Summary

- Arthur Hayes said the recent sharp drop in Bitcoin is likely due to structured products linked to BlackRock’s spot Bitcoin ETF ‘IBIT’.

- He explained that when banks and securities firms issue derivatives based on an ETF, delta-hedging sales to protect against losses can be triggered at certain price levels, exacerbating declines in a downturn.

- Hayes said he plans to compile a list of related notes and structured products issued by commercial banks to identify trigger points that drive sharp price swings.

As Bitcoin’s price has plunged recently—at one point falling to $60,000—an analysis has emerged that this sell-off may be driven by derivatives (structured products) linked to BlackRock’s spot Bitcoin ETF, ‘IBIT’.

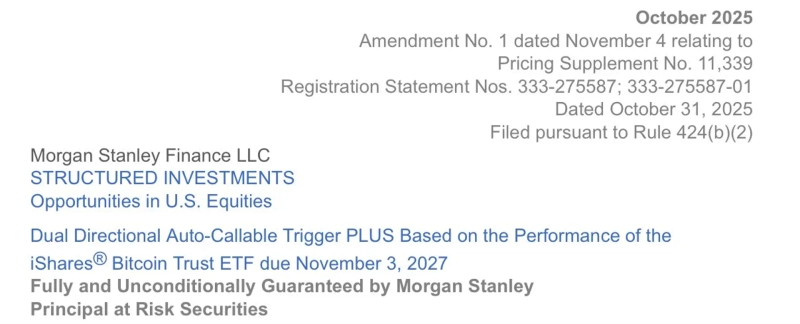

On the 6th (local time), Arthur Hayes, co-founder of BitMEX, wrote on X, “This Bitcoin dump is most likely due to hedging flows from structured-product dealers using BlackRock’s spot Bitcoin ETF as the underlying asset.”

Typically, when banks or securities firms issue derivatives (such as ELS and ETN) based on an ETF, a “delta-hedging” mechanism kicks in: once prices reach certain levels, they must sell the underlying asset (Bitcoin) to defend against losses. This, he explained, created a vicious cycle in which selling begets more selling during downturns, amplifying the decline.

He added, “To better identify the ‘trigger points’ that can cause sharp price swings, I plan to compile a list of all relevant notes and structured products issued by banks currently in the market.”

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀