PiCK

U.S. spot Bitcoin ETFs see $275.81 million in net outflows…Funds pull back mainly from IBIT and FBTC

Summary

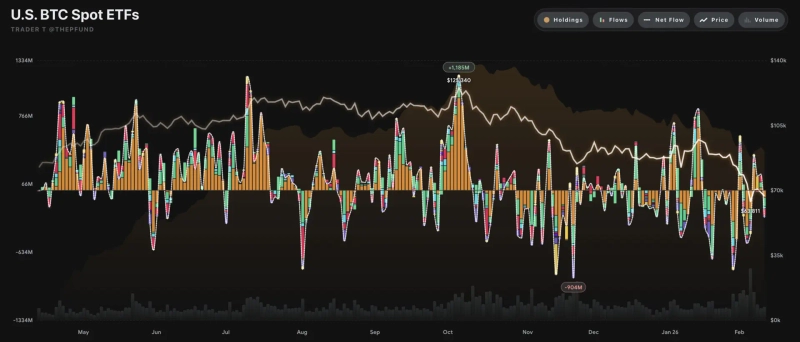

- U.S. spot Bitcoin ETFs saw net outflows of $275.81 million over a single day.

- Major asset managers’ products—including IBIT, FBTC, ARKB, BITB, GBTC, and HODL—posted broad-based net outflows, signaling weakened investor sentiment.

- After net inflows the prior day, flows swung to large net outflows within a day, underscoring short-term institutional pullbacks alongside Bitcoin price volatility.

U.S. spot Bitcoin ETFs recorded net outflows of $275.81 million in a single day.

According to data compiled by TraderT on the 11th (local time), total net outflows from Bitcoin ETFs came to $275.81 million. Investor sentiment appeared to weaken as funds exited products across major asset managers.

BlackRock’s iShares Bitcoin Trust (IBIT) posted net outflows of $72.92 million, while Fidelity’s FBTC saw $92.60 million leave the fund. ARK Invest’s ARKB recorded $70.51 million in net outflows, and Bitwise’s BITB logged $21.98 million.

Grayscale’s GBTC also saw $17.91 million in outflows, while VanEck’s HODL reported net outflows of $6.67 million.

By contrast, WisdomTree’s BTCW was the only fund to post net inflows, at $6.78 million. Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, and Grayscale Mini BTC showed no change in flows.

After registering net inflows the previous day, the market flipped to sizable net outflows just one day later, again highlighting short-term institutional withdrawals amid Bitcoin price volatility.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE