Summary

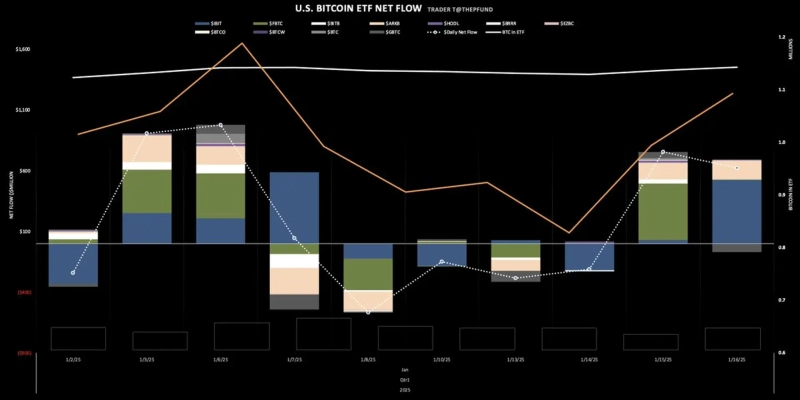

- It was reported that the US Bitcoin spot ETF recorded a net inflow of $622.26 million for two consecutive days.

- In particular, BlackRock's IBIT recorded the largest net inflow with $523.98 million.

- The price of Bitcoin showed an upward trend due to continuous fund inflows, surpassing $102,000.

The US Bitcoin (BTC) spot ETF recorded a net inflow for two consecutive days.

According to TradeT data on the 16th (local time), Bitcoin spot ETFs traded in the United States saw a total inflow of $622.26 million.

BlackRock's IBIT recorded the largest net inflow with $523.98 million, followed by Ark Invest's ARKB ($155.44 million), VanEck's HODL ($5.68 million), Fidelity's FBTC ($4.39 million), and Bitwise's BITB ($2.74 million).

The price of Bitcoin turned upward thanks to the inflow of funds for two consecutive trading days. On this day, Bitcoin rose approximately 1.7% compared to the previous day in the Binance Tether (USDT) market, surpassing $102,000. It has been 10 days since Bitcoin crossed the $102,000 mark.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀![[Exclusive] FSS to examine ZKsync coin that surged '1,000%' in three hours](https://media.bloomingbit.io/PROD/news/1da9856b-df8a-4ffc-83b8-587621c4af9f.webp?w=250)