[Analysis] “Bitcoin Sees Biggest Short Liquidation Since 2024…Leverage Imbalance Deepens”

Summary

- In Bitcoin’s derivatives market, about $736 million in short-position liquidations occurred in a single day, described as the largest since 2024.

- Funding rates are maintaining a short-dominant structure and accumulated short positions are weighing on the derivatives market, while spot-market liquidity is assessed as insufficient to offset this.

- If market conditions improve, excessively built-up short positions could turn into buying pressure through liquidations, but a sustained trend reversal requires a leading recovery in spot demand, it stressed.

Bitcoin’s (BTC) derivatives market has reportedly seen the largest short liquidation since 2024.

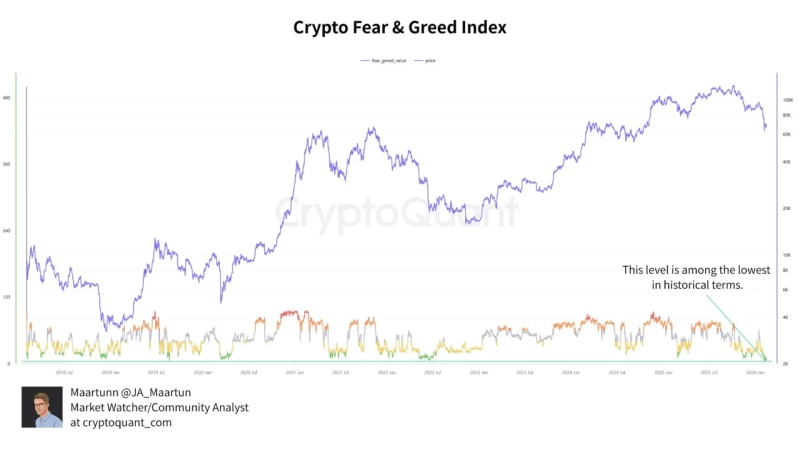

On the 15th (local time), CryptoQuant contributor XWIN Research Japan said, “About $736 million in short positions were liquidated in a single day in the Bitcoin derivatives market. This is the biggest amount since roughly $773 million was liquidated on Sept. 20, 2024,” adding, “While the magnitude of the price rise was limited, it is a signal that short traders have been aggressively building positions.”

Funding rates also continue to reflect a short-dominant setup, suggesting that market participants’ positioning remains tilted to the downside. The accumulated short positions are weighing on the derivatives market, while the spot market is assessed as not yet having formed sufficient liquidity to offset it.

That said, if market conditions improve, excessively built-up short positions could, through liquidations, instead turn into buying pressure. XWIN Research Japan noted, “Sharp and momentary rebounds are often triggered by this kind of structural imbalance,” while stressing, “For a sustained trend reversal, it needs to be confirmed in advance that spot demand is recovering.”

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)