Summary

- Bitcoin futures open interest has decreased to its lowest level in two months.

- In the futures market, the one-month Bitcoin premium increased to 15%, indicating that optimistic investor sentiment is still observed.

- Janet Yellen's debt ceiling warning has been analyzed to have strengthened investor sentiment.

On the 1st (local time), the cryptocurrency-focused media outlet Cointelegraph reported that Bitcoin positions in the futures market have decreased to their lowest level in two months.

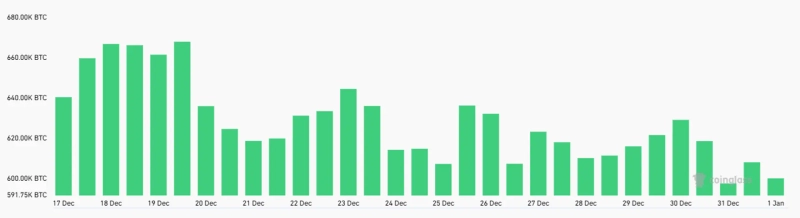

Bitcoin futures open interest peaked at 668,100 on December 20th but has since fallen to 595,700 due to volatility causing many positions to be liquidated. The media evaluated this as "the decrease in futures positions to the lowest level in two months indicates that Bitcoin's decline is limited."

Meanwhile, optimistic investor sentiment is still observed in the futures market. The one-month Bitcoin futures premium recorded its highest at 15% since December 20th last year.

Cointelegraph analyzed that U.S. Treasury Secretary Janet Yellen's warning about the debt ceiling has strengthened investor sentiment.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Key Economic and Crypto Events for the Week Ahead] U.S. January CPI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)