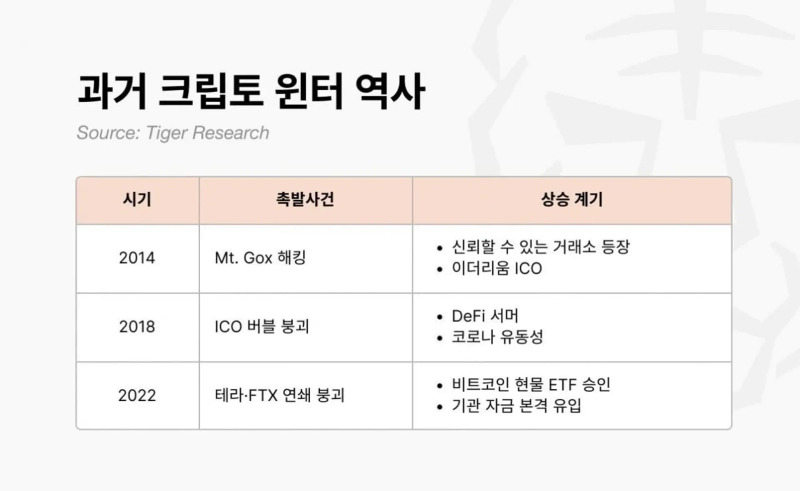

1. How did crypto winters arrive?

The first winter came in 2014. Mt. Gox was an exchange that processed 70% of global Bitcoin trading volume at the time. After roughly 850,000 BTC vanished in a hack, market trust collapsed. New exchanges with internal controls and audit functions emerged, and trust began to recover. Ethereum also entered the world through ICOs, opening up possibilities for a new vision and new ways to raise capital.

That ICO became the spark for the next bull market. As anyone could issue tokens to raise funds, the 2017 frenzy took off. Projects that raised tens of billions on nothing more than a white paper poured in, but most lacked substance. In 2018, as South Korea, China, and the U.S. rolled out regulation, the bubble burst and the second winter arrived. That winter did not end until 2020. After Covid, liquidity flooded in again, and funds returned as DeFi protocols such as Uniswap, Compound, and Aave drew attention.

The third winter was the harshest. When Terra-Luna collapsed in 2022, Celsius, Three Arrows Capital, and FTX failed in a chain reaction. This was not a simple price decline—the industry’s structure itself was shaken. In January 2024, the U.S. SEC approved spot Bitcoin ETFs; alongside the Bitcoin halving and Trump’s pro-crypto policies, capital began to concentrate once again.

2. The crypto winter pattern: major shock → collapse in trust → talent exodus

All three winters arrived in the same sequence: a major shock, a collapse in trust, and a talent exodus. It always began with a major incident—Mt. Gox hacking, ICO regulation, the Terra-Luna collapse and the FTX bankruptcy. The scale and form differed, but the outcome was the same: the entire market fell into shock.

That shock soon spread into a breakdown of trust. People who had been talking about what to build next began to ask whether crypto was truly a meaningful technology. The cooperative atmosphere among builders disappeared, and they began tearing into each other over who was to blame.

Doubt leads to a talent exodus. Builders who had been creating new momentum in blockchain fell into skepticism and left for places that seemed more certain—fintech and big tech in 2014, institutions and AI in 2018.

3. So is it a crypto winter now?

Even today, we can see the same pattern that past crypto winters followed.

Major shocks

Launch of a Trump meme coin: market cap of $27 billion in a single day → -90% plunge

10.10 liquidation event: the U.S. announces 100% tariffs on China → Binance’s largest liquidation on record ($19 billion)

Collapse in trust: skepticism spreads across the industry; focus shifts from building to blame

Pressure for a talent exodus: rapid growth of the AI industry → faster exits and promises of greater wealth than crypto

But it is hard to call the current moment a crypto winter. Past winters erupted from within the industry. Mt. Gox was hacked; many ICO projects were revealed as scams; FTX collapsed. The industry lost trust in itself. This time is different. ETF approvals opened the rally, while tariff policy and interest rates drove the downturn. External factors pushed prices up, and external factors pushed them down.

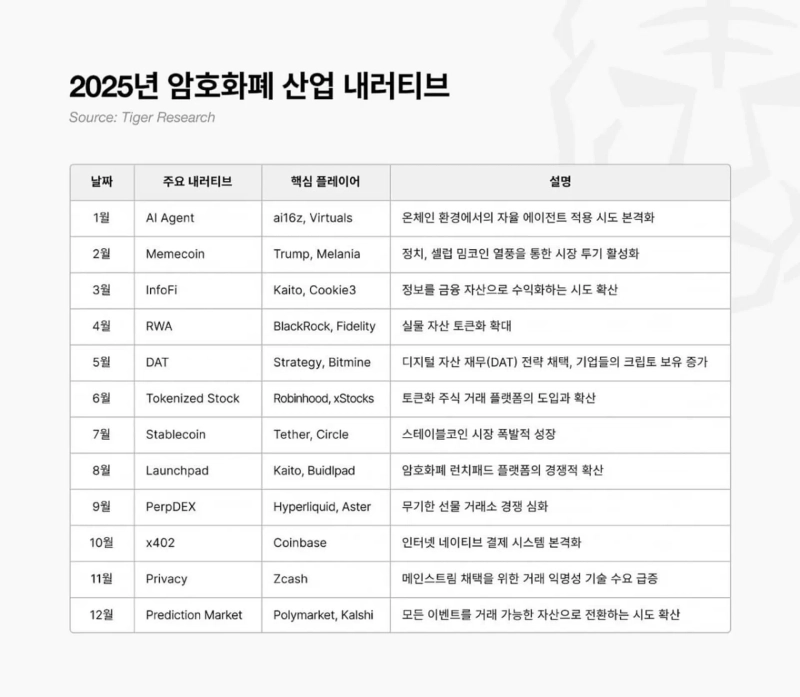

Builders have not left, either. RWA, perpDEXs, prediction markets, InfoFi, privacy—new narratives kept emerging and are still being built today. They have not lifted the entire market the way DeFi once did, but they have not disappeared. The industry has not collapsed; the external environment has changed.

If there was no spring of our own making, then there is no winter either.

4. How market structure changed after regulation

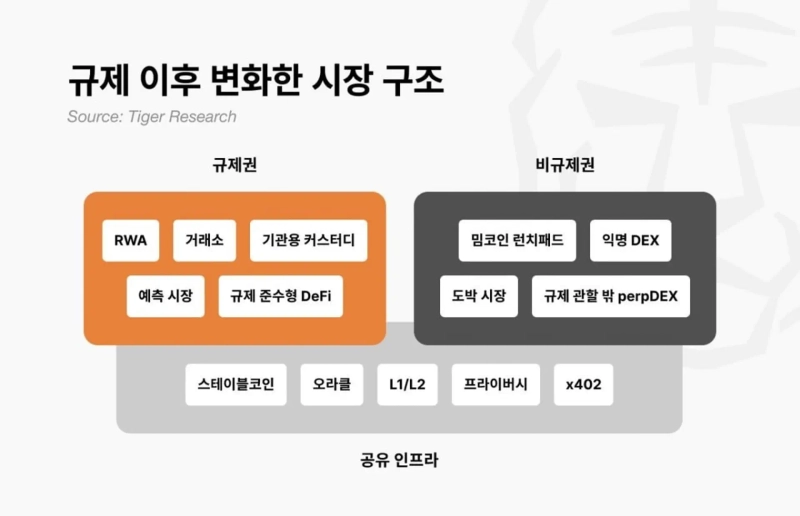

A major backdrop is how market structure shifted after regulation. The market has already split broadly into three layers: 1) the regulated sphere, 2) the unregulated sphere, and 3) shared infrastructure.

The regulated sphere includes RWA tokenization, exchanges, institutional custody, prediction markets, and compliant DeFi. These undergo audits, make disclosures, and receive legal protection. Growth is slower, but capital is larger and more stable. However, once inside the regulated sphere, it is difficult to expect the explosive upside seen in the past. Volatility declines and the upside is capped. The downside is capped as well.

By contrast, the unregulated sphere will become more casino-like. It includes meme-coin launchpads, anonymous DEXs, and perpDEXs outside regulatory jurisdiction. Barriers to entry are low and the pace is fast. 100x in a day and -90% the next day happens more often. Still, this area is not meaningless. Industries born in the unregulated sphere are creative, and once validated they move into the regulated sphere. That was the case for DeFi, and it is now happening with prediction markets. In that sense, it serves as a testbed. But the unregulated sphere itself will become increasingly separated from regulated-sphere businesses.

Shared infrastructure includes stablecoins and oracles. They are used in both the regulated and unregulated spheres. The same USDC is used for institutional RWA settlement and for Pump.fun trading. Likewise, oracles provide data both for verifying tokenized Treasuries and for liquidations on anonymous DEXs.

In other words, as the market fragments, capital flows have also changed. In the past, when Bitcoin rose, there was a trickle-down effect that lifted altcoins as well. Not anymore. Institutional capital entering via ETFs stayed in Bitcoin—and stopped there. Regulated-sphere capital does not flow into the unregulated sphere. Liquidity has stayed only where value has been proven. And even Bitcoin has yet to prove its value as a safe asset relative to risk assets.

5. Conditions for the next rally

Regulation is already being put in order. Builders are still building. That leaves two things.

First, a new killer use case must emerge from the unregulated sphere. Something that creates value that did not exist before—like DeFi Summer in 2020. Narratives such as AI agents, InfoFi, and on-chain social are candidates, but they are not yet large enough to move the entire market. The flow in which experimentation in the unregulated sphere is validated and then moves into the regulated sphere needs to be reestablished. That was the case for DeFi, and it is now happening with prediction markets.

Second, the macro environment. Even if regulation is organized, builders keep building, and infrastructure accumulates, upside will be limited without a supportive macro backdrop. DeFi Summer in 2020 exploded as liquidity surged after Covid. The rally following the 2024 ETF approvals also aligned with expectations of rate cuts. No matter how well the crypto industry performs, it cannot control rates and liquidity. For what the industry builds to be compelling, the macro environment must turn.

A broad-based “crypto season,” where everything rises together as it once did, will be difficult to see again. The market has fragmented. The regulated sphere grows steadily, while the unregulated sphere spikes hard and crashes hard.

The next rally will come. It just won’t come for everyone.

Tiger Research is a blockchain-focused research firm that provides standards for making sound decisions in the complex Web3 industry. Since its founding in 2022, it has provided Web3 market research and strategic advisory services to more than 100 global blockchain foundations and over 150 institutions. Its reports are published in five languages—Korean, English, Chinese, Japanese, and Indonesian—and distributed through major media outlets and platforms in each country. Leveraging local networks and analytical capabilities across key Asian countries, it is growing into a global knowledge hub delivering actionable insights.

Disclaimer

This report has been prepared based on reliable sources. However, it does not explicitly or implicitly guarantee the accuracy, completeness, or suitability of the information. We assume no liability for any losses arising from the use of this report or its contents. The conclusions and recommendations, forecasts, estimates, outlooks, targets, opinions, and perspectives in this report are based on information available at the time of writing and may change without notice. They may also differ from, or be contrary to, the views of other individuals or organizations. This report is provided for informational purposes only and should not be regarded as legal, business, investment, or tax advice. References to securities or digital assets are for explanatory purposes only and do not constitute an investment recommendation or an offer to provide investment advisory services. This material is not intended for investors or prospective investors. This report is independent of the editorial direction of any media outlet, and all responsibility rests with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io