Editor's PiCK

Last Week, $300 Million Inflow into Digital Asset Investment Products Despite Downtrend

Summary

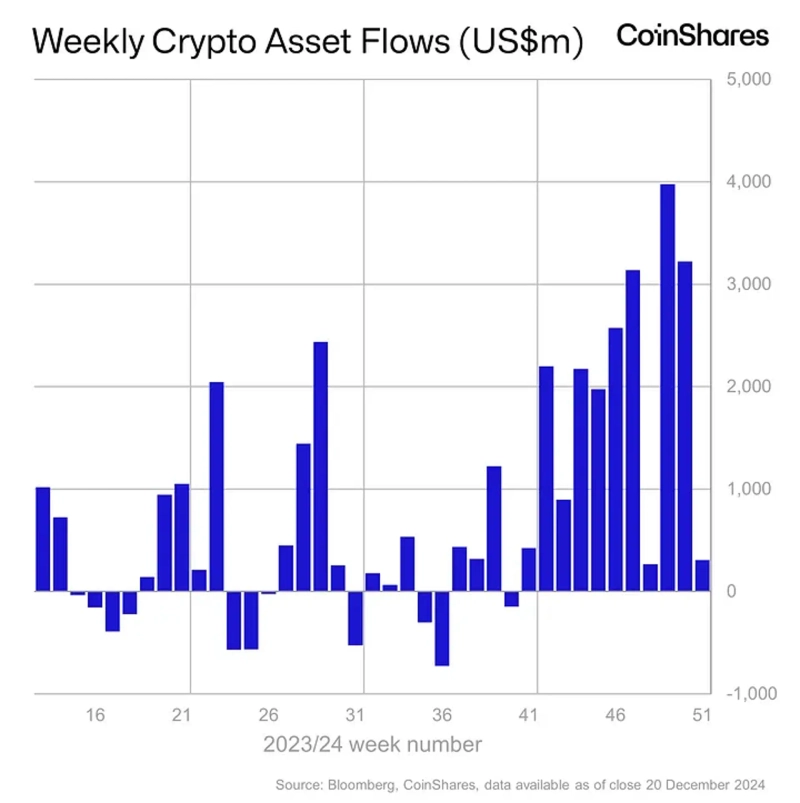

- Last week, digital asset investment products saw an inflow of $308 million.

- The net inflow after the FOMC announcement was analyzed as a strong attraction of digital investment products.

- Bitcoin recorded a net inflow of $375 million despite midweek outflows.

Last week, there was an inflow of $308 million into digital asset investment products.

On the 23rd, the cryptocurrency management company CoinShares reported in its 'Weekly Digital Asset Investment Product Fund Flows' report that "$308 million was invested in digital investment products last week," and noted, "Despite a nearly $1 billion outflow due to the hawkish Federal Open Market Committee (FOMC) on the 19th and 20th, there was a net inflow for the entire week."

The report analyzed, "As the market recently adjusted, the assets under management (AuM) of digital asset exchange-traded products (ETPs) decreased by $17.7 billion," suggesting, "This may be investors' response to the dot plot announced by the FOMC."

Previously, the Federal Reserve (Fed) lowered the benchmark interest rate by 0.25 percentage points at the December FOMC, significantly reducing the projected rate cuts for next year from four to two through the dot plot.

It added, "Bitcoin recorded a net inflow of $375 million over the week despite midweek outflows," and "additional funds were also invested in Ripple ($8.8 million) and Ethereum ($51 million)."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)