Summary

- Bitcoin's mining volume is limited, creating high scarcity, and it is gaining attention as an alternative asset because it is not controlled by governments or central banks.

- With the approval of Bitcoin Spot ETFs in the United States, Bitcoin is gaining more prominence, suggesting the potential for development into various financial products like gold.

- Due to extreme volatility and regulatory differences by country, Bitcoin is at risk of being perceived as a speculative asset.

Bitcoin Challenging 'Gold's Stronghold'

Limited Mining, High Scarcity

Not Controlled by Government or Central Banks

Transparent Transactions with Blockchain Technology

Regulatory Differences by Country

High Price Volatility is a Hurdle

As Bitcoin's price surpasses $100,000 for the first time in 15 years, there is both anticipation and concern about whether it can establish itself as a core asset like gold. Optimism that Bitcoin will stand tall as 'digital gold' intersects with skepticism that it will struggle to threaten gold.

Gold became the cornerstone of the global economy with the introduction of the gold standard in the late 19th century, which fixed the value of currencies to gold. Even after the United States abandoned the gold standard in 1971 following the Bretton Woods system, gold continues to serve as an investment asset, a reserve for central banks worldwide, and a safe asset in financial markets.

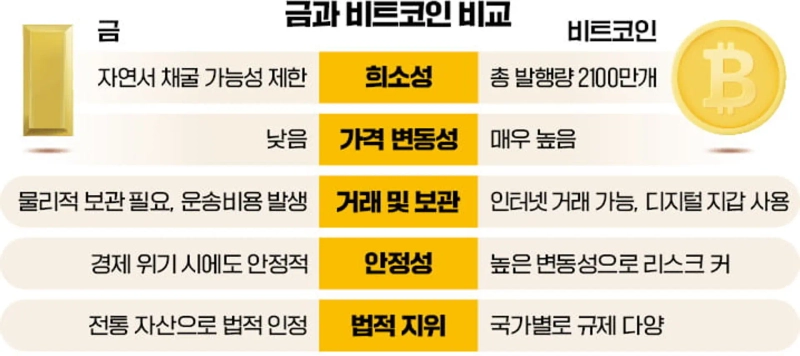

Bitcoin emerged in 2009, designed with a total issuance of 21 million units. Approximately 19.5 million units have been issued so far, accounting for 93% of the total issuance. Bitcoin has a halving event every four years, reducing the reward for mining. Its limited issuance creates high scarcity, similar to gold, which has naturally limited mining.

Bitcoin is backed by blockchain technology, ensuring transparency and security in transactions. It operates independently of central banks and government control. It is sometimes seen as an alternative when economic uncertainty rises and the value of fiat currencies falls. Compared to gold, it offers the advantages of easier transactions and storage with lower costs.

Bitcoin has recently gained more prominence as an asset with the approval of Bitcoin Spot ETFs in the United States earlier this year. BlackRock's Bitcoin Spot ETF surpassed $50 billion (approximately 70.75 trillion won) in assets under management in less than a year. Bitcoin has been developed into various financial products like futures and options, similar to gold. Last month, options trading based on Bitcoin Spot ETFs began in the United States.

Extreme volatility is Bitcoin's weakness, contrasting with the historical stability of gold. This leads to a strong tendency to perceive it as a speculative asset.

Bitcoin faces significant regulatory differences by country. Some countries prohibit or restrictively allow it. Particularly, regulatory changes in the United States and Europe are cited as factors that make Bitcoin's long-term value uncertain.

Jo Mi-hyeon, Reporter mwise@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

!["AI will encroach on every industry" fears send all three major indexes lower [New York market briefing]](https://media.bloomingbit.io/PROD/news/3b5be3da-d32a-498a-b98d-c444f93c3581.webp?w=250)