Summary

- Apex Group said it has signed a partnership with World Liberty Financial and plans to pilot USD1 for settlement of tokenized funds.

- The companies said they will test USD1 as a payment method for subscriptions, redemptions and distributions within Apex’s tokenized fund ecosystem.

- Apex is considering listing WLFI’s tokenized assets on LSEG’s digital market infrastructure platform, while WLFI said it plans to launch a mobile application that links digital asset wallets.

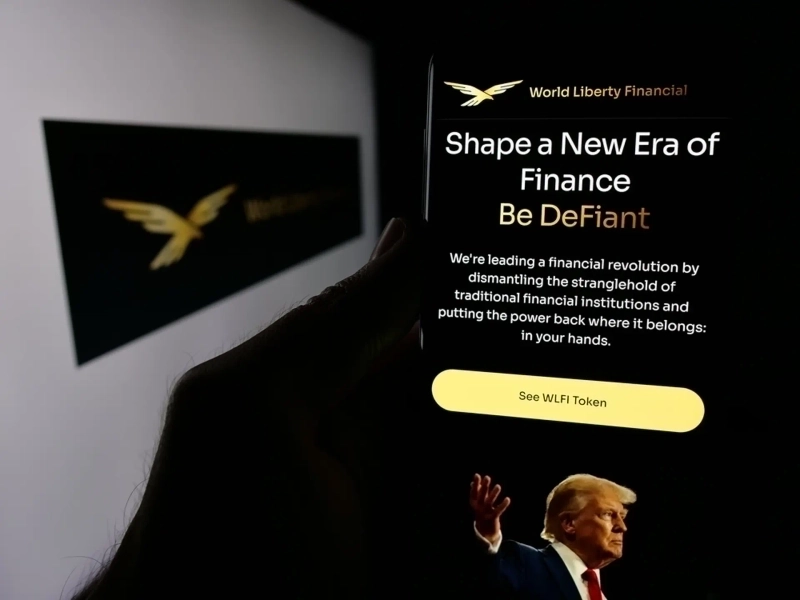

Apex Group, a global asset manager with $3.5 trillion in assets under management, has signed a partnership with World Liberty Financial (WLFI), the Trump family’s DeFi project. The two companies plan to pilot WLFI’s stablecoin, USD1, for settling tokenized fund transactions.

According to cryptocurrency-focused media outlet CoinDesk on the 18th (local time), the companies said at the World Liberty Forum held at Mar-a-Lago that they will test USD1 as a means of payment for subscriptions, redemptions and distributions within Apex’s tokenized fund ecosystem.

Apex is also reviewing a plan to list WLFI’s tokenized assets on the London Stock Exchange Group (LSEG)’s digital market infrastructure platform. WLFI said it is planning to launch a mobile application that links bank accounts with digital asset wallets.

JH Kim

reporter1@bloomingbit.ioHi, I'm a Bloomingbit reporter, bringing you the latest cryptocurrency news.

![Wall Street cheered Nvidia–Meta tie-up, but ‘flinched’ at rate-hike talk [New York market briefing]](https://media.bloomingbit.io/PROD/news/32f5a9d3-5551-4f6e-bbd3-aa4cf4d0d897.webp?w=250)