"The Rally Isn't Over Yet" - 3 Reasons Merrill Says Not to Worry [Kim Hyun-seok's Wall Street Now]

Summary

- Merrill reported that the S&P500 index is expected to show a 15% profit growth rate in 2025 following 10% in 2024, supporting the bull market with corporate profit growth.

- Although the top 7 companies in the S&P500 accounted for half of the index's performance, market participation expansion and AI innovation can enhance productivity in various industries, supporting market expansion.

- While stock valuations have exceeded the long-term average, they are likely to be maintained due to the structural factors of technology-focused companies.

<January 2, Thursday>

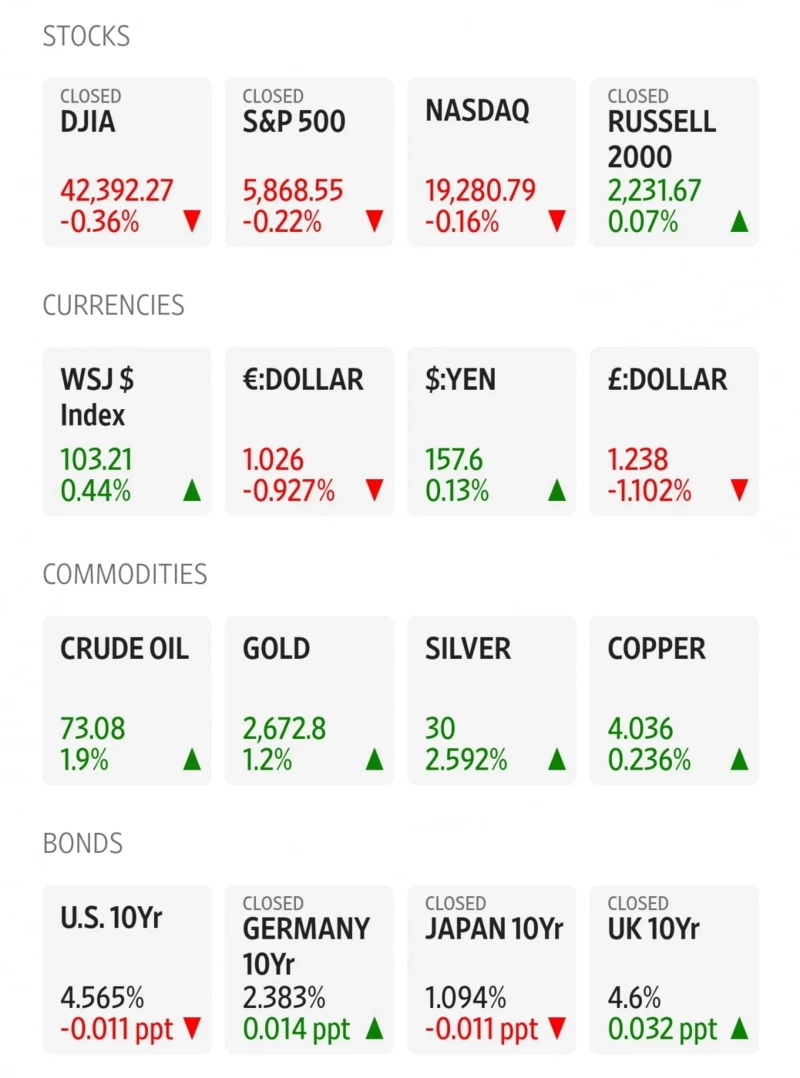

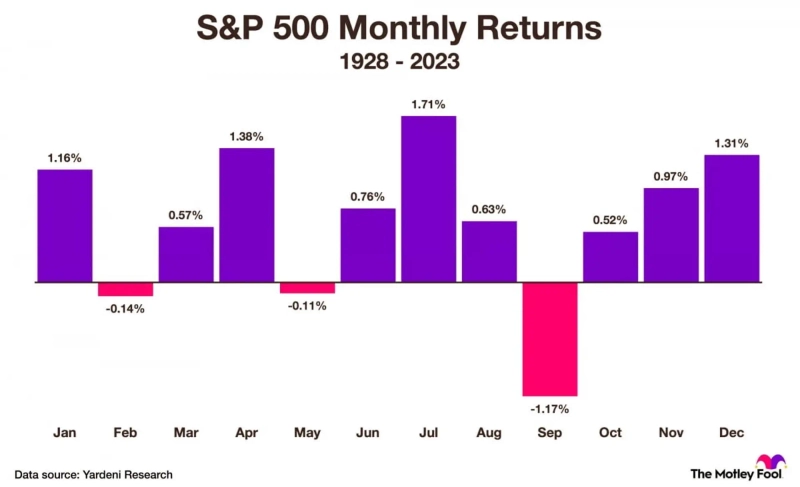

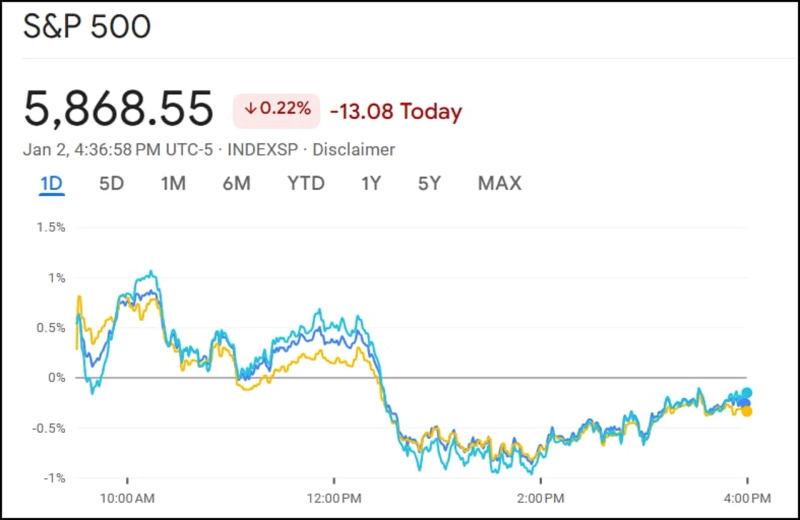

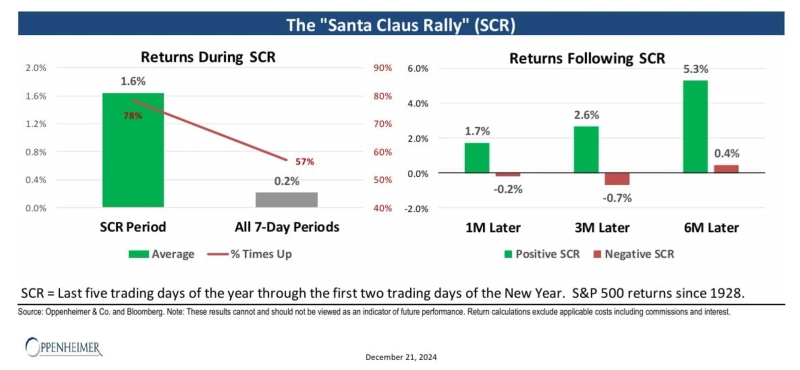

On January 2 (Eastern Time), the New York stock market, which had shown a four-day consecutive decline at the end of 2024, attempted a rebound on the first trading day of the new year. The new year always brings hope to investors. January is seasonally a good month for the stock market, with the S&P500 index typically rising around 1%. Perhaps that's why the morning saw a significant upward trend. The truck crash in New Orleans and the Cybertruck explosion in front of the Trump Hotel in Houston on the 1st raised the possibility of terrorism, but it did not affect the market. However, as time passed, bond yields recovered to flat levels, and the dollar soared, causing the stock market to turn weak again. Concerns remain high due to policy uncertainties such as tariffs ahead of the inauguration of the Donald Trump administration on the 20th, and the possibility of the Fed's easing retreat.

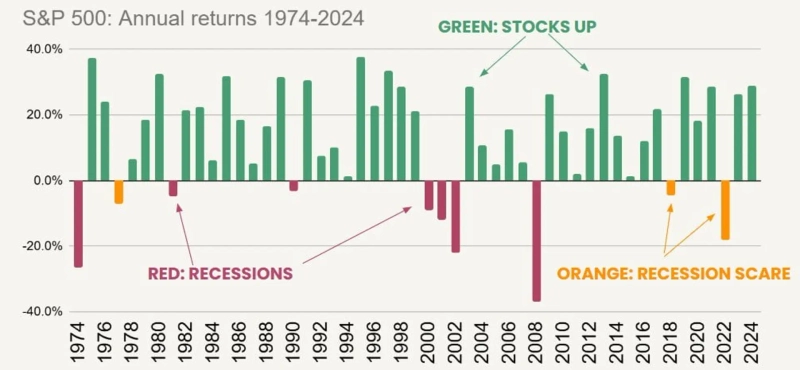

On the morning of the 1st, buying pressure appeared in both stocks and bonds. Major indices on the New York stock market started trading with a 0.3-0.5% upward trend at 9:30 AM. The possibility of the S&P500 index rising significantly again after rising more than 20% consecutively in 2023 and 2024 is small and certainly rare. It only happened once during the four-year consecutive rise between 1995 and 1998. Although it is difficult to rise more than 20%, there have been many instances of rising for three consecutive years. Investors will be satisfied with a slightly lower return in 2025. Historically, bull markets have lasted an average of 5.5 years once they start, rising about 180% during this period. This bull market started in October 2022, now two years old, and has risen about 60%.

In the New York bond market, interest rates showed a downward trend in the morning. The yield on the 10-year Treasury fell to 4.517% around 8 AM. There are views that it is difficult for Treasury yields to rise significantly as recent economic data has slightly slowed.

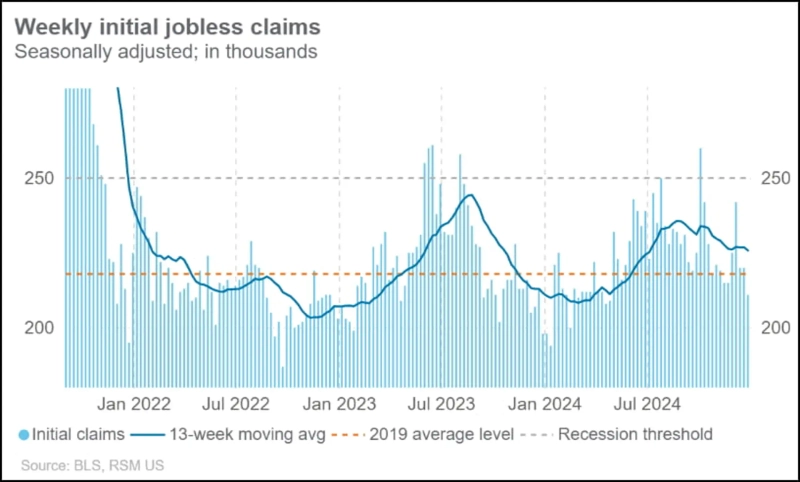

However, as the weekly new unemployment claims announced at 8:30 AM showed the lowest level in four months, bond yields began to stir again.

The number of new unemployment claims was counted at 211,000, a decrease of 9,000 from the previous week, marking the lowest record in eight months since April. The number of claims filed for more than two consecutive weeks also decreased by 52,000 to 1,844,000 compared to the previous week. Evercore ISI analyzed, "Unemployment benefits tend to become unstable at the end of the year when holidays are concentrated, but it still suggests that the labor market is solid."

The bond market atmosphere changed. Bond yields recovered to flat levels after 11 AM, rising to 4.599% at one point. Not only the unemployment claims but also the sharp rise in oil prices by around 2% and the influx of corporate bonds from companies like GM and Ford at the beginning of the year were negative for the bond market.

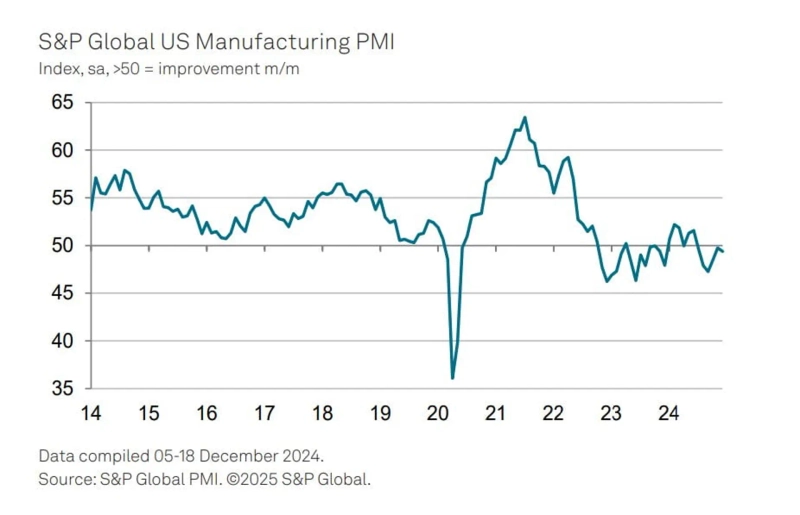

In fact, other economic data were not very good. The final December manufacturing PMI from S&P Global was recorded at 49.4. It fell slightly from 49.7 in November but improved from the preliminary figure of 48.3. Anyway, it stayed in the contraction phase (below 50) for five consecutive months. S&P stated that the decline in new orders was the cause of the weakness. Nevertheless, the input cost prices were the highest since August last year. Economist Chris Williamson analyzed, "Most companies expect business to recover in the new year, and respondents expect the new administration to ease regulations, reduce tax burdens, and increase demand for American products through tariffs. However, this optimism decreased somewhat in December. Companies are reporting concerns about rising input prices and speculating that interest rates will not fall as expected."

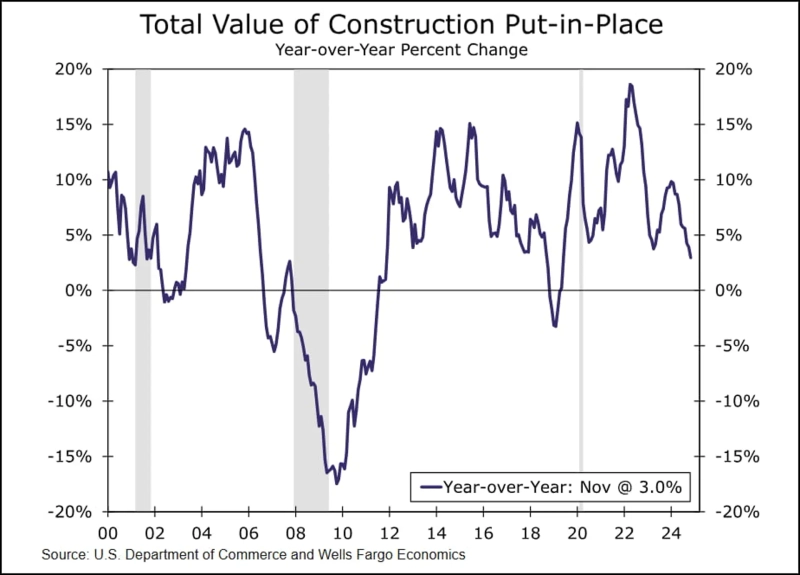

November construction spending was stagnant (0%) at the same level as the previous month. It fell short of expectations (+0.3%). Wells Fargo interpreted, "November construction spending showed no change as a slight increase in the residential sector offset a slight decrease in the non-residential sector. Investments in data centers, power grids, and roads continued, but most other non-residential sectors weakened. Overall, construction spending continues to slow due to rising interest rates."

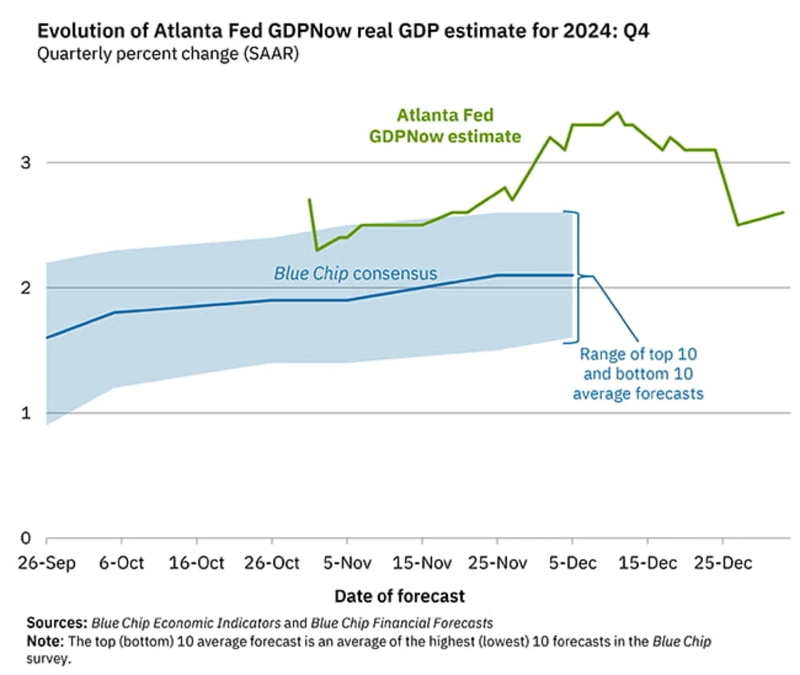

After today's data was released, the fourth-quarter growth rate estimates were lowered. The Atlanta Fed's GDPNow was lowered from 3.1% to 2.6%, and Goldman Sachs lowered it from 2.4% to 2.3%. However, since the figures are still high, it had little impact on expectations for a Fed rate cut. The CME FedWatch market's January rate cut expectation recorded 11.2%, slightly rising from 9.6% at the end of the year.

Eventually, around 4:10 PM, the yield on the 10-year Treasury fell by 1.4 basis points to 4.563%, and the 2-year yield fell by 0.8 basis points to 4.244%. A bond market official said, "There is overall anxiety due to the inauguration of the Trump administration." Trump also claimed on Truth Social yesterday, "Tariffs have brought tremendous wealth to the United States. Tariffs will pay off our debt." Also, ahead of the opening of the 119th Congress tomorrow, the House entered the election of the Speaker. Some hardliners in the Republican Party oppose current Speaker Mike Johnson, who has often compromised with Democrats. To be elected as Speaker, a majority vote (218 votes) is required. Assuming 434 members vote, excluding Matt Gaetz who resigned, and the Democrats (215 seats) oppose, if only two of the 219 Republicans defect, reelection will fail. With the Republican Party's congressional dominance in an unstable situation, there are also doubts about whether tax cuts will pass properly. The debt ceiling suspension measure ended yesterday. KPMG economist Diane Swonk pointed out, "The Treasury will take special measures to prevent a national debt default (default) from mid-January, and Congress must raise the debt ceiling again by summer. Otherwise, there is a risk of default. Due to the drama surrounding the debt ceiling, at least two credit rating agencies have downgraded the U.S. national credit rating since 2011."

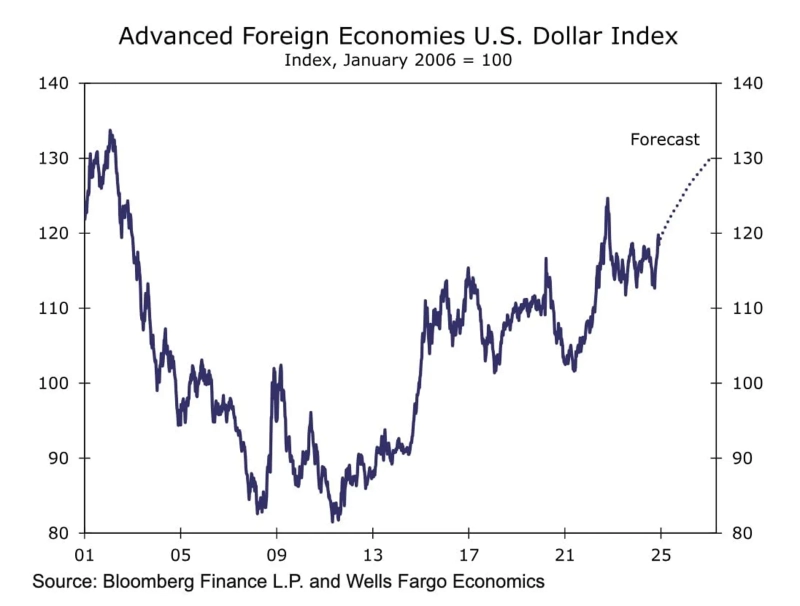

As interest rates recovered to flat levels during the day, the dollar's upward trend intensified. It jumped 0.77% from the previous session, recording 109.32, the highest level since November 2022. Wells Fargo stated, "The dollar's strength outlook has strengthened since the presidential election. Now, the Fed's easing pace is expected to be more gradual, while the G10 central banks' easing pace is expected to accelerate. Tariffs imposed by Trump could burden other countries' growth prospects, and if tariffs lead to an improvement in the U.S. trade balance, that could also help the dollar. We believe that this combination of dynamics could cause the dollar to surge in 2025, testing levels last seen in 2002." The simultaneous weakening of the euro and yuan also had an impact. The interruption of Russian natural gas supply through Ukraine weakened the euro. In China, the December Caixin manufacturing PMI fell to 50.5 from 51.5 in the previous month, and Trump's tariff remarks led to a 2.9% plunge in the CSI300 index, marking the worst new year since 2016.

Such a strong dollar, like high interest rates, is a factor that negatively affects the performance of U.S. companies. Major indices turned downward in the afternoon. Eventually, the S&P500 index closed down 0.22%, the Nasdaq down 0.16%, and the Dow down 0.36%.

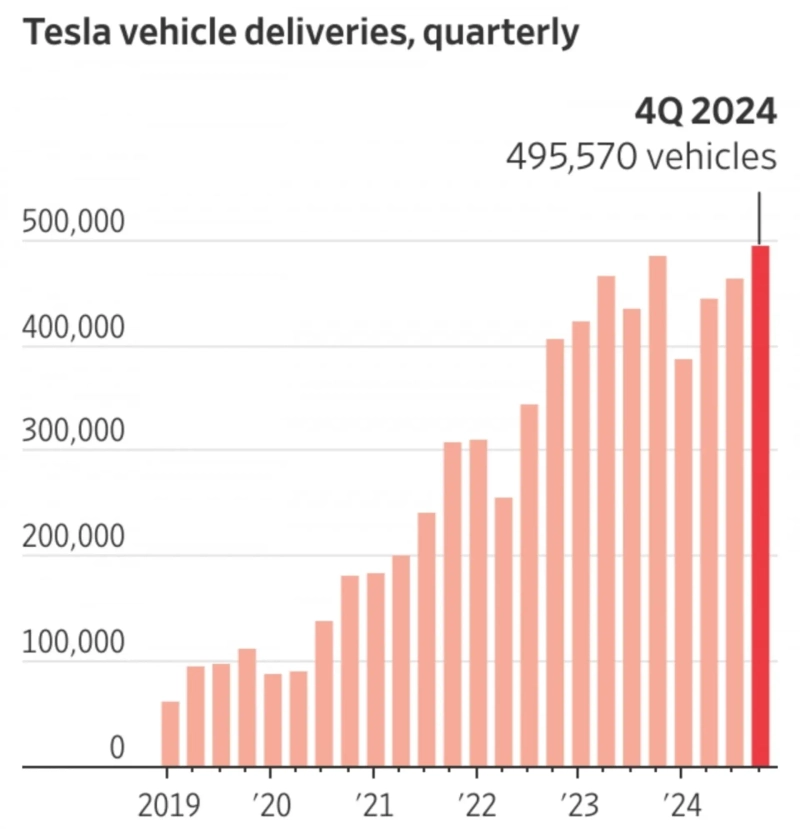

Tesla, which announced fourth-quarter deliveries that fell short of expectations, plunged more than 6%, affecting the market sentiment. As a result, it fell more than 20% from the December peak. Fourth-quarter vehicle deliveries were 495,570, an increase of 11,063 from the same period last year. However, it fell short of Wall Street's expectation of over 500,000 units. As a result, last year's annual deliveries were 1,789,226, nearly 20,000 less than in 2023 (1,808,581). The annual delivery decline is the first since Tesla's establishment. It is being pushed by Chinese-made electric vehicles in Europe, and although deliveries in China increased compared to the previous year, they did not meet the growth rate of Chinese companies like BYD. Until November last year, the electric vehicle market in China grew by 8%, but Tesla's main model, the Model Y, only increased by 5%. The positive point was the energy storage system (ESS) business. In the fourth quarter, 11 GWh was sold, and 31.4 GWh was sold last year, more than doubling from 14.7 GWh in 2023. Therefore, it is expected that the fourth-quarter earnings to be announced on the 29th will be better than expected.

Morgan Stanley maintained an overweight rating and a target price of $400, stating, "The weak fourth-quarter deliveries are due to a lineup of relatively old vehicles ahead of the launch of a new affordable model (Juniper) scheduled for early to mid-2025 and the global increase in low-cost models. The fourth-quarter ESS business was positive." Stifel stated, "We think the fourth-quarter deliveries will weigh on the stock price. However, the sale of 11 GWh in the ESS business is the highest quarterly record ever, and it meets our strong expectations for this business. Overall, we believe that the traction of full self-driving (FSD) and Cybercap will be an important driver for the stock price in 2025."

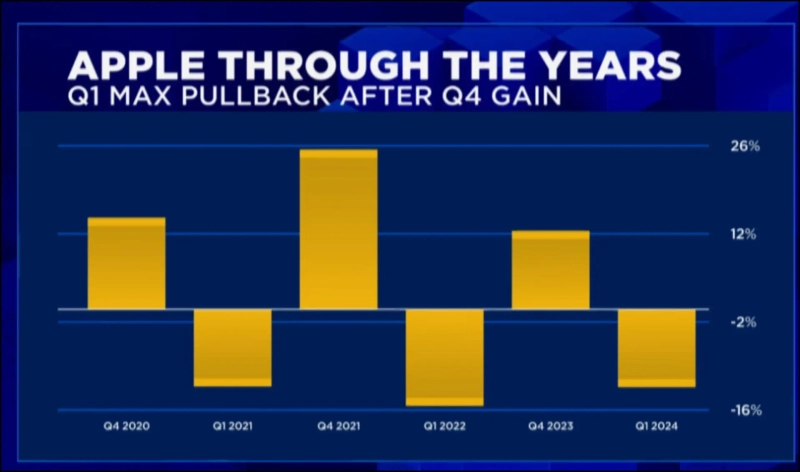

It wasn't just Tesla that burdened the market. Apple also fell by 2.6%. Reuters reported, "Apple has offered discounts on the iPhone 16 model in China." According to IDC, Apple's market share in China fell by 0.3 percentage points in the third quarter of 2023, while Huawei surged by 42%. UBS (neutral, target price $236) lowered its iPhone sales estimates. "Compared to the previous forecast and market consensus of 2% growth in iPhone sales in the fourth quarter, we now expect a 4% decline," it argued.

Fortunately, semiconductor stocks like NVIDIA rebounded, offsetting the negative effects. NVIDIA continues to rise ahead of CEO Jensen Huang's keynote speech at CES on the night of the 6th. Bank of America (buy, target price $190) reaffirmed its buy rating on NVIDIA ahead of CES and the keynote speech on the 6th, expecting ▲ the rise of the robotics strategy (Jetson Thor) and the 'Physical AI' theme spanning from semiconductors to software ▲ potential entry into the AI PC field ▲ data center updates (Blackwell status and second-half upgrades, introduction of next-generation Rubin in 2026).

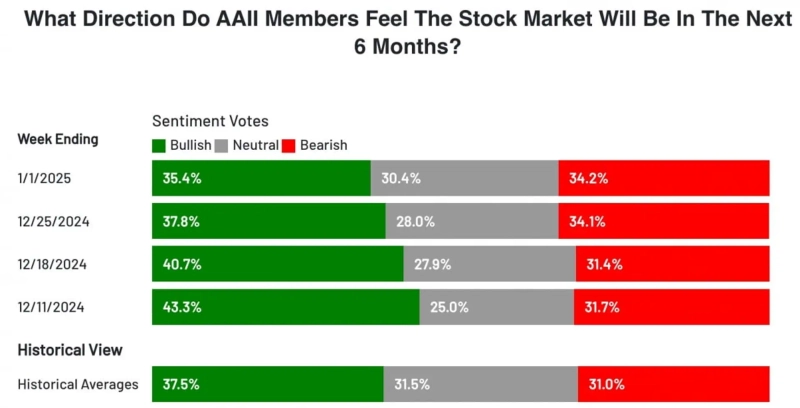

According to the latest investor sentiment survey by the American Association of Individual Investors (AAII), the bullish outlook for the next six months has decreased to 35.4%. It is the lowest since April 2024. The neutral view exceeded 30% for the first time in eight weeks. The bearish outlook has been higher than the past average for the sixth time in the past seven weeks. This means that investor sentiment has weakened. However, the number obtained by subtracting the bearish outlook from the bullish outlook still maintained a positive (+) value.

Optimism is still alive. Most of Wall Street states that there was no significant change in the overall narrative (solid economic growth, sustained corporate profits, resilient consumers, Trump optimism) despite low trading volumes during the year-end decline period. Lisa Shalett, CIO of Morgan Stanley Asset Management, one of the 'pessimists,' said in a Bloomberg interview about the bad year-end in 2024, "It's too early to call it a bad omen."

Merrill analyzed, "There are three concerns for investors in 2025," and said, "Don't worry."

① Concerns that the rally is over

=The rally over the past two years has been truly remarkable. The S&P500 index rose more than 20% for two consecutive years. It's the first time since 1999. The index recorded 57 all-time highs in 2024, and crossed the 6000 mark 276 days after surpassing the 5000 mark. After such a strong rally, investors are questioning the sustainability of the rally. However, several positive factors are likely to support upward performance in 2025. Fundamentals such as corporate profit growth and dividend increases are supporting the rise. The earnings growth rate of S&P500 companies is expected to increase from 10% in 2024 to 15% in 2025. Consumers and the labor market remain strong, and the economic growth outlook is positive. If the current bull market ends, it will historically be at a very short and rare level with low growth rates.

② Concerns about market concentration

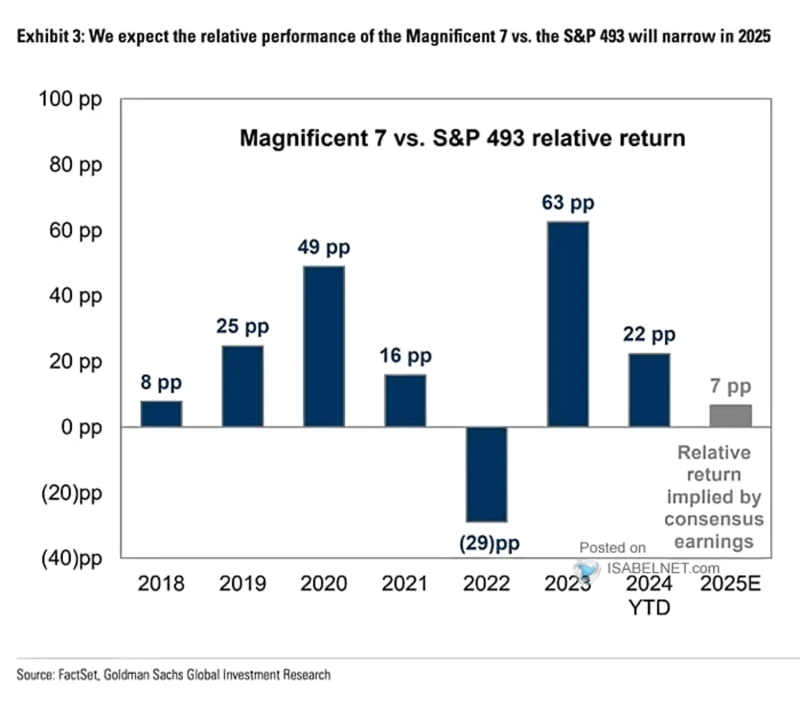

=The market is still concentrated in some mega-cap stocks. The top 7 companies in the S&P 500 account for more than 30% of the index's market capitalization and contributed about half of the index's performance in 2024. However, there are also signs that market participation is expanding. The Equal Weighted S&P500 Index also recorded a 20% return compared to the beginning of last year. The market is expected to widen further in 2025. Small and mid-cap stocks are likely to rise, driven by economic growth and infrastructure development prospects. Also, innovation led by AI can enhance productivity in various industries and maintain margins, supporting continuous market expansion.

③ Concerns that stock valuations are too expensive

=It is true that valuations have exceeded the long-term average. However, today's market has different structural factors than in the past, making it likely that these valuations will be maintained. In 1980, 70% of S&P500 companies were composed of asset-intensive industries such as manufacturing, finance, and real estate. Now, 50% have shifted to technology-focused companies with light assets. These companies can efficiently utilize capital with low fixed costs and improve productivity and economies of scale more quickly. They deserve higher valuations.

New York=Kim Hyun-seok, Correspondent realist@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] Toss sets up a dedicated blockchain unit…begins building digital-asset infrastructure](https://media.bloomingbit.io/PROD/news/76d3ff2d-0b0f-402b-b842-90eeeb7f183d.webp?w=250)