PiCK

UK investment bank also warns of '$50,000'… Bitcoin’s 'digital gold' narrative crumbles

Summary

- Bitcoin has failed to reclaim the $70,000 level, with the 100 million won line breaking in the won market and reports suggesting the “digital gold” narrative has collapsed.

- U.S. spot Bitcoin ETFs logged net outflows for four straight weeks, while a deepening risk-off shift saw investors move into stablecoins.

- As Standard Chartered cut its Bitcoin target to $100,000 and flagged the risk of a further drop to $50,000, the market is raising the need to reclaim Realized Price and the True Market Mean, along with an out-of-ordinary catalyst.

Bitcoin (BTC), which has recently plunged, is failing to reclaim the $70,000 level. In the won market, the psychological support line of 100 million won has broken. Some are now questioning whether Bitcoin’s “digital gold” narrative has effectively collapsed.

According to cryptocurrency price tracker CoinMarketCap on the 13th, Bitcoin was trading in the low $66,000 range, down about 1.5% from the previous day. That marks a drop of nearly 30% versus a month ago. Previously, on the 6th of this month, Bitcoin slid in a single day from the $70,000 range into the $60,000s and has remained weak since.

On domestic exchanges such as Bithumb and Upbit, it briefly traded around 96 million won, well below 100 million won. Bitcoin had first surpassed 100 million won in November 2024 following Donald Trump’s election as U.S. president, and had consistently traded above that level. In effect, it has now given back nearly all of the gains built up on expectations for President Trump’s pro-crypto policies last year.

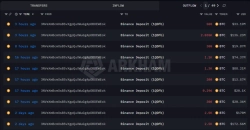

US ETFs see net outflows for four straight weeks

As Bitcoin continues to struggle, not only retail investors but also institutional money is heading for the exits. According to crypto data analytics firm SoSoValue, U.S. spot Bitcoin exchange-traded funds (ETFs) have posted weekly net outflows for four consecutive weeks. Meanwhile, the number of active addresses for dollar stablecoin Circle (USDC), based on the 30-day simple moving average (SMA), hit 186,000 recently, setting a new all-time high. A CryptoOnChain contributor to CryptoQuant said, “A surge in (stablecoin) active addresses is a classic ‘risk-off (risk aversion)’ signal,” adding that “investors are rapidly rotating out of volatile assets such as Bitcoin and altcoins into stablecoins to preserve capital.”

Macroeconomic factors are also likely to weigh. In particular, last month’s U.S. nonfarm payrolls report came in well above market expectations, denting hopes for rate cuts. Geopolitical risks are another burden, with the U.S. recently deciding to deploy a second aircraft carrier to the Middle East to pressure Iran. There is also still the possibility of a shutdown at the U.S. Department of Homeland Security (DHS), whose budget agreement deadline is the 13th.

Markets are increasingly pricing in further downside. UK-based investment bank Standard Chartered (SC) on the 12th lowered its Bitcoin price target for this year to $100,000 from $150,000. It marks the second downward revision in the past three months. Standard Chartered’s assessment is that Bitcoin could fall further to $50,000 before a meaningful recovery takes hold.

“An ‘out-of-ordinary catalyst’ needed”

A key near-term support level is cited as $55,000, the “Realized Price.” Realized Price refers to the average cost basis across all Bitcoin investors. In a recent weekly report, on-chain analytics firm Glassnode said, “Structurally, a Bitcoin rebound is likely to meet resistance,” and added that for a meaningful near-term regime shift to emerge, an “out-of-ordinary catalyst” is needed—such as reclaiming the “True Market Mean” around $79,200 to reaffirm structural strength.

Some also argue that investors’ fundamental trust in Bitcoin is weakening. Bitcoin, long dubbed “digital gold,” drew attention as an inflation hedge, but in times of crisis it failed to function as a safe-haven asset like physical gold. Some see this context behind why Tether (USDT), the world’s largest dollar stablecoin issuer, has been steadily accumulating physical gold as part of its reserves. Relatedly, Cardano (ADA) founder Charles Hoskinson said, “Market sentiment is at an all-time low,” adding that “crypto needs a new narrative.”

Still, some investors have stepped in to “buy the dip.” According to CryptoQuant, on the 6th—when Bitcoin plunged nearly 14% in a single day—long-term holders (LTHs) bought $5.68 billion (about 8.2 trillion won) worth of Bitcoin. Global crypto exchange Binance also converted its $1 billion (about 1.5 trillion won) SAFU fund, set aside as a user protection fund, entirely into Bitcoin this month. Binance said it “reaffirmed its existing belief that Bitcoin is the best long-term reserve asset.”

Attention is also on the next moves by Strategy, the world’s largest corporate holder of Bitcoin. Strategy’s unrealized losses are said to be nearing $6 billion (about 8.7 trillion won) after the recent plunge. Bitcoin’s current price is nearly 13% below Strategy’s average purchase price (about $76,000). Strategy had been buying billions of dollars’ worth of Bitcoin each week through last month, but this month its purchases have shrunk to tens of millions of dollars. Bloomberg said, “Strategy’s stock premium has effectively disappeared,” adding that “(Strategy’s) Bitcoin accumulation model has also lost momentum.”

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

![[Analysis] "Bitcoin deposits to Binance top $7.5bn…mirroring past bear markets"](https://media.bloomingbit.io/PROD/news/49d66929-6d71-49d5-969d-f7ff78e8357c.webp?w=250)