[Analysis] “Bitcoin’s Coinbase premium stays negative for an extended period… institutional demand has yet to return”

Summary

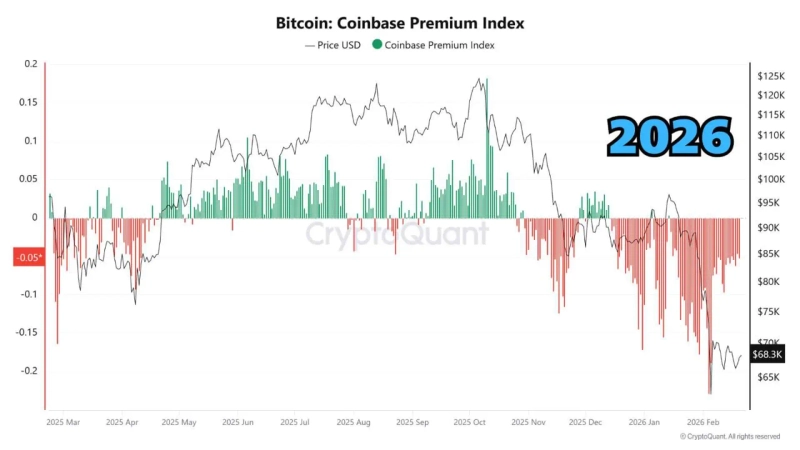

- The analysis said that even though Bitcoin is above its macro average cost basis, there are still no confirmed signs of a full-fledged return of institutional capital in the U.S.

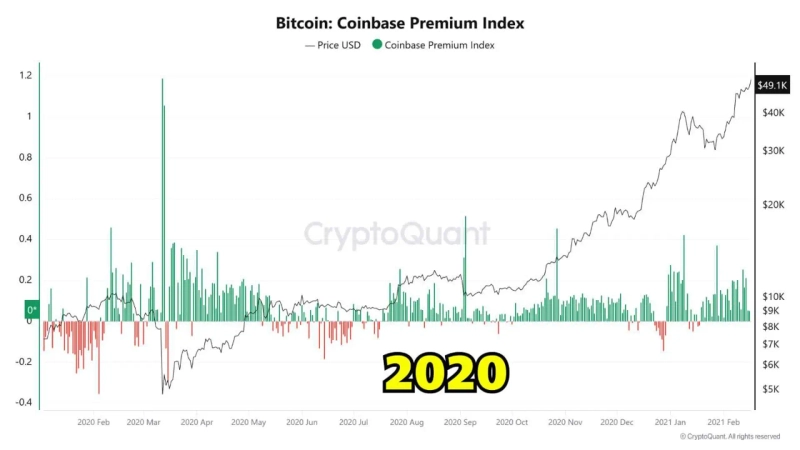

- It noted that unlike the 2020 bull market, the Coinbase premium is staying in negative (-) territory for an extended period, suggesting institutional capital has not returned in earnest.

- It added that whether the Coinbase premium can turn and remain positive will be a key leading indicator of a trend reversal.

An analysis found that although Bitcoin (BTC) is holding above its macro average cost basis, there are still no confirmed signs of a full-fledged return of U.S. institutional capital.

On the 21st (local time), CryptoQuant contributor XWIN Research Japan said, “In the 2020 bull market, when Bitcoin broke through resistance, the Coinbase premium consistently stayed positive (+), indicating inflows of institutional buying,” adding, “By contrast, the premium is currently remaining in negative (-) territory for a prolonged period, suggesting institutional capital has yet to return in earnest.”

He continued, “The current phase is closer to a consolidation range forming in the absence of structural leadership. Whether the Coinbase premium turns positive and stays there will be a key leading indicator of a future trend reversal.”

The Coinbase premium measures the gap between Coinbase’s BTC/USD price and Binance’s BTC/USDT price. A positive (+) premium means dollar-based buying is strong and is generally interpreted as net buying inflows from U.S. institutions or large investors. Conversely, negative (-) territory suggests weakening demand among Coinbase participants or dominant selling pressure.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.