Summary

- Binance futures traders have recently shown a tendency to bet on the decline of Ethereum.

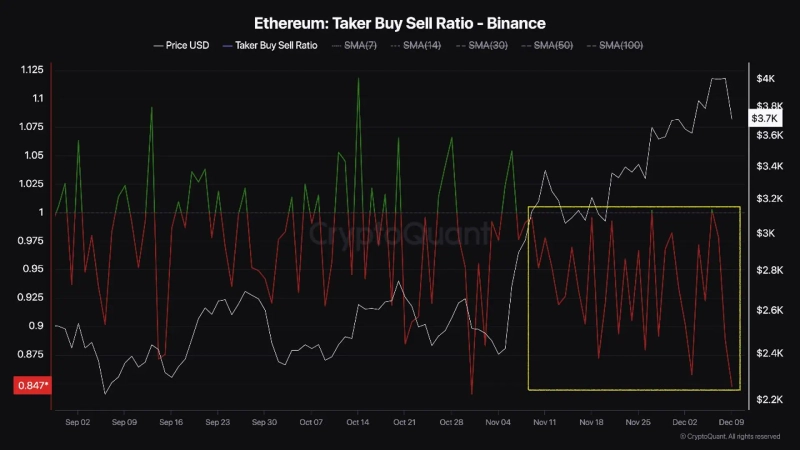

- The declining buy/sell ratio of futures on the Binance exchange suggests traders' bearish outlook.

- Emphasized the importance of monitoring the trend in demand for Ethereum spot ETFs.

Recently, Binance futures traders have shown a tendency to bet on the decline of Ethereum (ETH) rather than its rise, despite its recent upward trend.

On the 10th (local time), CryptoQuant author Darkfosf reported, "Although the recent rise in Ethereum's price approached the major resistance level of $4,000, the buy/sell ratio of futures on the Binance exchange showed a declining trend."

He further analyzed, "This ratio has been negative since early November, indicating that Binance futures traders are more inclined to bet on a decline in Ethereum rather than a rise."

However, the author emphasized, "As the demand for Ethereum spot ETFs has surged, showing an upward trend, the interest of institutional investors is having an increasingly significant impact. It is important to monitor the future trend of ETF demand."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin falls below $71,000…Lowest level since October 2024](https://media.bloomingbit.io/PROD/news/0e5880b9-61dd-49d4-9d2e-c47a3fb33a93.webp?w=250)