Editor's PiCK

US November Core PCE Rises 2.8% YoY, Below Expectations; Bitcoin Recovers to 95K

Summary

- It was reported that the U.S. November Core PCE price index growth rate fell short of market expectations.

- As a result, the possibility of maintaining a monetary easing policy increased, leading to a rise in Bitcoin prices.

- It was reported that the price of Bitcoin recovered to 95,000 dollars immediately after the announcement.

The United States' November Core Personal Consumption Expenditures (PCE) price index fell short of market expectations.

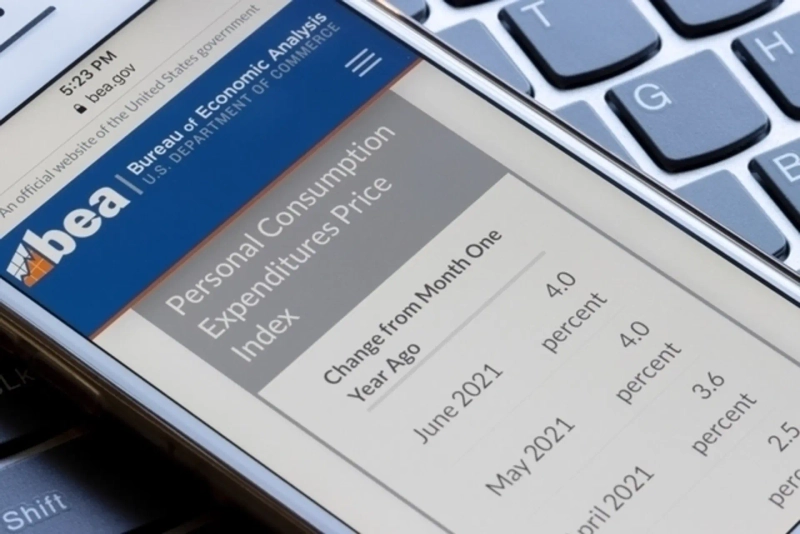

On the 20th (local time), according to data released by the U.S. Department of Commerce's Bureau of Economic Analysis (BEA), the Core PCE for November rose by 2.8% year-on-year, lower than the market expectation of a 2.9% increase.

Core PCE, which excludes the volatile food and energy prices, is a key indicator that the Federal Reserve (Fed) considers when making policy decisions such as setting interest rates.

As the Core PCE, a representative inflation indicator, recorded a figure below expectations, a market sentiment emerged that the monetary easing policy stance could be maintained, leading to an upward trend in Bitcoin (BTC).

Bitcoin, which had fallen to the 93,000-dollar level before the indicator's release, surged vertically to 95,000 dollars immediately after the announcement.

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)