PiCK

Despite Trump’s pledge to ‘cut’… “U.S. debt ratio set to hit post-WWII high” [Lee Sang-eun’s Washington Now]

Summary

- The Congressional Budget Office (CBO) said the U.S. fiscal deficit and national debt are set to surge to all-time highs within the next 10 years.

- It said tax cuts under the OBBBA, expanded defense and border security spending, and rising interest costs will generate additional deficits totaling trillions of dollars over the next decade.

- The CBO said the current U.S. fiscal path is not sustainable, making it likely to exert downward pressure on U.S. Treasuries and the dollar’s value.

Contrary to the Trump administration’s long-touted pledge to “reduce debt,” an analysis says the U.S. fiscal deficit and the size of the national debt are likely to surge to record levels within the next decade.

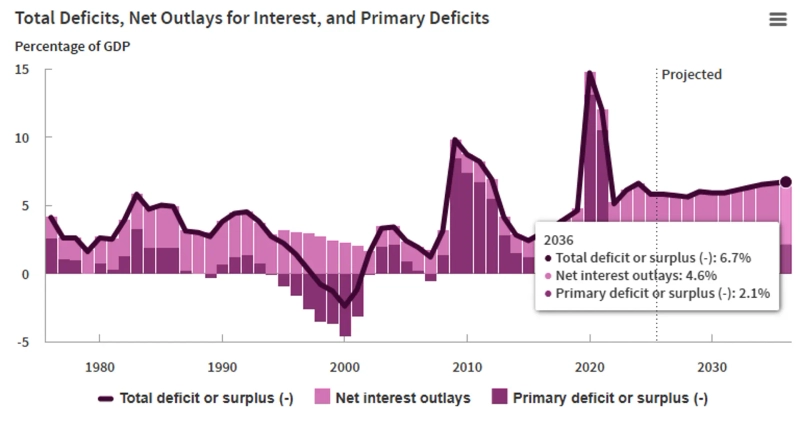

According to the Congressional Budget Office’s (CBO) 10-year projections, the U.S. government’s fiscal deficit this year is expected to reach $1.9 trillion (5.8% of GDP). While the deficit’s share of GDP this year is projected to be the same as last year’s, the CBO forecasts that by 2036—10 years from now—the federal deficit will swell to $3.1 trillion, accounting for 6.7% of GDP. That is well above the 50-year average deficit ratio of 3.8%.

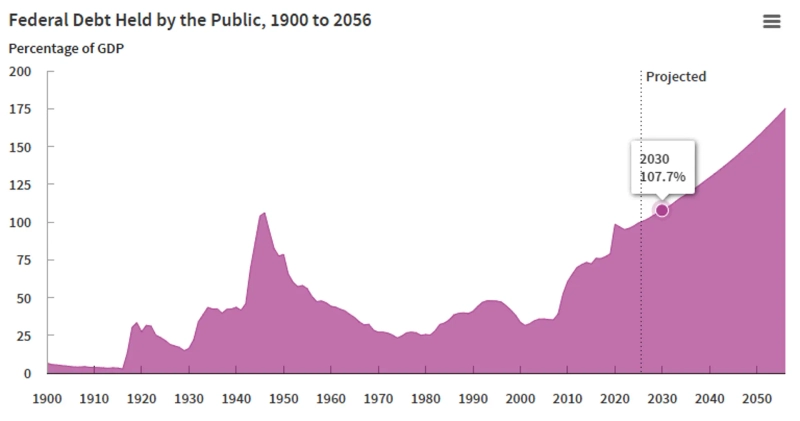

The total national debt is also expected to reach risky levels. The CBO projected that U.S. public debt, which stood at 99% of GDP at the end of last year, will climb to 107.7% by 2030—within five years. That would surpass the all-time high of 106% recorded in 1946, immediately after World War II. The CBO warned the ratio could rise to 120% by 2036 and as high as 175% within the next 30 years.

The biggest driver of the rising deficit is higher debt-service costs. The CBO’s projections show the primary deficit surged during the COVID-19 period and is now trending down. The primary deficit (excluding interest) as a share of GDP fell to 2.7% last year, from 3.6% in 2024 after the Trump administration took office. The CBO expects the primary deficit share to decline to around 2% over the next 10 years. Even so, the overall deficit continues to grow largely due to rising interest costs. Interest expenses paid by the federal government last year were tallied at 3.2% of GDP. The CBO calculated that this share will increase to 4.6% going forward. The CBO assumed a scenario in which inflation converges toward 2% a year over the next decade, with the 10-year U.S. Treasury yield at 4.4% a year in 2036 and the Federal Reserve’s policy rate at about 3.3%.

Among the factors widening the deficit, the CBO pointed to the “One Big Beautiful Bill Act (OBBBA),” pushed by President Trump last year and passed by the ruling Republican Party. CBO Director Phillip Swagel said the bill would extend tax cuts—reducing revenues—while sharply increasing defense and border security spending, generating about $4.7 trillion in additional deficits over the next decade.

The Trump administration’s hardline immigration crackdown is also a burden on the economy. The CBO projected that lower immigration would restrain labor-market growth and, as a result, add about $500 billion to deficits over 10 years. Rising Medicare and Social Security costs due to population aging are also factors worsening the fiscal outlook.

Trump’s aggressive tariff policy is expected to offset part of the fiscal deficit. The CBO assessed that if the tariff policy remains in place, it could reduce deficits by roughly $3 trillion over the next decade. It explained that tariff revenues would rise and that the resulting reduction in debt interest payments could also be expected.

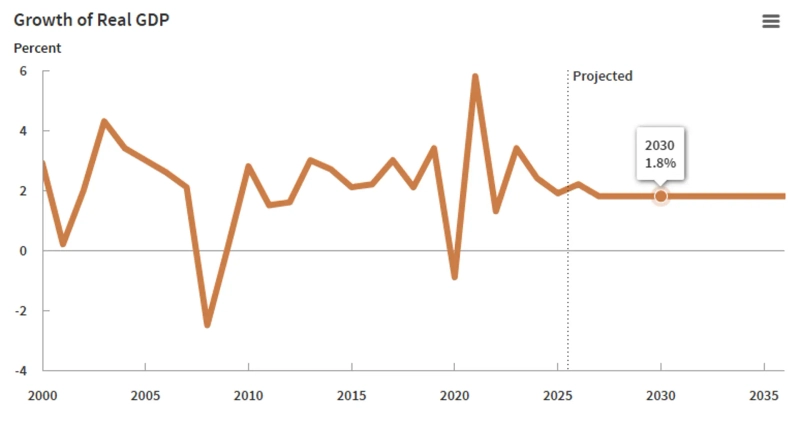

The CBO estimated that U.S. real GDP growth this year would edge up due to increased spending such as OBBBA outlays (1.9->2.2% from 2024 to 2025), but would fall to around 1.8% starting next year. It noted that high tariff rates and tougher immigration enforcement could be constraints. Over the longer term, it said GDP growth would moderate due to factors such as population aging.

CBO Director Phillip Swagel made it clear that the current U.S. fiscal trajectory is “not sustainable.” This is likely to act as downward pressure on U.S. Treasuries and the dollar over time.

In financial markets that day, the dollar edged higher and the 10-year U.S. Treasury traded around 4.19% (up 5 bp). This was seen as reflecting the market’s greater sensitivity to a stronger-than-expected jobs report and the possibility the Fed holds rates steady, rather than the CBO’s long-term outlook.

Washington=Correspondent Lee Sang-eun selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Despite Trump’s pledge to ‘cut’… “U.S. debt ratio set to hit post-WWII high” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/8c7809d5-0bc5-4094-8563-4dbd8393af0f.webp?w=250)

![Selling pressure despite a 'surprise jobs report'… the three major indexes end slightly lower [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/71d04eea-1cc0-4ced-a1e2-c695c8d95cac.webp?w=250)