[Analysis] "Bitcoin Long-term Holders' Selling Pressure Weakens... Positive Signal for the Market"

Summary

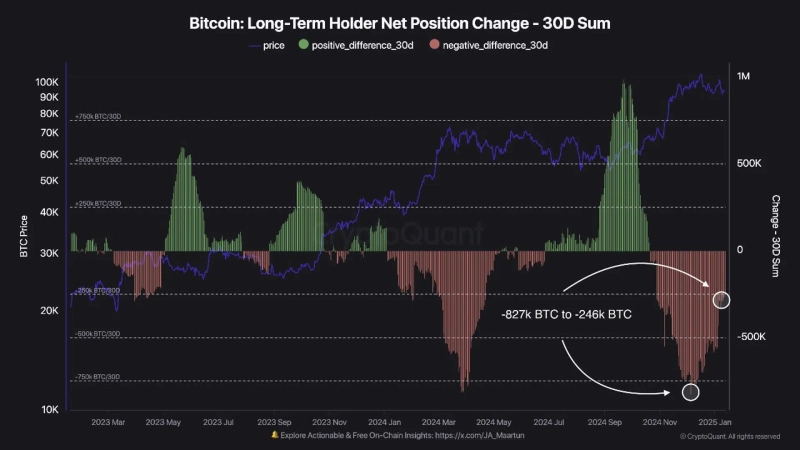

- It was reported that the selling pressure from long-term holders has weakened, showing a positive signal for the market.

- After the Bitcoin price peak, the net position change of long-term holders has recovered.

- Despite the positive signal, a return to the accumulation phase is needed for the market to fully transition into a bullish phase.

An analysis has emerged indicating that the selling pressure from long-term holders of Bitcoin (BTC) is showing signs of weakening, which is a positive signal for the market.

On the 14th (local time), CryptoQuant author Darkfost reported, "When the Bitcoin price peaked at $97,000 on December 5, the net position change of long-term holders fell to -827,000 BTC. However, it has now recovered to -246,000 BTC. This means that the selling pressure from long-term holders has decreased to one-third of what it was over the past month."

The author added, "The weakening of selling pressure from long-term holders is a positive signal for the overall market. However, for the market to fully transition into a bullish phase, the net position change of long-term holders needs to return to an accumulation phase."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.![[Market] Bitcoin drops intraday to the $72,000 level… debate over 'safe-haven credibility' reignited](https://media.bloomingbit.io/PROD/news/e3aeb7f7-851b-4479-bfd0-77d83a3b7583.webp?w=250)