Summary

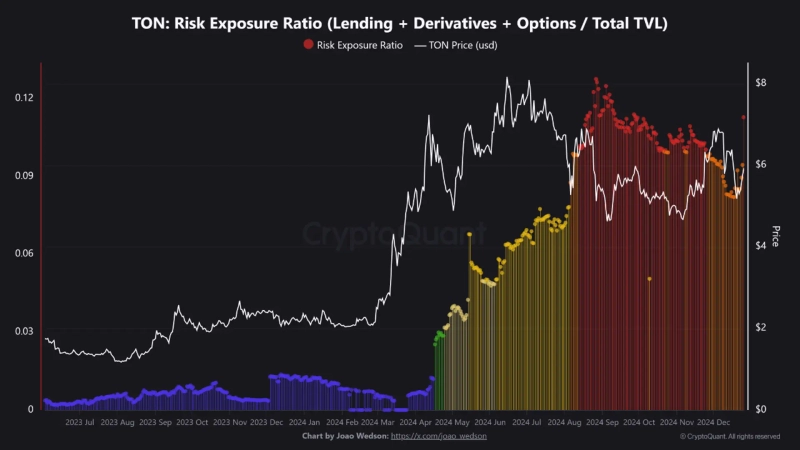

- The risk of The Open Network (TON) is analyzed to be at a high level.

- A significant portion of TON's Total Value Locked (TVL) is said to be allocated to risk-exposed categories such as loans, derivatives, and options.

- The increased demand for derivatives and leverage may reflect investors' confidence in a bullish market.

An analysis has emerged indicating that the risk level of The Open Network (TON) is high.

On the 27th (local time), João Wedson, a contributor to CryptoQuant, stated, "The risk level of The Open Network is high," explaining that "a significant portion of TON's Total Value Locked (TVL) is allocated to categories such as loans, derivatives, and options." He further noted, "These categories are all highly exposed to market and liquidity risks," adding that "concerns about stability may increase."

However, he added, "There is room for a positive interpretation," suggesting that the increased demand for derivatives and leverage reflects investors' confidence in a bullish market."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

![Dow Tops 50,000 for First Time Ever as “Oversold” Narrative Spreads [New York Stock Market Briefing]](https://media.bloomingbit.io/PROD/news/1c6508fc-9e08-43e2-81be-ca81048b8d11.webp?w=250)