PiCK

"Korean Central Bank Likely to Cut Interest Rates Three Times... US Fed's Hawkish Stance May Slow Down the Pace"

Summary

- The Korean Central Bank is expected to cut the interest rate three more times this year, with political uncertainty and market volatility potentially affecting the pace.

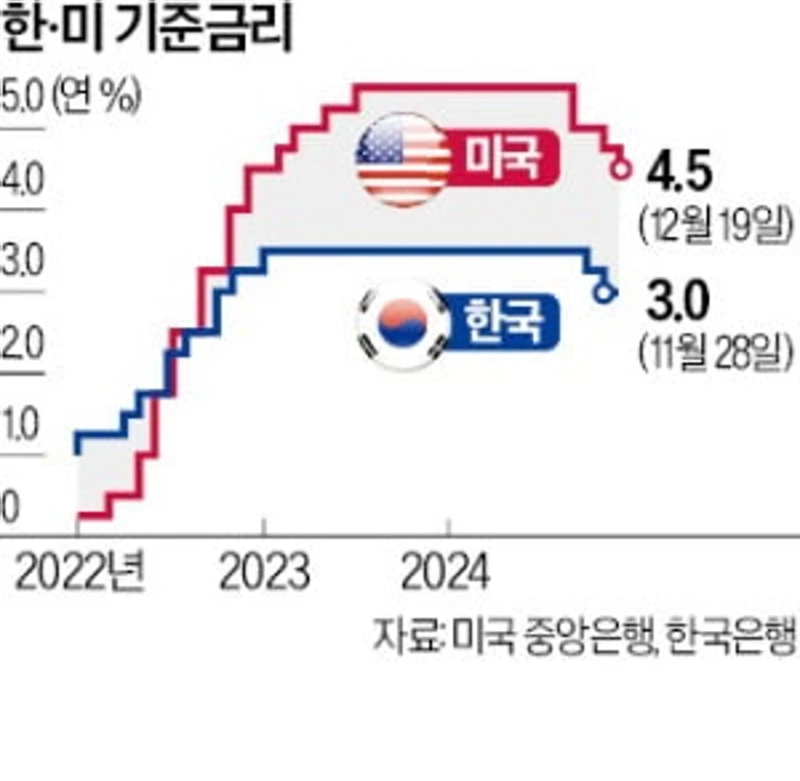

- There is a possibility that the rate could drop from the current 3.0% to 2.25%, but the US Fed's hawkish stance could act as a hindrance.

- The Korean Central Bank is preparing policy responses while monitoring the impact of domestic political events and changes in US monetary policy on the foreign exchange market and economic growth.

Interest Rate Outlook

This year, the Korean Central Bank is expected to continue its policy of lowering interest rates. This is because concerns about economic downturns are growing amid stable inflation, necessitating a response to downward pressure on growth rates. Political uncertainty and the foreign exchange market situation, influenced by US monetary policy, are cited as factors that could affect the pace of rate cuts.

In its report on the '2025 Monetary and Credit Policy Operation Direction' released at the end of last year, the Korean Central Bank stated, "We will continue to stabilize inflation rates, alleviate downward pressure on growth, and pay attention to financial stability risks while further lowering the interest rate." This reaffirms the continuation of the rate-cutting trend that began in October last year.

The Korean Central Bank particularly noted, "We will consider the increased downside risks to the economy due to heightened political uncertainty, intensified global competition in key industries, and changes in the trade environment."

Following President Yoon Suk-yeol's declaration of martial law and the subsequent impeachment situation, consumer sentiment has rapidly cooled, leading to expectations that the Korean economy will grow more slowly than previously forecasted in the fourth quarter and this year.

The market expects the Korean Central Bank to cut rates three more times next year. It is anticipated that the current rate of 3.0% will drop to 2.25%. Opinions differ on the timing of the cuts, with some suggesting January and others February.

HSBC and Deutsche Bank forecast that the Korean Central Bank will start cutting rates in January. HSBC cited political uncertainty, while Deutsche Bank pointed to weak external factors such as exports as reasons for potentially lower growth forecasts. Barclays predicted that the interest rate would be lowered three times in February, May, and October.

There are also forecasts that the hawkish stance of the US Federal Reserve (Fed) could slow down the pace of Korea's rate cuts. Goldman Sachs predicted, "If the Fed's hawkish stance strengthens and the won remains weak for an extended period, the Korean Central Bank's room for further rate cuts will be reduced."

Park Jeong-woo, an economist at Nomura Securities, analyzed, "The Fed's hawkish stance supports the Korean Central Bank's decision to freeze the interest rate in January next year."

There is also room for adjustments in monetary policy depending on the intensity of tariff policies following the Trump administration's inauguration. Domestically, political events are a variable. Concerns persist that financial and foreign exchange market uncertainties will continue until President Yoon Suk-yeol's impeachment trial, and if a presidential election is held next year, there is a possibility that cash-based pledges could cause inflation to rebound.

Kang Jin-kyu, reporter josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] Toss Reviews Acquisition of Overseas Crypto Exchange… In Talks With US Institutional Platform](https://media.bloomingbit.io/PROD/news/148973fc-2c49-4ab4-8934-c7e9d49c847b.webp?w=250)

![[Exclusive] Toss sets up a dedicated blockchain unit…begins building digital-asset infrastructure](https://media.bloomingbit.io/PROD/news/76d3ff2d-0b0f-402b-b842-90eeeb7f183d.webp?w=250)