Bitcoin flashes warning signs for its worst first quarter in eight years…down 22% since the start of the year

Summary

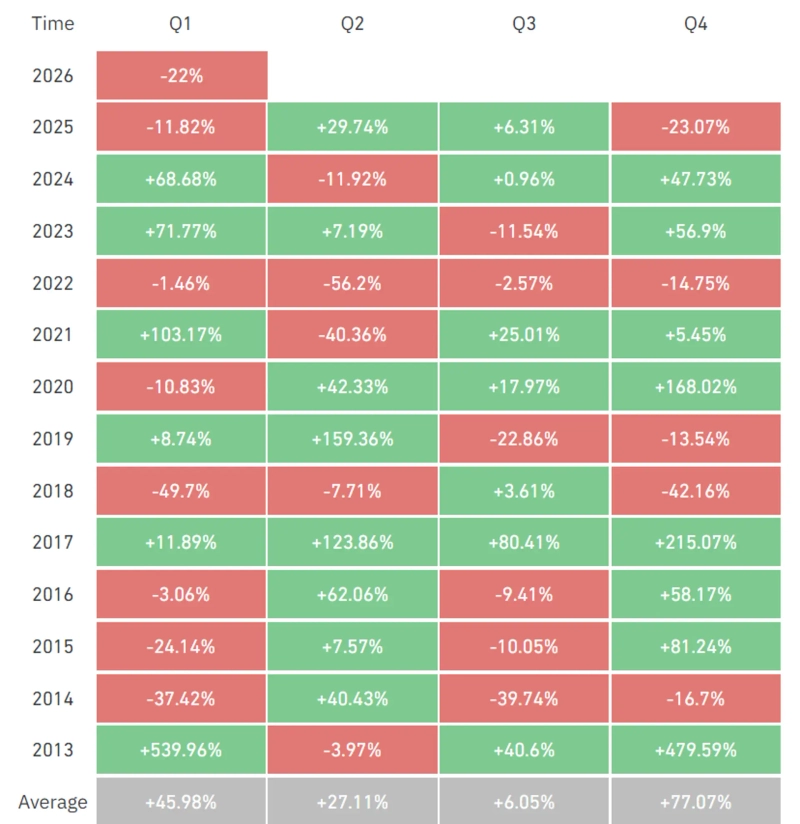

- Bitcoin (BTC) reportedly fell about 22% from roughly $87,700 at the start of the year to around the $68,000 level, raising the possibility of its worst first quarter in eight years.

- Bitcoin is down 10.2% in January and more than 13% so far in February, leaving open the possibility of closing lower in both months for the first time on record; Ethereum (ETH) is also down more than 34% in the first quarter.

- Nick Ruck, head of research at LVRG, said the decline appears to be a typical correction phase amid global macro uncertainty, while long-term drivers such as broader institutional adoption and the halving cycle remain intact.

Bitcoin (BTC) has fallen more than 22% since the start of the year, raising the possibility that it could post its worst first-quarter performance in eight years.

According to CoinGlass data cited by Cointelegraph on the 16th (local time), Bitcoin started the year at around $87,700 and has since slid to roughly the $68,000 level, down about $20,000. This marks the weakest performance since the 49.7% plunge in the first quarter during the 2018 bear market.

Bitcoin has finished lower in seven of the past 13 first quarters. Recent examples include -11.8% in 2025 and -10.8% in 2020. Market analyst Daan Trades Crypto said, "The first quarter is traditionally a highly volatile period," adding that "historically, first-quarter performance has not carried through as the year’s trend."

Bitcoin is also leaving open the possibility of closing lower in both January and February for the first time on record. After falling 10.2% in January, it is down more than 13% so far in February. To turn February into a positive month, it would need to reclaim the $80,000 level. Ethereum (ETH) is also down more than 34% in the first quarter, making it historically the third-weakest first quarter on record.

Still, some view the move as a correction rather than a structural breakdown. Nick Ruck, head of research at LVRG, said it is "a typical correction phase amid global macro uncertainty," adding that long-term drivers such as broader institutional adoption and the halving cycle "remain intact." Bitcoin is currently extending a five-week losing streak, trading in the $68,000 range.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

![[Market Update] Bitcoin slides to the $68,000 range… "Macro caution persists despite upbeat CPI"](https://media.bloomingbit.io/PROD/news/7c356c31-7d95-4f87-9e5b-bf3ebab9c6d6.webp?w=250)

![[Analysis] "XRP enters a pullback after failing to hold $1.62… focus on whether it can break above $1.51"](https://media.bloomingbit.io/PROD/news/43b35985-b585-4ba4-8af7-82ef19948262.webp?w=250)