"Last Year, Illegal Cryptocurrency Address Inflows Reached $40.9 Billion... Specialization of Crime Intensifies"

Summary

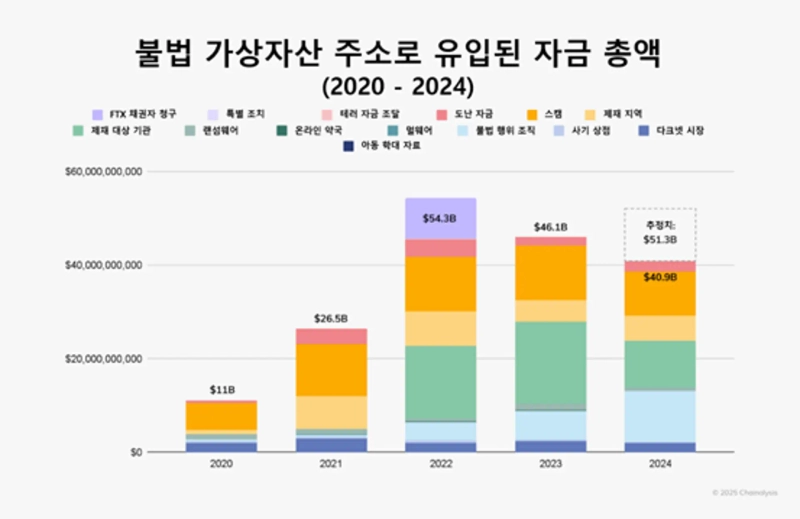

- Last year, the damage inflow to illegal cryptocurrency addresses reached $40.9 billion, and it is expected to reach about $51 billion when including additional identified crime amounts.

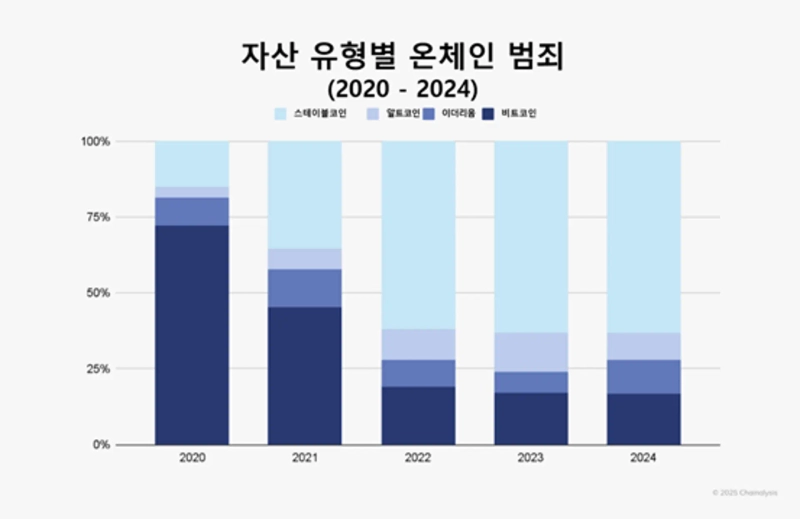

- Stablecoins are most exploited in illegal activities, and by 2024, they accounted for 63% of exploited assets.

- Chainalysis is strengthening AI-based security capabilities to respond to cybercrimes using artificial intelligence.

Last year, the amount of damage inflow to illegal cryptocurrency addresses reached a staggering $40.9 billion.

According to blockchain data analysis company Chainalysis on the 15th (local time), the amount of money flowing into illegal cryptocurrency addresses last year was $40.9 billion (approximately 54 trillion won), and it is expected to reach about $51 billion when including additional identified crime amounts. This is about 0.14% of the total on-chain transaction volume.

Chainalysis explained, "So far, the damage from cryptocurrency crimes is negligible compared to the total on-chain transactions, but the proportion of illegal activities is expected to increase in the future."

The asset most exploited in crimes was found to be stablecoins. Until 2021, Bitcoin, with its high liquidity, was most exploited in crimes, but since 2021, stablecoins have been used more, and by 2024, the figure rose to 63% of exploited assets.

Baek Yong-gi, head of Chainalysis Korea, stated, "In 2024, with the increase in sophisticated cybercrimes such as sexual exploitation attacks using artificial intelligence (AI) and bypassing KYC procedures, there was a significant threat to the cryptocurrency ecosystem. Chainalysis is actively responding by strengthening AI-based security capabilities through the acquisition of Exagate and Alteria to enhance the stability of cryptocurrency transactions."

YM Lee

20min@bloomingbit.ioCrypto Chatterbox_ tlg@Bloomingbit_YMLEE![[Today’s Key Economic & Crypto Calendar] Atlanta Fed GDPNow, More](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)