Editor's PiCK

[Analysis] "Major Exchanges See Large Bitcoin (BTC) Deposits... Short-term Bearish Possibility"

Summary

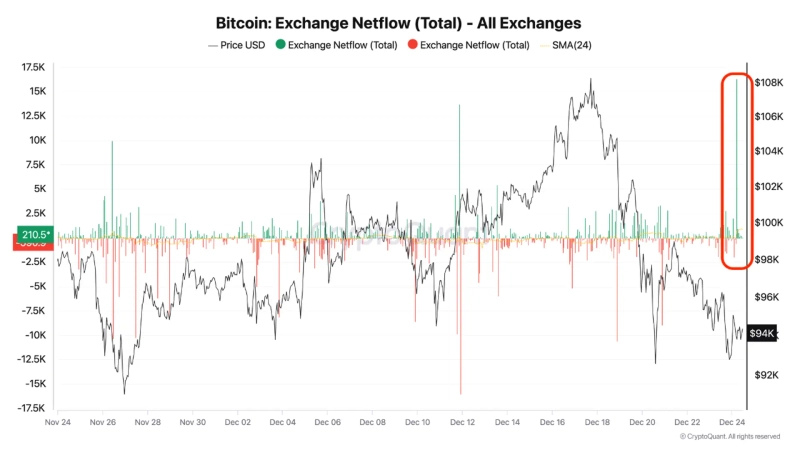

- The increase in large Bitcoin deposits and the outflow of stablecoins suggest a short-term bearish trend.

- Approximately 15,000 BTC have been deposited into major exchanges.

- There is no clear outlook for a prolonged bear market.

An analysis has emerged suggesting that the possibility of a short-term bearish trend is increasing as large Bitcoin (BTC) deposits are rising on major cryptocurrency exchanges.

On the 24th, Onatt, an analyst from the cryptocurrency analysis platform CryptoQuant, stated in a Quicktake report, "Despite the recent plunge, selling pressure continues in the spot market," adding, "There have been large deposits exceeding 15,000 BTC, and stablecoins like Tether (USDT) are being massively withdrawn from exchanges."

The analyst added, "This combination suggests that Bitcoin prices may fall further in the short term," but also noted, "There is no clear outlook for a prolonged bear market from a macroeconomic perspective."

Meanwhile, a decrease in the circulation of stablecoins typically indicates a reduction in capital inflow into the cryptocurrency market.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)