Summary

- XRP holdings on centralized exchanges (CEX) totaled about 12.9 billion tokens, the lowest level since May 2021.

- XRP funding rates on global exchanges fell to -0.028%, pointing to excessive short positioning and a potential bottom signal.

- With XRP futures open interest (OI) down more than 40%, cumulative net inflows into U.S. XRP spot ETFs were tallied at $1.23 billion.

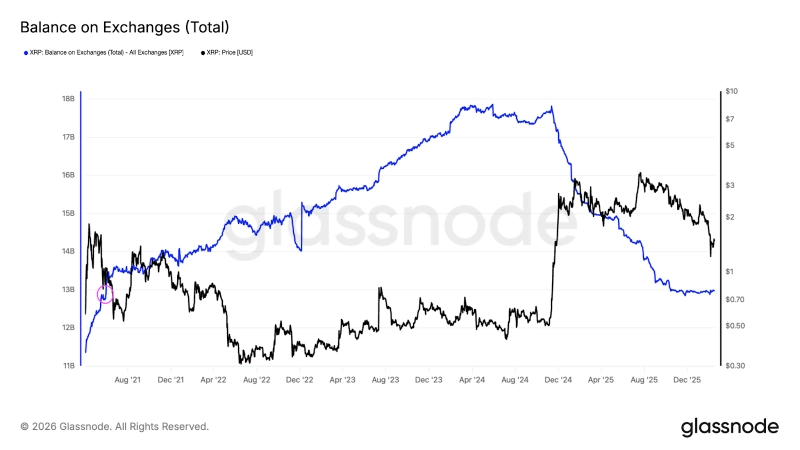

XRP holdings on centralized exchanges (CEX) have fallen to the lowest level in five years. On-chain indicators have prompted analysis that XRP’s price is nearing a bottom.

Cointelegraph, citing Glassnode data on the 18th (local time), reported that exchange XRP holdings totaled about 12.9 billion tokens as of the previous day (the 17th). Cointelegraph said, "XRP holdings on exchanges have declined noticeably over the past two years," adding that "(12.9 billion) is the lowest level since May 2021."

Typically, a decline in token holdings on exchanges is interpreted as easing sell-side pressure. Cointelegraph said, "(The decline in holdings) suggests investors have little intention to sell," adding that "this strengthens the case for XRP upside potential."

Funding rates are also trending lower. According to Cointelegraph, XRP funding rates on global cryptocurrency exchanges fell to as low as -0.028% on the 6th of this month, the lowest level since April last year. Cointelegraph said, "Negative funding rates reflect an excessive concentration of short (sell) positions," adding that "historically, extremely negative funding rates have often been a sign that the market has reached oversold conditions and put in a bottom."

Open interest (OI) is also declining. According to Coinglass, XRP futures open interest fell more than 40% over the past month, from $4.55 billion at the start of the year to $2.53 billion recently. Cointelegraph said, "This suggests leveraged investors are reducing exposure rather than opening new positions," adding that "if conviction in the bearish case fades and buying pressure picks up again, a price rebound is possible."

Institutional money is also flowing in steadily. According to SosoValue, U.S. XRP spot exchange-traded funds (ETFs) posted net monthly inflows for three consecutive months through January after their launch in November last year. Cumulative net inflows into XRP spot ETFs totaled $1.23 billion as of the day.

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul