Summary

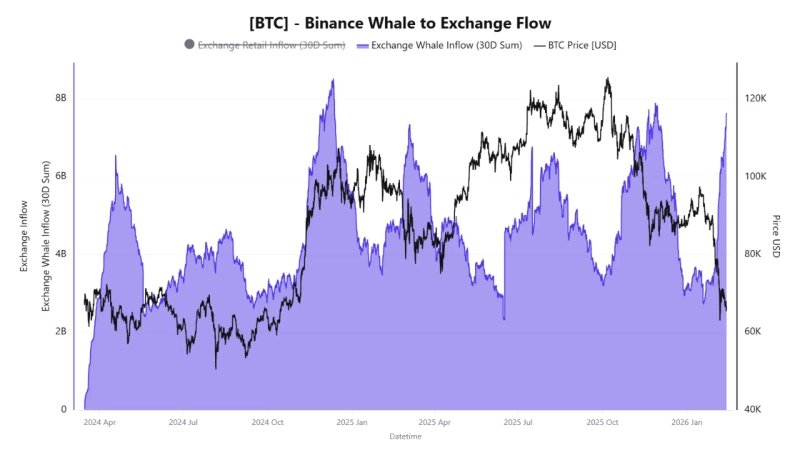

- CryptoQuant said cumulative Bitcoin deposits to Binance over the past 30 days have surpassed $7.5 billion, resembling previous bear-market phases.

- It also reported that the total supply of Ethereum-based Tether (USDT) fell by about $7 billion in less than a month, raising the possibility of a liquidity squeeze.

- The contributor stressed that sustained exchange inflows and a decline in stablecoin supply have historically been linked to crypto-asset price declines, warning that aggressive long positions could be risky.

In the recent Bitcoin (BTC) market, a simultaneous rise in exchange inflows and a decline in stablecoin supply (crypto assets pegged to fiat currencies) has been observed, raising concerns about a potential liquidity squeeze.

On the 13th (KST), CryptoQuant analyst Amr Taha said in a report that "the cumulative amount of Bitcoin deposited to Binance over the past 30 days has exceeded $7.5 billion," adding that "this is the second time exchange inflows have breached that threshold."

The contributor noted that "after whale inflows surpassed $7.5 billion in late November last year, Bitcoin fell from around $92,000 to below $70,000," and assessed that "a similar pattern could repeat this time as well."

A decline in stablecoin supply is also cited as a factor pointing to a bear market. The contributor explained that "the total supply of Ethereum (ETH)-based Tether (USDT) fell from more than $103 billion on Jan. 18 to around $96 billion on Feb. 12," noting that "a supply contraction of roughly $7 billion occurred in less than a month."

He added that "a similar case appeared in mid-May 2022, when Ethereum-based Tether supply dropped by about $3 billion from $39 billion to $36 billion, after which Bitcoin plunged from above $30,000 to below $20,000."

In conclusion, the contributor stressed that "an environment in which exchange inflows persist and stablecoin supply shrinks has historically led to declines in crypto asset (cryptocurrency) prices," adding that "it does not necessarily imply an immediate crash, but aggressive long positions could be risky. Unless liquidity improves, upside potential may be limited."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Analysis] "Bitcoin deposits to Binance top $7.5bn…mirroring past bear markets"](https://media.bloomingbit.io/PROD/news/49d66929-6d71-49d5-969d-f7ff78e8357c.webp?w=250)