US spot Ethereum ETFs see $129.22 million in net outflows…institutional sentiment weakens

Summary

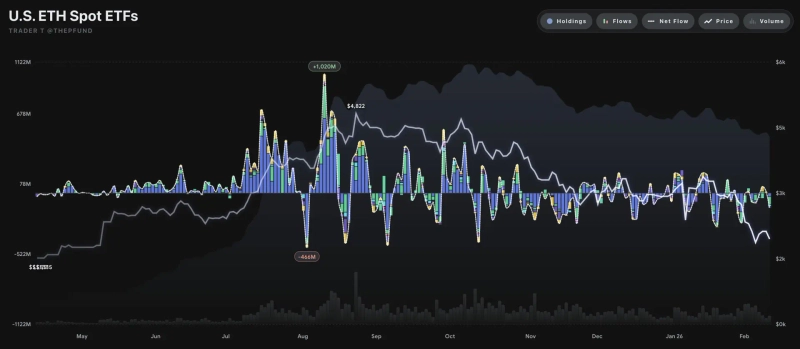

- US spot Ethereum ETFs posted $129.22 million in net outflows in a single day.

- Outflows continued from major issuers’ products including BlackRock’s ETHA, Fidelity’s FETH, Bitwise’s ETHW, and Grayscale’s ETHE and Mini ETH.

- Following Bitcoin ETFs, net outflows have persisted in Ethereum ETFs, pointing to a strengthening defensive stance among institutional capital.

US spot Ethereum ETFs saw net outflows totaling $129.22 million in a single day.

According to data compiled by TraderT on the 11th (local time), total net outflows across all Ethereum ETFs came to $129.22 million, with withdrawals concentrated in products run by major asset managers.

BlackRock’s ETHA recorded $29.49 million in net outflows, while Fidelity’s FETH saw $67.09 million leave the fund. Bitwise’s ETHW posted $16.74 million in net outflows.

Grayscale’s ETHE saw $11.47 million in outflows, and the Grayscale Mini ETH ETF recorded $4.43 million in outflows.

Meanwhile, 21Shares’ CETH, Invesco’s QETH, Franklin’s EZET and VanEck’s ETHV saw no changes in flows.

With net outflows continuing in Ethereum ETFs following Bitcoin ETFs, the trend suggests institutional capital is becoming more defensive amid the recent pullback in digital assets.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Analysis] "Bitcoin deposits to Binance top $7.5bn…mirroring past bear markets"](https://media.bloomingbit.io/PROD/news/49d66929-6d71-49d5-969d-f7ff78e8357c.webp?w=250)