Concerns Over Trump's Tariffs in the US Economic Community: "Could Lead to Deterioration in Corporate Productivity and Labor Market Shock"

Summary

- There are concerns that Trump's tax cut policy could exacerbate the US deficit, with the reported total national debt reaching approximately $36 trillion.

- It is anticipated that US tariff imposition could lead to increased import prices and deteriorating corporate profitability, particularly weakening manufacturing competitiveness.

- There is an increase in cases of Chinese companies avoiding tariffs via Vietnam, which could result in favorable outcomes for China in the US-China trade war.

Concerns Emerge at the American Economic Association on the 3rd

Nobel Laureate David Card: "Trump Will Increase the Deficit"

Expectations of More Chinese Companies Avoiding Tariffs via Vietnam

Predictions of US Import Prices Rising, Impacting the Domestic Economy

In San Francisco, at the American Economic Association held from the 3rd to the 5th (local time), scholars expressed deep concerns over the economic policies proposed by President-elect Trump, including tariffs, immigration, and the deficit.

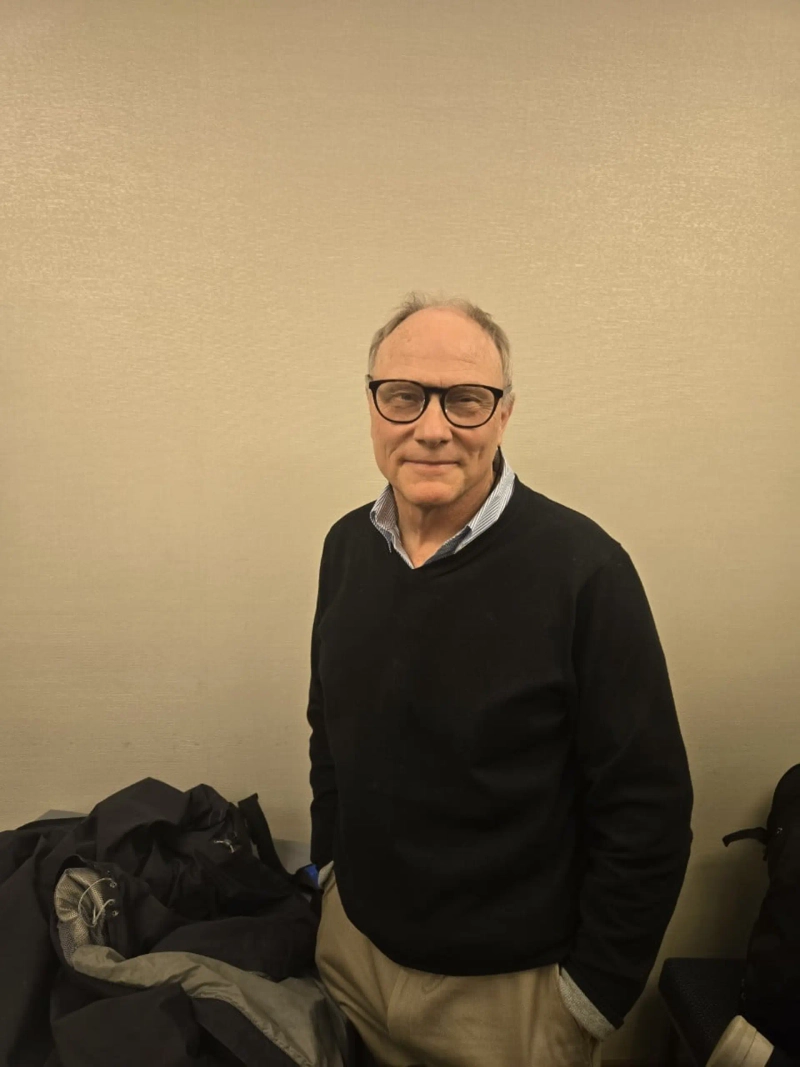

David Card, a Nobel laureate and professor of economics at UC Berkeley (pictured), pointed out that Trump's tax cut policy could further increase the US deficit.

Several sessions on Trump's tariffs were held simultaneously. A common theme in these sessions was that US tariffs could backfire, leading to increased import prices and deteriorating corporate profitability.

"There Will Be Major Issues with the Deficit"

On the 3rd (local time), Professor Card stated that there would be "major issues" regarding the deficit. He noted, "The US government is currently facing a massive deficit, and it will grow larger," adding, "Thus, political negotiations will be crucial, whether to simply let the deficit increase or to reduce social welfare programs or try other methods."

According to the US Treasury, the total expenditure of the US government for the 2024 fiscal year is $6.75 trillion, with total revenue at $4.92 trillion. The deficit, which is the difference between total revenue and total expenditure, increased by $138 billion from the previous fiscal year to $1.83 trillion. Consequently, the total national debt is approximately $36 trillion.

Professor Card highlighted, "(When Trump takes office) there will be tax cuts, but the issue is whether the second Trump administration will allow the deficit to increase or try to reduce other expenditures." An increase in the deficit could lead to a surge in bond issuance, impacting the bond market. If expenditures are reduced, political conflicts over policy priorities could intensify.

In a separate session titled 'Economic Policies of the Trump Administration,' Kim Clausing, a professor of economics at UCLA, also warned of the need for sustainable fiscal management. Professor Clausing stated, "The Trump administration is likely to continue or expand tax cuts," adding, "This could worsen the deficit further, but infrastructure investment or other economic growth policies are necessary, though there may be a lack of fiscal capacity for them."

"Will Reduce US Imports and Increase Chinese Imports"

Regarding Trump's tariff policy, there was also an opinion that it could inadvertently benefit China. In the 'US-China Trade War' session, Shaphat Yar Khan, a professor of economics at Syracuse University, predicted, "The US-China trade war, resulting from tariff imposition, will shock demand in China, leading to wage declines and making Chinese goods cheaper in the global market." This is because China, having lost the large US market, could push its products at lower prices to other countries.

Research findings also indicated an increase in companies avoiding tariffs by utilizing Vietnam. Ebehi Iyoha, a professor at Harvard Business School, introduced, "By measuring the proportion of identical goods imported from China among goods exported from Vietnam to the US (relocation rate), it was found that the relocation rate increased by 2.4% between 2018 and 2021." He particularly pointed out, "The number of Chinese-owned companies operating in Vietnam has increased, and these companies showed the highest relocation rate in exports to the US."

Fierce Debates Over Tariffs and Immigration Issues

In the same session, Professor Clausing engaged in a fierce debate with Oren Cass, founder of the conservative think tank American Compass, regarding immigration issues.

Cass criticized traditional economics for failing to predict or resolve the trade imbalance with China. Consequently, he advocated for supporting domestic production and re-examining free market principles.

Cass quoted George Costanza, saying, "If every instinct you have is wrong, then the opposite would have to be right," referring to the economists who advocated for free trade with China in the early 2000s, which he claimed ultimately failed. He suggested that American economists need to seek new approaches.

He particularly mentioned the US trade deficit, which amounts to $1 trillion annually, arguing that "this has led to a decline in manufacturing jobs and a slowdown in productivity."

On the other hand, Professor Clausing emphasized the benefits of globalization and warned that trade restrictions like tariffs harm domestic producers and consumers. He pointed out, "The tariff policy during Trump's first term resulted in an additional cost of $2,000 to $2,500 per US household annually." He also explained, "More than half of US imports are intermediate goods, and if tariffs increase the prices of these intermediate goods, it could weaken manufacturing competitiveness and add further shock to manufacturing workers."

The two also clashed over immigration issues. Cass emphasized the need for strengthened control and reform in border management to reduce illegal immigration. He also mentioned efforts to prioritize the deportation of criminals among illegal immigrants in the US.

Conversely, Professor Clausing expressed concern that large-scale deportation policies could reduce labor supply, hindering economic growth and GDP. He worried that "large-scale immigration deportations could burden the labor market and potentially increase inflation."

San Francisco Correspondent: Park Shin-young nyusos@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Exclusive] Toss sets up a dedicated blockchain unit…begins building digital-asset infrastructure](https://media.bloomingbit.io/PROD/news/76d3ff2d-0b0f-402b-b842-90eeeb7f183d.webp?w=250)