PiCK

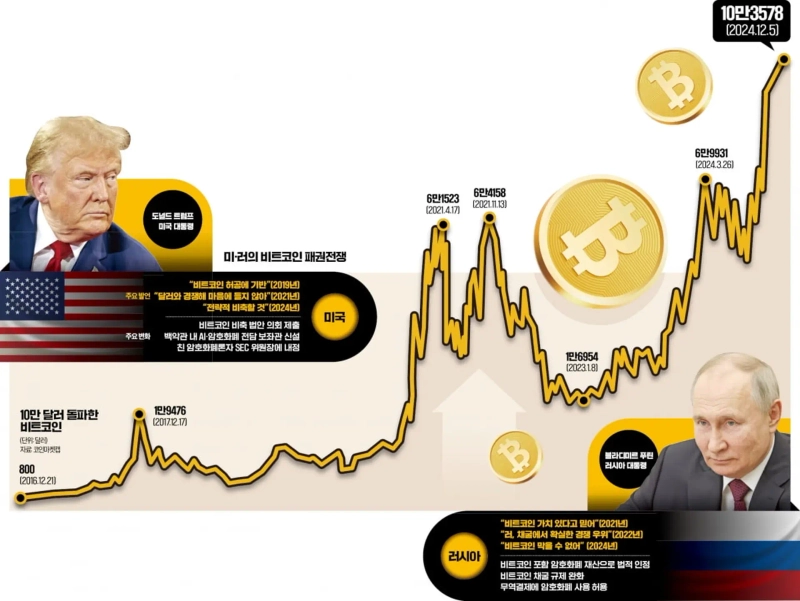

US 'Worst Debt Solver' vs Russia 'Savior from Western Sanctions'... Bitcoin at the Center of New Cold War

Summary

- The US is reportedly discussing plans to strategically stockpile Bitcoin to solve astronomical national debt and deficit issues.

- Russia, after the Ukraine war, is considering Bitcoin as an alternative to bypass Western sanctions and has recognized cryptocurrencies as assets.

- In a world economy fragmented by US-China hegemony competition, Bitcoin is expected to be highlighted as an asset that allows for free cross-border transactions.

DEEP INSIGHT

The Era of $100,000 Bitcoin, US-Russia Hegemony War Begins

A Strategic Asset for the US and a Means to Contain China

Trump Forms a Pro-Crypto Administration

Proposal to Purchase 1 Million Coins Over 5 Years

Expectations for Solving Record High Debt

Impact of China Buying Gold Instead of US Treasuries

A Clever Move for Russia to Bypass Sanctions and Reduce Dollar Dependence

Putin Recognizes Cryptocurrencies like Bitcoin as Assets

Approves VAT Exemption for Mining and Sales

Expanding Mining Infrastructure with BRICS

Promoting as a Means for Energy and Raw Material Transactions

The era of '$100,000 Bitcoin' has arrived. Just a few years ago, Bitcoin, which emerged in 2009, was compared to the 17th-century speculative asset, the Dutch tulip. Now, it is likened to gold, the most trusted asset in the world. Jerome Powell, the Chairman of the US Federal Reserve, has publicly declared that "Bitcoin is a competitor to gold."

Bitcoin is showing new prominence with the return of Donald Trump. It stands at the center of the new Cold War. In the US, there are discussions about strategically stockpiling Bitcoin and plans to write off astronomical debts. Russia, excluded from the international financial system due to the Ukraine war, sees Bitcoin as a new breakthrough. This is why there are predictions that Bitcoin will have a potential impact on the global economy and geopolitical order, beyond the debate of whether it is an asset or not.

Will Bitcoin Become a Strategic Asset for the US?

According to CoinMarketCap on the 8th, the price of Bitcoin surpassed $100,000 for the first time on the 5th. Domestically, it exceeded 140 million won. The recent Bitcoin rally was significantly influenced by Trump's election as US President. President-elect Trump announced during the election period that he would actively foster the cryptocurrency industry and ease regulations. In particular, the US administration promised to strategically stockpile Bitcoin. There is an analysis that Bitcoin is seen as a strategic element to contain China, a key pillar of US foreign policy. Moreover, China is reducing its holdings of US Treasuries while increasing its gold reserves. Accordingly, there is a claim that the US will actively support Bitcoin as an alternative to gold.

Specific implementation plans have also emerged. In July, Republican Senator Cynthia Lummis proposed the 'Bitcoin Reserve Bill.' The main content is to purchase 1 million Bitcoins over the next five years. The bill states, "Just as gold reserves have historically served as a cornerstone of financial security, holding Bitcoin in the digital age can enhance financial leadership and security." The intention to solve the US's severe fiscal deficit and debt with Bitcoin also played a role. The US national debt recently exceeded $36 trillion (about 5,110 trillion won) for the first time. Within the US, there are voices saying, "If the value of Bitcoin rises to at least $1 million, the US can repay its debt with Bitcoin."

President-elect Trump has appointed a large number of pro-crypto figures to the next administration. Paul Atkins, a former SEC commissioner favorable to cryptocurrencies, has been nominated as the chairman of the Securities and Exchange Commission (SEC), which oversees the cryptocurrency industry.

Russia's Enthusiasm for Bitcoin

Russia is also showing strategic moves. After the Ukraine war, Russia was excluded from the Society for Worldwide Interbank Financial Telecommunication (SWIFT) due to economic sanctions from Western countries. Its hands and feet were tied in utilizing global financial transactions and foreign exchange reserves. Bitcoin, being a decentralized digital asset, can bypass Western financial sanctions. In particular, Russia, with a high proportion of energy and raw material exports, is exploring the use of cryptocurrencies like Bitcoin as a means of payment. This is to reduce its dependence on the dollar.

Russia is working with BRICS, composed of Brazil, Russia, India, China, and South Africa, to strengthen Bitcoin mining infrastructure. In August, it recognized cryptocurrencies, including Bitcoin, as assets. It also approved a bill exempting value-added tax on mining and sales, while imposing a personal income tax of up to 15% on cryptocurrency income. Russian President Vladimir Putin recently said, "Many countries are turning to alternative assets, including cryptocurrencies," and "Who can ban Bitcoin?"

Dollar Hegemony: Threat or Strengthening?

In a world economy fragmented by US-China hegemony competition, the value of Bitcoin, which allows for free cross-border transactions, is expected to be highlighted. There is also a possibility that countries like Russia will emerge to reduce their dependence on the dollar through Bitcoin. However, Bitcoin has high volatility and has limitations as a stable means of payment. Also, due to the nature of Bitcoin based on blockchain technology, transaction tracking is transparent. This is why there are observations that it may be difficult to expand Bitcoin transactions in closed authoritarian countries. It is also questionable whether China, which is negative about Bitcoin, will cooperate. China is focusing on developing a Central Bank Digital Currency (CBDC).

Bitcoin is mainly traded based on the dollar, such as stablecoins linked to the dollar value. For this reason, there are many predictions that the dollar hegemony will be further strengthened as the cryptocurrency market, like Bitcoin, expands.

Mi-hyun Cho/Hyung-gyo Seo reporters mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["AI will encroach on every industry" fears send all three major indexes lower [New York market briefing]](https://media.bloomingbit.io/PROD/news/3b5be3da-d32a-498a-b98d-c444f93c3581.webp?w=250)