Summary

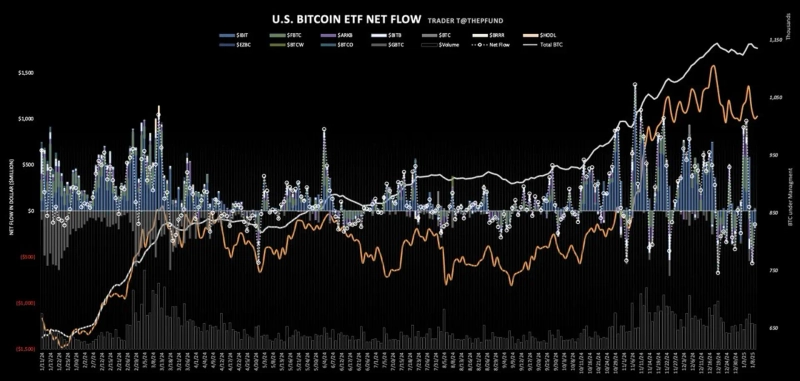

- It was reported that the US Bitcoin spot ETF experienced a net outflow of $148.88 million.

- BlackRock IBIT was identified as the main cause of the outflow, while other Bitcoin spot ETFs recorded net inflows.

- It was added that the Bitcoin price rose by 0.7% in the Binance Tether market within a day.

The US Bitcoin spot ETF experienced a net outflow for two consecutive days.

According to data from Trader T on the 10th (local time), the Bitcoin spot ETF traded in the US recorded a net outflow of $148.88 million. This marks the second consecutive day following the 8th.

This net outflow is attributed to a large-scale outflow (-$183.10 million) from BlackRock IBIT. Excluding BlackRock and Bitwise BITB (-$1.55 million), all Bitcoin spot ETFs recorded net inflows.

Meanwhile, Bitcoin is trading at around $94,100 on the Binance Tether (USDT) market, up approximately 0.7% from the previous day.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)