[Analysis] "Bitcoin faces a structural stress test in early February amid extreme fear…institutional outflows accelerating"

Summary

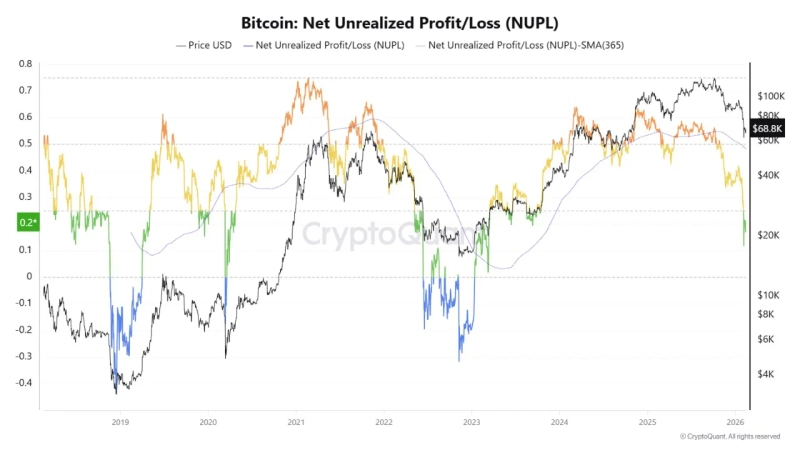

- It assessed that in early February, the Bitcoin market saw both sentiment and supply-demand dynamics shaken, marked by extreme fear, institutional fatigue, Net Unrealized Profit/Loss (NUPL) at 21.30%, and a Fear & Greed Index of 8.0.

- It said structural supply-demand pressure and a slowdown in growth are continuing, as shown by $2.172 billion in net outflows from spot Bitcoin ETFs, 42.85% of total supply in loss territory, and quarterly returns of -25.78%.

- It noted that while medium- to long-term accumulation-zone potential remains—given 380,104 BTC accumulated over the past 30 days, MPI at -1.31, and proximity to the 200-week moving average and realized price around $55,800—heightened volatility could persist until ETF inflows return.

An analysis finds that in early February 2026, the Bitcoin (BTC) market is simultaneously showing signs of institutional fatigue and extreme fear.

On the 15th (local time), CryptoQuant contributor GugaOnChain said, "As Bitcoin underwent about a 50% pullback from the early-February peak, Net Unrealized Profit/Loss (NUPL) fell to 21.30%, entering the fear zone, and the Fear & Greed Index dropped to 8.0, plunging the market into extreme panic. With macro uncertainty intertwined with structural fund flows, both sentiment and supply-demand dynamics appear to have been shaken at the same time," he assessed.

Pressure is also evident in institutional fund flows. During the period, spot Bitcoin ETFs saw net outflows totaling $2.172 billion. With 42.85% of total supply moving into loss territory, supply-demand pressure has structurally intensified. Quarterly returns posted -25.78%, leaving a lack of recovery momentum. Growth rates are also in contraction across the board, with Bitcoin at -19.10%, the top 20 assets by market cap at -12.48%, and small- and mid-caps at -18.30%.

Still, not all indicators are negative. Over the past 30 days, accumulation addresses net-absorbed 380,104 BTC, indicating that structural accumulation flows persist. The miner metric MPI stands at -1.31, suggesting miners are maintaining a holding stance rather than selling aggressively.

GugaOnChain emphasized, "Bitcoin is currently approaching a major structural test, nearing the 200-period moving average on the weekly chart and the realized price area around $55,800," adding, "This zone is interpreted as a medium- to long-term accumulation band from both technical and on-chain perspectives." He continued, "However, for a full-fledged trend reversal, investor sentiment needs to stabilize and a re-inflow of institutional funds such as via ETFs must be confirmed; for the time being, it is highly likely that the market will remain in a phase of searching for direction amid heightened volatility," he added.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![Trump, after ruling mutual tariffs illegal: “10% additional tariff on the whole world” [Lee Sang-eun’s Washington Now]](https://media.bloomingbit.io/PROD/news/6db53d1e-258b-487d-b3ae-a052b6e919cf.webp?w=250)

![Wall Street rises on ruling that ‘Trump reciprocal tariffs are unlawful’…uncertainty lifted [Wall Street Briefing]](https://media.bloomingbit.io/PROD/news/446b6f3b-7068-4a6a-bd23-fea26c188a3f.webp?w=250)