Summary

- CryptoQuant said Bitcoin remains in a bearish phase but has not yet entered a full-fledged bottoming zone.

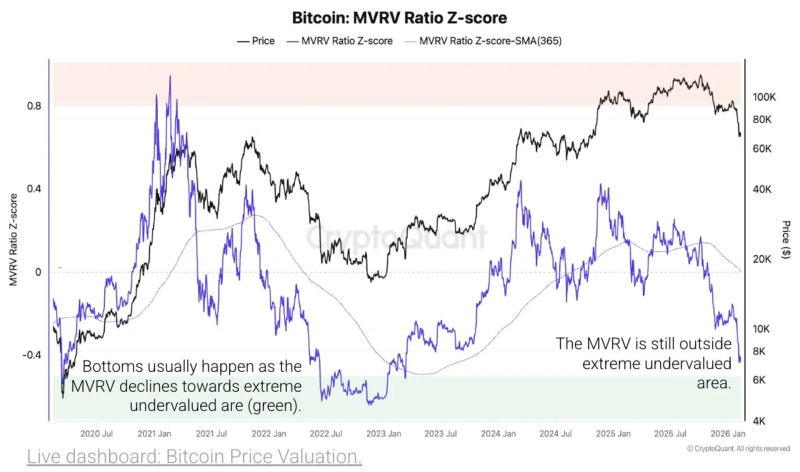

- It said on-chain indicators such as MVRV and NUPL, long-term holder loss levels, and the bull-bear market cycle indicator have not reached the extreme undervaluation conditions typical of past bottoms.

- It added that a test of the Bitcoin realized price (about $55,000) has not occurred, and that—similar to past cycles—a deeper drop versus the realized price and a prolonged adjustment period may be needed.

Bitcoin (BTC) has recently plunged, triggering a wave of realized losses, but an analysis suggests on-chain data indicate the market has yet to reach a true bottom.

On the 12th (local time), CryptoQuant, a crypto-asset (cryptocurrency) data analytics firm, said in its weekly report that “while Bitcoin remains in a bearish phase, it has not entered a full-fledged bottoming zone,” offering this assessment.

According to the report, Bitcoin investors realized about $5.4 billion in daily losses in a single day on the 5th. That is the largest figure since March 2023 and exceeds levels seen during the FTX collapse.

However, CryptoQuant said it is too early to view this as a bottom signal. That is because the monthly cumulative realized losses, converted not into dollar value but into the number of bitcoins (BTC), amounted to only about 300,000 BTC. This is still low compared with 1.1 million BTC recorded during the late-2022 bear market, suggesting leverage and overcrowded positioning in the market have not been fully flushed out.

Key valuation indicators also have yet to reach historically low levels. Both the market value to realized value (MVRV) ratio and the net unrealized profit/loss (NUPL) metric have not moved into the extreme undervaluation zone typically observed near bottoms.

The report noted that “about 55% of the total Bitcoin supply is still in profit,” adding that “at bottoms in past cycles, this ratio fell to around 45–50%.”

It also said long-term holders’ selling behavior remains far from bottom-like. Long-term investors are currently selling around their average cost (0% return), whereas previous bear-market bottoms formed when long-term holders capitulated, offloading holdings while absorbing 30–40% losses.

A “bull-bear market cycle indicator,” used to gauge the market cycle, also remains in the bearish stage. The market has not yet entered the extreme bearish zone where bottom formation began in the past.

CryptoQuant said further price support testing may be needed. The report said “on-chain data show that the key support level—the realized price (about $55,000)—has not yet been tested,” adding that “Bitcoin is currently trading about 18% above the realized price.”

It continued: “Looking at past cycles, after falling to 24–30% below the realized price, prices went through a 4–6 month bottoming process,” and projected that “a bottom is more likely to be formed through time and repeated corrections than through a single capitulation event.”

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![Evernorth: “XRP Is Central to Next-Generation Finance…A Downturn Is a Buying Opportunity” [Cointerview]](https://media.bloomingbit.io/PROD/news/3c5ebde2-c604-4886-aa3e-b8c1e0c600c4.webp?w=250)