Summary

- The yield on the 10-year US Treasury bond is nearing 5%, causing the US stock market to weaken.

- The rise in bond yields increases the yield on safe assets, which can burden the stock market.

- The stock market is expected to undergo a short-term adjustment until interest rates stabilize.

10-Year Yield Nears 5%... US Major Stock Indices Weak This Year

Inflation and Fiscal Deficit Expected from Trump

'Historically Overvalued Stock Market' Adds Pressure

Demand Shifts to Safe Assets Instead of Stocks

"Stock Market Short-Term Adjustment Until Rate Stabilizes"

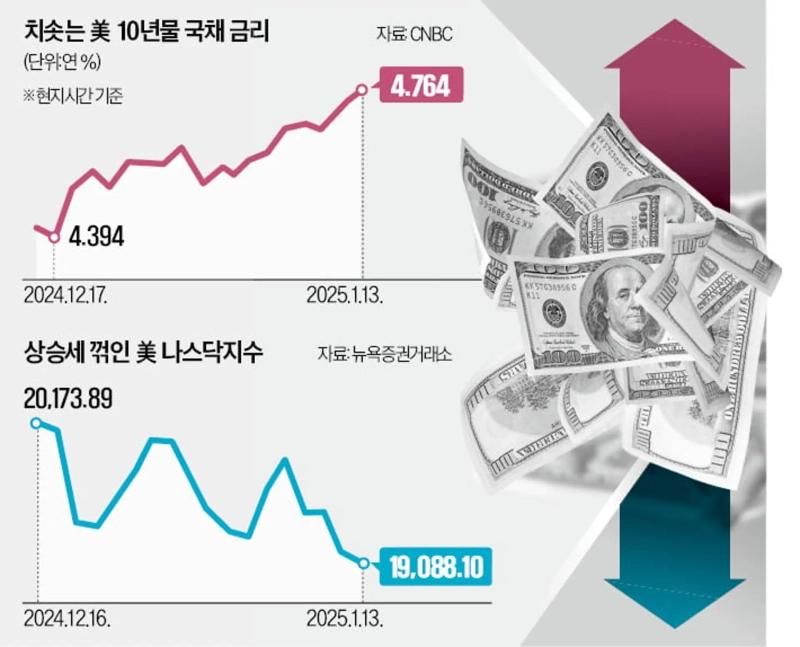

The rapid rise in government bond yields in major developed countries, including the United States, has become a negative factor for the global stock market in recent weeks. The yield on the 10-year US Treasury bond is approaching 5%, and the yields on government bonds in major countries in Japan and Europe are also on the rise. The chill in the bond market is spreading to the stock market, and the New York Stock Exchange in the US has been sluggish this year.

○ US 10-Year Treasury Yield Heading Towards 5%

On the 13th (local time) in the New York bond market, the yield on the 10-year US Treasury bond exceeded 4.8% during the day, marking the highest level since November 2023. The 10-year US Treasury yield has been rising continuously since hitting an annual low of 3.621% in September last year. The US economy is showing strength, and inflation concerns have grown as President-elect Donald Trump is expected to implement high tariff policies upon taking office after winning the presidential election. Concerns about an expanding fiscal deficit due to increased government spending are also cited as factors. As the budget deficit approaches $2 trillion annually, the Treasury Department will have to issue more bonds, which could devalue existing bonds.

Long-term bond yields, including the 10-year, are calculated as the sum of short-term bond yields and the term premium (additional yield for holding bonds longer). Recently, the term premium on the 10-year US Treasury has approached 0.7 percentage points, the highest in years.

Bond yield fluctuations are globally interconnected. When US Treasury yields rise, investors seeking higher returns sell other countries' bonds to buy US Treasuries, leading to a chain reaction of rising yields. According to the International Finance Center, the yield on the UK's 10-year government bond rose by 0.83 percentage points compared to early September last year, reaching the highest level since July 2008. Yields on government bonds in other European countries, such as Germany (0.27 percentage points) and France (0.42 percentage points), are also on the rise. The yield on Japan's 10-year government bond soared to 1.250% on the 14th, the highest in 13 years and 9 months since April 2011.

○ Chill in the Stock Market

As government bond yields surge, the US stock market, which experienced repeated rallies last year, has been sluggish this year. The Nasdaq index has fallen by 1.63%, the S&P 500 index by 1.14%, and the Dow index by 0.85% so far this year. Rising interest rates increase borrowing costs across the economy and can pressure the stock market by raising the risk-free yield investors can earn by holding bonds. When the yield on safe assets rises, risky assets like stocks may seem more expensive. Adam Turnquist, an investment strategist at LPL Financial, said, "I think it will be very difficult for the stock market to gain meaningful momentum until at least the rates stabilize," adding, "There is a possibility of a short-term adjustment."

There are also concerns that the stock market, already historically overvalued, may be more vulnerable in the current high-interest-rate environment. The cyclically adjusted price-to-earnings ratio (CAPE), developed by Nobel laureate economist Robert Shiller of Yale University, is currently at 37.04 times, the highest level since December 2021 (38.31 times). CAPE calculates the price-to-earnings ratio (PER) by adjusting the earnings per share (EPS) over the past 10 years to present value. The International Finance Center diagnosed that "the high level of long-term interest rates in major countries may have a negative impact on economic activities in each country for a considerable period."

Reporter Kim Lian knra@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.