Editor's PiCK

Hyperliquid surges 20% alone in a down market…breaks into the top 10 by market cap

Summary

- Hyperliquid surged 21.69% from the previous day, breaking into the top 10 by market capitalization.

- Expectations for platform expansion were highlighted after the announcement of HIP-4, centered on introducing outcome-based trading and prediction markets.

- Fundamentals were strengthened by $70.5 million in revenue over 30 days and a token buyback structure that uses 99% of revenue to purchase HYPE tokens.

Hyperliquid jumps 20% day-on-day

Buying interest builds on diversification into prediction markets and other business models

"Fundamentals stand out thanks to a token buyback structure"

Hyperliquid (HYPE), a perpetual futures decentralized exchange (DEX), is posting a sharp intraday rally. The move has also shaken up the long-entrenched 'Top 10' crypto market-cap rankings.

According to CoinMarketCap, a crypto market-data website, Hyperliquid was trading at $37.15 as of the 3rd (KST), up 21.69% from the previous day. That marks a 39.15% gain from a week earlier, contrasting with declines over the same period in major cryptoassets such as Bitcoin (-11.35%), Ethereum (-20.69%), Binance Coin (-12.13%), and XRP (-15.21%).

With other cryptoassets still stuck in a downtrend, Hyperliquid’s surge lifted its market capitalization to $11.287 billion, allowing it to overtake Cardano (ADA) and climb to No. 10 by market cap.

Market participants first point to diversification of its business model as a key driver behind Hyperliquid’s rise.

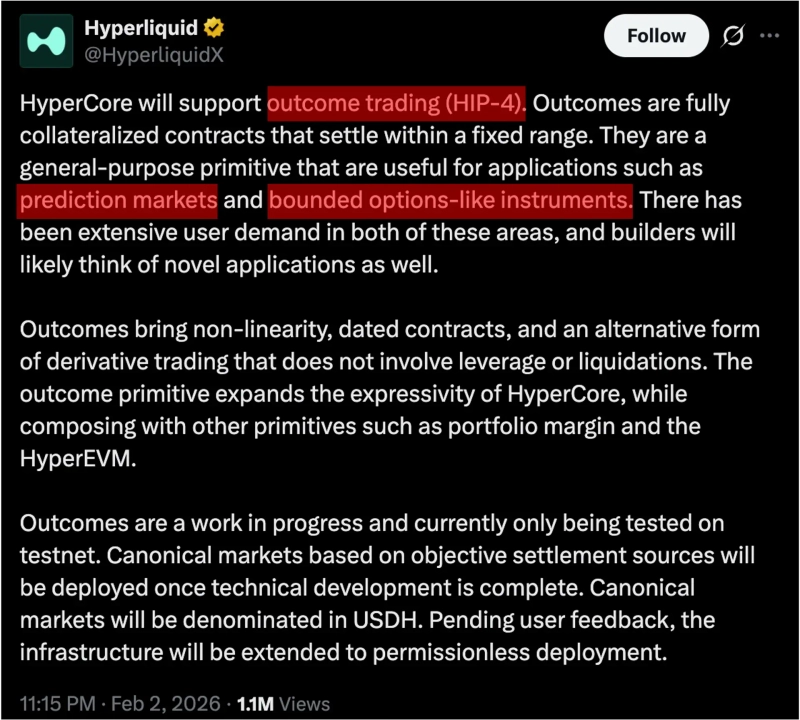

Hyperliquid announced an improvement proposal, 'HIP-4 (Hyperliquid Improvement Proposal),' via its official X (formerly Twitter) account the previous day. HIP-4 outlines plans to introduce an 'outcome-based' trading mechanism into Hypercore, Hyperliquid’s trading protocol.

Outcome-based trading refers to a derivatives structure in which contracts are settled based on whether a specific event occurs or whether prices fall within a certain range over a set period. It is commonly used in prediction markets that bet on future outcomes such as election results, policy decisions, or whether a certain price level is reached. The market believes that adopting outcome-based trading could enable Hyperliquid to expand beyond a perpetual futures DEX into a broader platform encompassing prediction markets.

Jung Ji-sung, a researcher at Korbit Research Center, said, "Since its launch, Hyperliquid has continuously expanded the range of asset classes it covers, including the rollout of real-world asset tokenization (RWA) products last year," adding, "This move to introduce outcome-based trading can also be seen as a natural extension in terms of entering prediction markets."

Hyperliquid’s total value locked (TVL) currently stands at $1.594 billion. That is roughly four times Polymarket’s TVL ($380 million), and by platform size alone, Hyperliquid is seen as significantly larger than Polymarket. Polymarket is currently valued by the market at around $12–15 billion. Jung said, "Prediction-market platforms are generally being assigned high valuations in today’s market," adding, "If Hyperliquid also generates trading volume in prediction markets, it could have a positive impact on its valuation."

In addition, amid the down market, Hyperliquid’s fundamentals as a 'revenue-generating protocol' also underpinned its strength.

Hyperliquid is among the highest-earning projects in the crypto protocol space. Its revenue is tallied by aggregating the fees users pay in derivatives and spot trading, a key feature being that it is based on real usage.

According to DeFiLlama, Hyperliquid generated $70.5 million in revenue over the past 30 days, the highest figure excluding stablecoin issuers Tether and Circle.

Moreover, when such revenue is generated, Hyperliquid adopts a structure in which 99% is allocated to an 'Assistance Fund' and used to buy HYPE tokens. As protocol usage increases, revenue expands, which can translate into token purchases and create upward price pressure.

Jung said, "Hyperliquid continues to generate strong revenue even during the recent market slump," adding, "Compared with many tokens struggling in a down market, Hyperliquid stands out in that it is building fundamentals that feed through to the actual token price via its token buyback structure."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)