Last week's digital asset investment inflow of 270 million dollars... Bitcoin outflow, Ethereum inflow↑

Summary

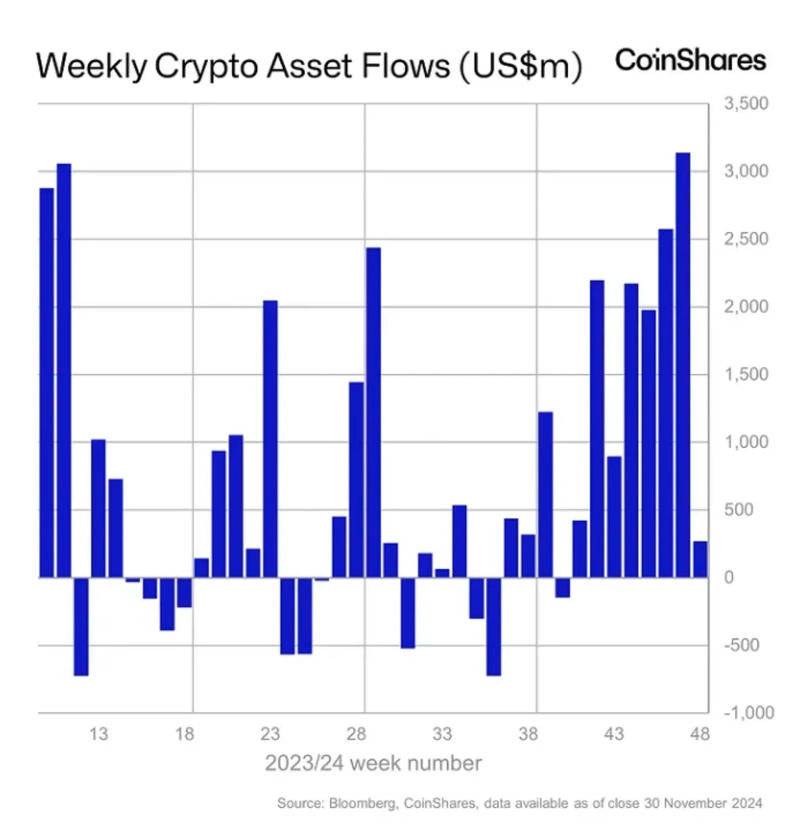

- Last week, 270 million dollars flowed into digital asset investment products.

- Bitcoin experienced an outflow for the first time since September, which was analyzed as a psychological resistance line by investors.

- Ethereum saw an inflow of funds, while Ripple experienced the largest ever inflow related to investment products.

Last week, a total of 270 million dollars was reported to have flowed into digital asset investment products.

On the 2nd, CoinShares, a digital asset management company, stated in its 'Weekly Digital Asset Investment Product Fund Flow' report that "270 million dollars flowed into digital asset products last week." The amount of inflow last week was significantly reduced compared to the inflow amount (320 million dollars) in the first week of November.

The report stated, "Bitcoin (BTC) experienced an outflow for the first time since September, with 45 million dollars flowing out," and analyzed, "This is seen as a realization of profits by investors following the psychological resistance line test of 100 million dollars."

The report also mentioned, "Ethereum (ETH) saw an inflow of 64 million dollars," adding, "Ethereum investment sentiment has turned aggressive, and this year's inflow amount is recorded at approximately 2.2 billion dollars."

Furthermore, "Ripple (XRP) saw an inflow of 95 million dollars in anticipation of the launch of a spot exchange-traded fund (ETF) in the U.S. The inflow amount related to Ripple investment products last week was the largest ever," it added.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.